News business revenue was up 19% Y-o-Y, Viacom18 revenue was up 62% Y-o-Y

FinTech BizNews Service

Mumbai, April 23, 2024: Reliance Industries Limited, on Monday announced the financial and operational performance of Reliance Industries Limited (RIL) for the quarter and year ended 31st March 2024.

STRATEGIC PARTNERSHIP WITH DISNEY TO MERGE BUSINESS OF VIACOM18 WITH STAR INDIA ANNOUNCED; TO LEAD DIGITAL TRANSFORMATION OF INDIA’S MEDIA LANDSCAPE

QUARTERLY REVENUE AT Rs 2,808 CRORE, UP 62.2% Y-o-Y

FY24 REVENUE AT Rs 10,826 CRORE, UP 49% Y-O-Y

Annual Performance

• Media business delivered one of the strongest performances, setting new operating and revenue

benchmarks across verticals. Operating revenue for the year was at Rs 9,297 crore, up by 49.4% Y-o-Y, driven by strong growth across all segments.

News business revenue was up 19% Y-o-Y, Viacom18 revenue was up 62% Y-o-Y. Sports was the biggest driver of revenue growth for Viacom18 while News revenue growth was driven by both TV network and Digital platforms.

• The businesses made significant investments during the year in scaling up its new verticals, Sports and Digital. Sports properties like IPL, BCCI cricket series, SA20 and others, helped Viacom18 significantly ramp up its presence in the sports segment. The Group also increased its investments in Digital platforms, both news and entertainment, driving strong growth for JioCinema, Moneycontrol and News18 platforms. The increased investments had an impact on EBITDA for the year.

Quarterly Performance (4Q FY24 vs 4Q FY23)

• Media business recorded a strong operating and financial performance across verticals during the quarter. Revenue from operations was up by 63.0% Y-o-Y to Rs 2,419 crore, driven by Sports, Movies and News verticals.

• News business revenue was up 25% Y-o-Y, driven by the strong growth in advertising revenue of both TV and Digital Platform.

• Viacom18 revenue grew 83% Y-o-Y led by Sports and Movies segments. Sports revenue growth was

primarily driven by 13 IPL matches held during the quarter, as the tournament kicked off earlier this

year. Release of 'Fighter', the biggest movie of 2024 so far, drove the growth in the Movies segment.

The advertising revenue on TV network also delivered strong growth on the back of robust viewership share.

• Consolidated EBITDA of the Group was impacted by continued investments in Sports and Digital

verticals of Viacom18, the leading drivers of revenue growth for the foreseeable future.

Viacom18

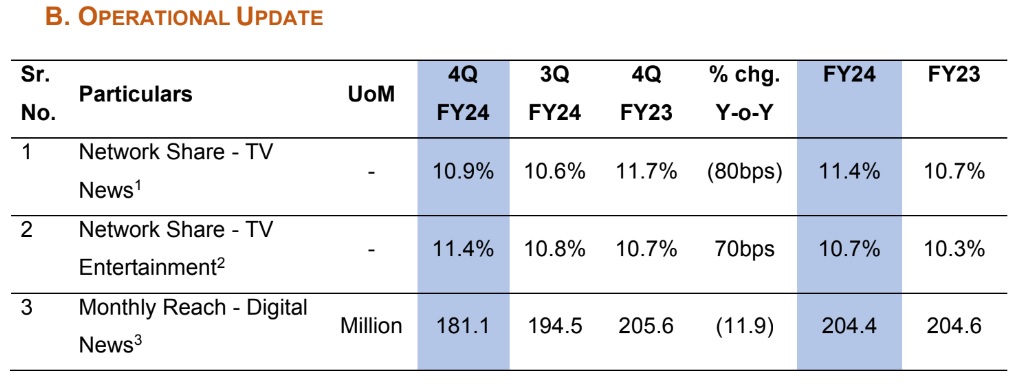

• TV network share increased by 70 bps Q-o-Q to 11.4%, driven by the strong performance of Hindi

GEC, Movie and Sports portfolio. Colors achieved its highest GRPs in the last 8 years and highest

market share in the last 12 years, briefly climbing to the #1 position during the quarter. Colors

Cineplex maintained its position in the Hindi movie genre, driven by premier of popular movies as

well as airing of cricket series. Colors Kannada and Colors Marathi continued to be the two strong

channels in the regional markets.

• IPL 2024 began with a big bang on JioCinema, registering 50%+ increase in reach on the opening

day of the season with 11.3 crore viewers. The platform continued its programming innovations to

enable higher reach for the event. After introducing commentary in Bhojpuri last year, Haryanvi was

added to list of 12 languages this year, giving the consumers of regional languages unprecedented

choice. Consumers were also given two new options for choosing camera angles - ‘Hero Cam’ (to

follow their favourite players) and ‘Multi-View’ (to view action from all the camera angles

simultaneously). Shows like ‘Legends Lounge’, ‘What Just Happened’, and ‘How It Started, How

It’s Going’ helped build engagement on the platform.

• JioCinema was the home of multiple other sporting events during the quarter including India-England Test series, India-Afghanistan T20 series, and Women Premier League (WPL). WPL saw 3x growth in watch-time with 70% higher reach compared to the first season.

• JioCinema also delivered record reach and engagement for TV network shows. Bigg Boss Hindi saw 2.7x viewers, 1.3x watch-time and 1.6x views and Bigg Boss Kannada had 5.6x viewers, 3.5x watch-time and 4.2x views compared to the last season.

News

• Network18’s TV News bouquet was the highest reach news network in the country, connecting with 175 mn people on a weekly basis. The network had an all-India viewership share of 10.9%1 with leadership in English news (CNN News18 has consistently been the #1 channel for more than 2 years), Business news (CNBC TV18 has been the undisputed #1 channel) and Hindi news (News18 India was the #12 Hindi news channel in evening primetime). The network had leadership in regional markets of UP/Uttarakhand, Bihar/Jharkhand, Gujarat, Jammu/Kashmir/Ladakh/Himachal.

• Network18’s Digital portfolio continued to be India’s #2 publisher, reaching over 180 million people on a monthly basis. Moneycontrol maintained leadership in terms of engagement metrics with 3x page-views and time-spent compared to the nearest competitor, highlighting its position as the most engaged financial markets destination for Indian consumers. Moneycontrol Pro crossed 7.5 lakh paid subscribers, making it the #1 subscription-based news platform in India and amongst the top 20 globally as per FIPP's Digital Subscription Report. Firstpost was amongst the fastest growing digital news brands, crossing 4 million subscribers on Youtube.

STRATEGIC UPDATE

• On 28th February 2024, Reliance, Viacom18 and The Walt Disney Company announced the signing of binding definitive agreements to form a joint venture that will combine the businesses of Viacom18 and Star India. In addition, RIL will invest Rs 11,500 crore at closing for JV’s growth strategy, valuing the JV at Rs 70,352 crore (~US$ 8.5 billion) on a post-money basis, excluding synergies. The JV will seek to lead the digital transformation of the media and entertainment industry in India and offer consumers high-quality and comprehensive content offerings anytime and anywhere. With the addition of Disney’s acclaimed films and shows to Viacom18’s renowned productions and sports offerings, the JV will offer a compelling, accessible, and novel digital-focused entertainment experience to people in India and the Indian diaspora globally. The JV will be controlled by RIL and owned 16.34% by RIL, 46.82% by Viacom18 and 36.84% by Disney.

• Network18 had earlier announced the merger of TV18 and E18 with Network18, consolidating TV and Digital news assets and Moneycontrol business in one listed company through a Scheme of Arrangement, which is in the process of obtaining requisite approvals.