The launch is set to commence in its Beta phase for the equity cash segment, with the collaborative support of clearing corporations, stock exchanges, depositories, stockbrokers, banks, and UPI app providers

FinTech BizNews Service

Mumbai, December 29, 2023: ASBA like facility of 'Trading supported by blocked amount in Secondary Market' through block mechanism was approved by SEBI, based on the RBI approved facility of single-block-and-multiple-debit in UPI, with the implementation timeline of 01-Jan-2024.

The launch of 'UPI for Secondary Market' is set to commence next week in its Beta phase for the equity cash segment, with the collaborative support of key stakeholders including clearing corporations, stock exchanges, depositories, stockbrokers, banks, and UPI app providers. Initially, this functionality will be available for limited set of pilot customers.

During this pilot, investors can block funds in their bank accounts, which will only be debited by the Clearing Corporations upon trade confirmation during settlement. Clearing Corporations will directly process payouts to these clients on a T+1 basis.

This Beta launch is facilitated by Groww as the brokerage app, alongside BHIM, Groww, and YES PAY NEXT as UPI apps. Initially, HDFC Bank and ICICI Bank customers will be able to avail this facility. Further, HDFC Bank, HSBC, ICICI Bank, and Yes Bank are acting as sponsor banks for the clearing corporation and exchanges.

Other stakeholders, including stockbrokers such as Zerodha, Customer’s banks like Axis Bank and Yes Bank, and UPI-enabled apps like Paytm and PhonePe are in the certification stage and set to participate in Beta launch soon.

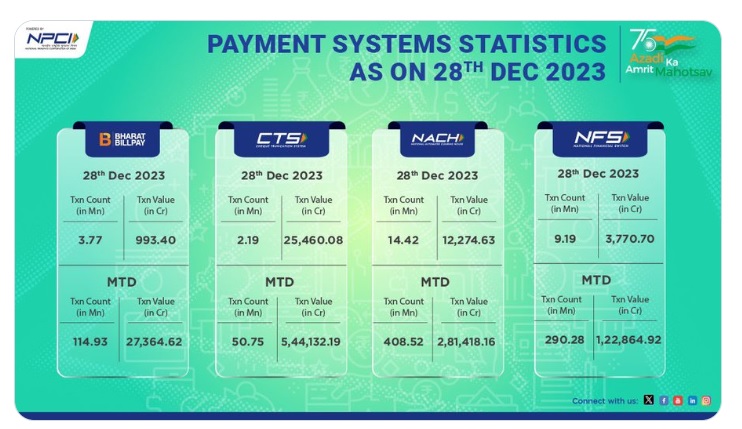

About NPCI:

National Payments Corporation of India (NPCI) was incorporated in 2008 as an umbrella organization for operating retail payments and settlement systems in India. NPCI has created a robust payment and settlement infrastructure in the country. It has changed the way payments are made in India through a bouquet of retail payment products such as RuPay card, Immediate Payment Service (IMPS), Unified Payments Interface (UPI), Bharat Interface for Money (BHIM), BHIM Aadhaar, National Electronic Toll Collection (NETC) and Bharat BillPay.

NPCI is focused on bringing innovations in the retail payment systems through the use of technology and is relentlessly working to transform India into a digital economy. It is facilitating secure payment solutions with nationwide accessibility at minimal cost in furtherance of India’s aspiration to be a fully digital society.