The share of consumer loans impacted by RBI circular (Rs 14.8 Lakh Cr) to total outstanding loan (Rs151.5 Lakh Cr) is only around 9.8% in September'23. The impacted portion of the personal loans category is only 31% of the total personal loans (Rs 48.3 Lakh Cr)

Dr. Soumya Kanti Ghosh,

Group Chief Economic Adviser,

State Bank of India

Mumbai, November 18, 2023: RBI Governor unequivocally flagged the risk of asymmetric and accelerated growth picking pace in certain components of consumer credit during last policy statement. Regulated Entities (REs) were advised to adopt better underwriting standards to handle upfront building up of any material risk by the DG, RBI. Then CAFRAL earlier this month brought to the fore the growing concerns about systemic contagion, analysing the spurt in unsecured lending from all ecosystem players underscoring the need for tighter and timely preventive measures to mitigate any eventual potential systemic fallout. Within the NBFCs, FinTech lending has been projected to exceed traditional bank lending by 2030!

In hindsight, the decision to raise the risk weights perhaps is an attempt by RBI to send out a strong message of addressing any incipient financial stability risks in the system as such risks are coincident indicators. Thus, proactively managing such risks seems the best policy option rather than managing delinquencies (if any) post occurrence of events. These measures are in continuity with the tilt towards an Expected Loss (EL) driven stress recognition system for regulated entities and RBI’s recent move to subject 15 Upper Layer NBFCs to greater regulatory scrutiny.

Some Sort Of Déjà Vu

The risk weights in respect of consumer credit exposure of commercial banks (outstanding as well as new), including personal loans (but excluding housing loans, education loans, vehicle loans and loans secured by gold and gold jewellery) has been increased by 25 percentage points to 125%. Similarly, consumer credit exposure of NBFCs also got increased to 125%. Regarding credit card receivables, the risk weights increased to 150%. It would, however, be pertinent to mention that RBI had reduced the risk weight on Consumer Credit (excluding Credit Card receivables) to 100% from 125% during September’2019. So, it should be read as some sort of déjà vu, restoring the status quo ante of 2019, for the fortification of the system.

Immediate Impact

The immediate impact of the enhanced risk weights is the excess capital now that banks would require. As per our calculation, the banking industry needs Rs 84,000 crore of excess capital / 5% increase on Rs 15.2 trillion capital requirement of banking system approx /55-60 bps increase in CRAR due to these regulatory measures.

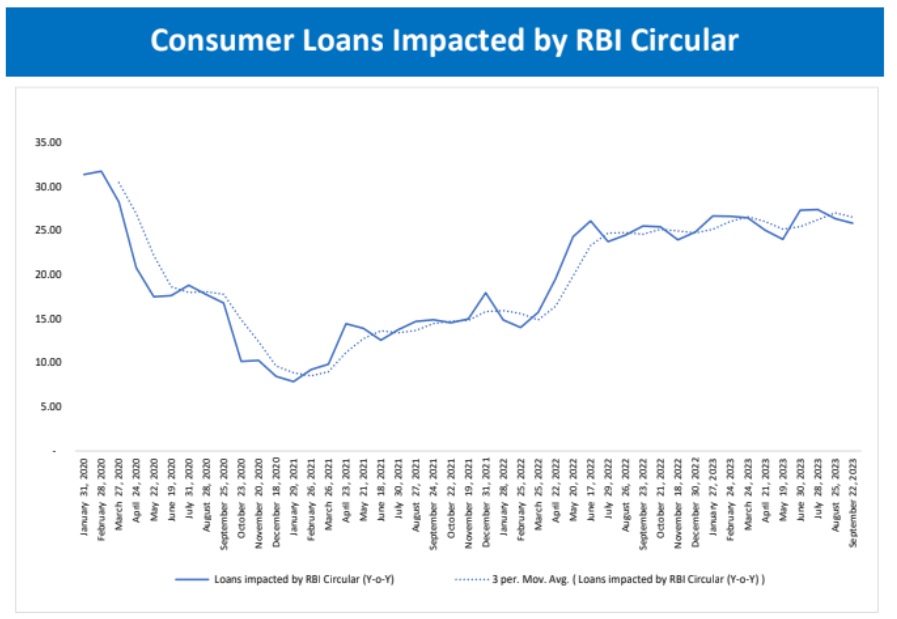

Secondly, the RBI circular impacts consumer loans in general but excluding housing loans, education loans, vehicle loans and loans secured by gold and gold jewellery. Filtering out the exclusions, the trends in consumer credit shows that it was growing at 25% plus since May 2022. The share of these loans impacted by RBI circular (Rs 14.8 Lakh Cr) to total outstanding loan (Rs151.5 Lakh Cr) is only around 9.8% in September’23. The impacted portion of the personal loans category is only 31% of the total personal loans (Rs 48.3 Lakh Cr).

The current regulatory steps taken by RBI may be termed as countercyclical measures as these types of actions refer to the measures (both monetary and fiscal) that stabilize the business cycle by reining in economic activity during booms and bolstering it during downturns. For example, during October 2008 to April 2009, in order to mitigate the adverse impact of the global financial crisis on the Indian economy, RBI aggressively eased the monetary policy. During this period, prudential norms were also relaxed in a countercyclical fashion, again mainly following a sectoral approach. The relaxations focused primarily on real estate and NBFC sector as these were the segments which had been most severely hit due to the downturn. In an opposite vein, during September 2004 to August 2008, risk weights and provisioning prescriptions were tightened periodically by RBI as a countercyclical measure. As a pro-active measure, risk weights for capital market exposure, real estate and housing sector were tightened even as these sectors were becoming over-heated. We believe however that the latest action by RBI is to do more with complementing the past monetary policy action through non rate actions now, rather than any specific concern.

Empirical Research

Specifically, empirical research shows that the countercyclical regulatory rules allow monetary authorities to achieve the same objectives (in terms of deviation of output and inflation from targets) but with smaller adjustments in interest rates, Thus, it seems that the current increase in repo rates have long peaked out and it is primarily through liquidity and macro prudential measures that RBI is to achieve the desired objective of growth and inflation. Rational lending practices, sans irrational exuberance by certain sub-sets, can actually bolster the system in long run and minimize the collateral impact on responsible lenders.

Countercyclical Measures

Trends In Consumer Credit Impacted By Rbi Circular