25 Future Unicorns Dropped Out From ASK Private Wealth Hurun India Future Unicorn Index 2024

FinTech BizNews Service

Mumbai, June 21, 2024: The Hurun Research Institute today released the ASK Private Wealth Hurun India Future Unicorn Index 2024, a ranking of India’s start-ups founded in the 2000s, worth at least US$200mn, not yet listed on a public exchange and most likely to ‘go Unicorn’ within three years (Gazelles) or five years (Cheetahs). The cut-off date was 31 May 2024.

ASK Private Wealth Hurun India Future Unicorn Index 2024 is a snapshot of India’s start-up ecosystem. This is an index of the most valuable private equity or venture capital-funded companies in India founded after 2000, ranked according to their latest funding round valuation.

To feature in the ASK Private Wealth Hurun India Future Unicorn Index 2024, the start-up is required to have a minimum valuation of US$200mn (INR 1,670 crore).

Hurun Research found 152 Indian future Unicorns from 31 cities. On average, they were set up in 2015, with the vast majority selling software and services, with only 18% selling physical products. 44% are selling to businesses, while 56% are consumer-facing. Future Unicorns were seen disrupting financial services, business management solutions, education and healthcare.

Speaking at the launch, Rajesh Saluja, CEO & MD, ASK Private Wealth said, "The latest ASK Private Wealth Hurun India Future Unicorn Index report emphasizes the importance of a well-funded startup ecosystem in fostering a thriving economy. A transformative shift is in progress in the dynamic landscape of India's startups. It is the visionary entrepreneurs and forward-thinking investors who are driving this change, paving the way for a new generation of companies. These emerging companies, fuelled by innovation and resilience, are not just promising to shape India's future but also making a significant contribution to our nation's economic trajectory, thereby reinforcing their significance.”

“There is an increasing focus on profitability and sustainable operating models, with 22 of the list entrants making profits in FY23. More than 1.5 lakh people are employed by Future Unicorns. These are green shoots of tangible impact metrics.”

"ASK Private Wealth recognizes and supports India's most promising startups through this curated index of high-potential ventures as they pave the way for economic growth and innovation. Our dedicated team of wealth managers partners with founders to help them achieve their wealth creation and preservation goals and unlock their time so they can focus on what matters most to them – creating value through their startups. Our unwavering commitment to nurturing and promoting these promising ventures underscores our dedication to fostering a thriving startup ecosystem and contributing to India's economic development. " he added.

Anas Rahman Junaid, MD and Chief Researcher, Hurun India said, “"The ASK Private Wealth Hurun India Future Unicorn Index provides essential insights into the current state and future prospects of India's startup ecosystem. Amidst a funding winter, inflated pre-2021 valuations, and setbacks from companies like Byju's, the once golden startup ecosystem now faces a critical turning point. Despite 44 companies dropping out of the index over the past year, this year's index welcomes 38 new entrants.”

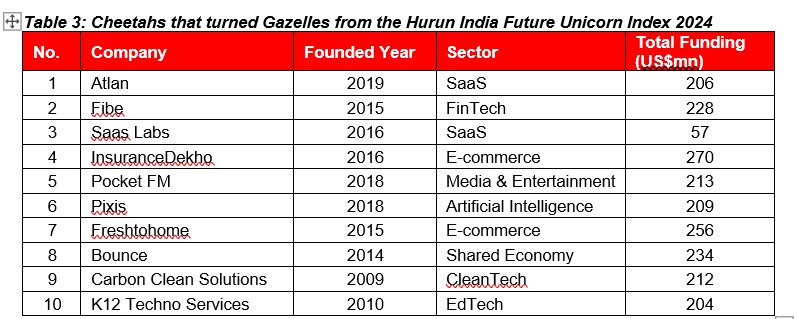

"This year's index saw notable promotions. Online travel aggregator ixigo, a former Cheetah, went public with a 48% premium. In 2022, ixigo was predicted to become a unicorn within five years, and it has now leaped directly to an IPO, bypassing Gazelle status. With a market cap of ₹6,000 crores (US$700 million), ixigo is on track for a billion-dollar valuation. Zepto, Porter, and Incred Finance achieved unicorn status, while 10 Cheetahs were promoted to Gazelles, highlighting the resilience and dynamism of India's start-up landscape."

"The ASK Private Wealth Hurun India Future Unicorn Index highlights how Indian startups and investors are adapting to a new reality. Despite previous dropouts, India has added 38 new entrants to the index, including 7 Gazelles (companies expected to become unicorns within 3 years) and 31 Cheetahs (projected to reach unicorn status within 5 years). This year's list is particularly exciting, featuring 1 Gazelle and 2 Cheetahs from SpaceTech, 5 Gazelles and 6 Cheetahs from Artificial Intelligence, and 1 Gazelle and 5 Cheetahs from the EV/Renewable Energy sectors. These companies are poised to shape India's future."

"Aerospace, in particular, stands out as one of the hottest sectors to watch. AI companies in the index have received a combined $1.6 billion in funding, while aerospace startups have garnered $160 million, and EV companies have attracted $1.2 billion. The significant gap in funding for aerospace compared to other sectors highlights its enormous growth potential.”

"Agnikul Cosmos, which has emerged as a new Gazelle on the list, successfully launched a 3D-printed rocket, showcasing India's innovative prowess in aerospace technology. The sector is also being propelled forward by the rising demand for large aircraft, driven by increasing passenger traffic, and substantial government defence expenditures. These factors, coupled with strategic government support and a strong focus on sustainability, are setting the stage for significant growth and value creation in the Indian aerospace industry in the coming years."

“The rate of value generation within India's most disruptive sectors is striking. Out of 152 prospective unicorns established after 2000, 12 of these Gazelles and Cheetahs were founded in 2020, indicating that some of the most valuable companies in these sectors were non-existent just a few years ago!”

“The economic slowdown has posed challenges for specific companies, with 24% of last year's Gazelles / Cheetahs either falling off the list or being downgraded. Hurun Research suggests that these companies may no longer have the potential to become unicorns within three years. Rising interest rates and geopolitical challenges have created hurdles for startups in raising capital.”

“The ASK Private Wealth - Hurun India Future Unicorns: Gazelles and Cheetahs Index is formulated with insights from top venture capitalists in India, making this perhaps the most comprehensive list of India's future unicorns.”

“The Hurun Gazelles, boasting an average age of merely nine years, imply that aspiring entrepreneurs should target building a gazelle by 2033 if they were to start up today. Similarly, the average age of Hurun Cheetahs is also nine years.”

“Which countries are poised to generate unicorns in the next three years? The US and China lead the pack, accounting for two-thirds of the world's identified Gazelles, despite comprising only a quarter of the global population. India, the UK, and Germany lead the rest of the world in this regard.”

"A vibrant startup ecosystem thrives on the presence of role models, including the individuals highlighted in the Hurun Rich Lists and the companies showcased in the Hurun Global Unicorn and Hurun Global 500 rankings. When a city or country successfully attracts the world's leading entrepreneurs and businesses, it sparks a chain reaction. The entrepreneurial spirit is highly infectious, and regions rich in role models naturally attract the most talented and ambitious young innovators. This dynamic creates a self-perpetuating cycle of growth and success," concluded Anas Rahman Junaid.

Gazelle: Unicorn in the next three years

Hurun Report defines “Gazelle” as a start-up founded after 2000 and has the potential to go Unicorn in three years. In the next three years, 46 Gazelles from the ASK Private Wealth Hurun India Future Unicorn Index 2024 are likely to become Unicorns.

In the ASK Private Wealth Hurun India Future Unicorn Index 2024, the Gazelles, which are the high-growth potential start-ups, have a cumulative valuation of these Gazelles featured in the index experienced a year-on-year decrease of 6%, amounting to US$29bn. Impressively, the 46 start-ups listed in the index have collectively secured a substantial funding of US$9.7bn.

In the ASK Private Wealth Hurun India Future Unicorn Index 2024, the FinTech sector leads with 8 Gazelles, followed by SaaS with 6. Artificial Intelligence and EdTech each register 5 Gazelles. Among the top Gazelles featured in the index are EdTech startup Leap Scholar, FinTech startup Money View, and AgriTech startup Country Delight. Following closely are AgriTech startup Ninjacart and SaaS startup MoEngage.

Cheetah: Unicorn in the next five years

Hurun Report defines “Cheetah” as a start-up founded after 2000 and has the potential to go Unicorn in the next five years.

Cheetahs are the fastest mammals on land over short distances and have exceptional stride length. They are nimble at high speeds, and the length between their steps is six to seven meters and four strides are completed per second.

Hurun classification has been validated in this year’s report as one Cheetah (Porter) from the last year's index, ‘skipped’ the Gazelle stage, and directly entered the Unicorn club.

Within the ASK Private Wealth Hurun India Future Unicorn Index 2024, the Cheetahs, characterized by their high-growth potential, showcase an impressive count of 106 Cheetahs, collectively securing a funding of US$12.4bn. The cumulative valuation of these Cheetahs featured in the index experienced a year-on-year increase of 10%, amounting to US$29bn. Leading the Cheetah index are the FinTech start-ups with 22- representations, closely followed by SaaS with 14 and E-commerce with 11.

Gazelles and Cheetahs turned to Unicorns

From the last year's index, only two Gazelles and one Cheetah have successfully transitioned into Unicorns. Zepto, the Indian grocery delivery startup, rocketed to unicorn status in August 2023 while InCred Finance smashed through the billion-dollar barrier in December 2023, joining the coveted unicorn club. Homegrown logistics platform Porter achieved unicorn status recently, surpassing a valuation of $1 billion. Ten companies were promoted from Cheetahs to Gazelles.

Almost 95% of unicorns in the Indian unicorn eco-system have come from ASK Private Wealth Hurun India Future Unicorn Index. Funding winter put a halt to the number of promotions in last 2 years. Chart below shows the key promotions over the years.

Among the top leading sectors, FinTech witnessed a 50% growth in generating new future unicorns compared to the previous year. Chart below shows the Industry-Wise Analysis of New Entrants.

Fintech has grown by almost 70% over the last four years, and by more than 100% compared to last year. Chart below shows the Distribution of Key industries among Cheetahs over the years.

Number of founders associated with future Unicorns

The ASK Private Wealth Hurun India Future Unicorn Index 2024 emphasizes the importance of co-founders, with only 20% of future Unicorns led by a solo co-founder. More than half of the future Unicorns have two founders, and 80% have more than a single founder, showcasing the collaborative nature of successful entrepreneurial ventures. On average, there are 2.2 founders per future unicorn.

More than half of the future unicorns have been founded by two founders while 20% of the startups were founded by a single founder. Chart below shows the Number of Co-founders.

Key Statistics

This year witnessed an increase in drop-offs from the Future Unicorn list, with a total of 25 start-ups dropping off. Twelve companies were downgraded from Gazelle to Cheetah, while ten transitioned from Cheetah to Gazelle. One Cheetah and two Gazelles were promoted to Unicorn status.

Top investors

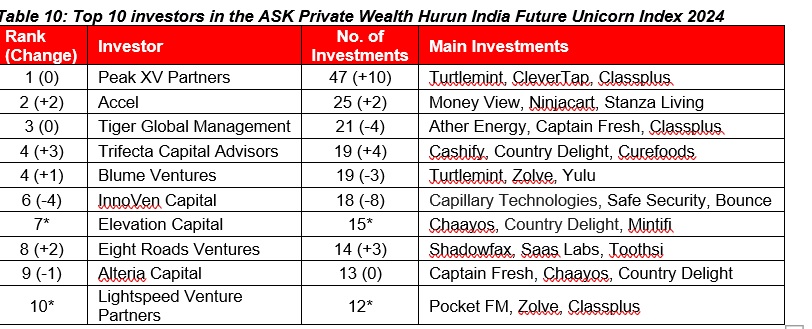

"We believe outlier founders and ideas shape the future of humanity”, is the purpose of venture capital (VC) firm Peak XV Partners (Formerly Sequoia Capital India & SEA). With an impressive portfolio of 47 investments, Peak XV Partners emerges as the top investor in the ASK Private Wealth Hurun India Future Unicorn Index 2024. Notably, Peak XV Partners registered successes, including Turtlemint, CleverTap and Classplus

Ranking 2nd on the ASK Private Wealth Hurun India Future Unicorn Index 2024, Accel has made investments in 25 companies that are poised to become the next generation of unicorns. Their portfolio features a diverse range of interesting companies, including Money View, Ninjacart, and Stanza Living.

Tiger Global Management's primary mission is to generate exceptional investment returns in the long run. As the third-largest investor in the ASK Private Wealth Hurun India Future Unicorn Index 2024, Tiger Global has made investments in 21 Gazelles and Cheetahs. Their portfolio showcases a diverse range of interesting companies, including Ather Energy, Captain Fresh and Classplus.

Portfolio of Angel Investors

Anand Chandrasekaran, a partner and investor at General Catalyst, leads third year in a row in the ASK Private Wealth Hurun India Future Unicorn Index 2024 with 20 investments in future Unicorns. Following closely behind is Kunal Bahl, with 11 investments. Notably, Kunal Shah has also made investments in 9 future unicorns, further contributing to the index’s robust investor portfolio.

Sector analysis

The ASK Private Wealth Hurun India Future Unicorn Index 2024 showcases a variety of start-ups, with FinTech leading with the highest number of companies, totalling 30. Following closely are SaaS with 20 and E-commerce with 15 companies. Collectively, FinTech, SaaS, and E-commerce represent 43% of the featured companies in the index, underscoring their importance in the Indian start-up ecosystem. Moreover, sectors like Artificial Intelligence (11), SpaceTech (3) and New Energy (6).

FinTech. India is home to 30 future Unicorns in the FinTech sector, with consumer lending emerging as the dominant subcategory, constituting more than half of the FinTech future Unicorns. Among them, Money View stands out as the most valuable FinTech Gazelle, while JusPay takes the lead as the most valuable FinTech Cheetah. The FinTech start-ups featured in the ASK Private Wealth Hurun India Future Unicorn Index 2024 have collectively raised an investment of US$5.7bn. FinTech holds a strong position, commanding a substantial share of the overall value of future Unicorns, with a total of US$11.4bn or 20% of the total value.

SaaS, standing as the second-largest sector, showcases an impressive count of 20 future Unicorns within the ASK Private Wealth Hurun India Future Unicorn Index 2024. Among them, MoEngage emerges as the most valuable SaaS Gazelle, while Lentra, Multiplier and FarEye takes the lead as the most valuable SaaS Cheetah. The SaaS start-ups listed in the index have collectively raised a substantial investment of US$2.1bn, reflecting the investor confidence and support in this sector's growth and potential.

E-commerce. In the ASK Private Wealth Hurun India Future Unicorn Index 2024, the e-commerce sector registered a remarkable count of 15 future Unicorns, amounting to a total value of US$6bn. Notably, InsuranceDekho and Medikabazaar emerge as the most valuable e-commerce Gazelles, while Jumbotail takes the lead as the most valuable e-commerce Cheetah. The e-commerce start-ups listed in the index have collectively raised an investment of US$2.4bn, highlighting the strong support and investor confidence in this sector.

Artificial Intelligence (AI) showcases a notable increase, with 11 future Unicorns in the ASK Private Wealth Hurun India Future Unicorn Index 2024, surpassing the previous year's count of eight. The cumulative value of AI future Unicorns amounts to US$4.4bn, representing approximately 8% of the total value of all future Unicorns. The AI start-ups featured in the index have collectively raised an investment of US$1.6bn, reflecting the confidence and support in the potential of AI-driven innovations. Notably, Observe.AI stands out as the most valuable AI Gazelle, while Locus takes the lead as the most valuable AI Cheetah.

EdTech, also holding 11 future Unicorns, secures the fifth position alongside AI within the ASK Private Wealth Hurun India Future Unicorn Index 2024, representing 7.2% of all future Unicorns. The cumulative value of all EdTech future Unicorns amounts to US$4.9bn, accounting for 8% of the total value of all future Unicorns. Notably, Leap Scholar emerges as the most valuable EdTech Gazelle, while Cuemath takes the lead as the most valuable EdTech Cheetah.

Where are they headquartered?

India has emerged as the third-largest startup ecosystem globally, with Bengaluru being a major tech hub within India. The ASK Private Wealth Hurun India Future Unicorn Index 2024 features 46 start-ups with headquarters in Bengaluru, emphasizing the city's prominence. With a cumulative valuation of US$18.3bn, Bengaluru serves as the home to 13 Gazelles and 33 Cheetahs, further solidifying its position as a hotbed for start-up growth. With numerous Unicorns already established, Bengaluru is set to maintain its status as the Unicorn capital of India for the foreseeable future.

After Bengaluru, the cities of Delhi NCR and Mumbai emerge as pivotal players in the start-up scene. Start-ups from Delhi NCR, registered an impressive cumulative valuation of US$10.3bn, highlighting the city's vibrant entrepreneurial environment. Conversely, Mumbai is home to 19 future unicorns in the index, with a cumulative valuation of US$6.5bn, consolidating its status as a significant centre for start-up innovation and advancement. Together, these cities contribute to the diverse and flourishing start-up landscape in India.

Notably, the top three cities account for 61 percent of the future Unicorns identified in the ASK Private Wealth Hurun India Future Unicorn Index 2024.

Youngest & oldest start-up founders

Within the ASK Private Wealth Hurun India Future Unicorn Index 2024, we find an inspiring example in Awais Ahmed and Kshitij Khandelwal, who, at the age of 26, are the youngest founders. Meeting at BITS Pilani, they jointly established Pixxel during their final year in 2018, with a mission to transform satellite imaging through a network of small, high-resolution satellites. Their pioneering strategy swiftly captured interest, propelling Pixxel to remarkable achievements. Their narrative underscores the foresight and promise of budding entrepreneurs.

K. Satyanarayana, at 63, is the oldest founder listed in the index, heading Ecom Express. The average age of the founders in the index is 41, highlighting a diverse range of experienced entrepreneurs. Significantly, there are 11 founders under the age of 30, demonstrating the emergence of young and ambitious entrepreneurs, alongside 31 founders who are over 50, emphasizing the influence of seasoned professionals in the start-up ecosystem. This diverse range of ages enriches the dynamic landscape of Indian entrepreneurship.

Women-led future Unicorns

In the ASK Private Wealth Hurun India Future Unicorn Index 2024, 20 women entrepreneurs from 19 companies have co-founded a total of 5 Gazelles and 14 Cheetahs, demonstrating their significant impact on the startup ecosystem. Notably, Heads Up For Tails is the only company in the index with two women co-founders, showcasing the leadership and commitment of women in driving the future of Indian entrepreneurship.

Vrushali Prasade, 29, is the youngest female co-founder in the ASK Private Wealth Hurun India Future Unicorn Index 2024. She co-founded Pixis, a codeless AI infrastructure company specializing in marketing. Prasade's entrepreneurial journey exemplifies the ambition and innovation of women in India's start-up ecosystem.

Manju Dhawan, at 58, is the oldest female co-founder in the ASK Private Wealth Hurun India Future Unicorn Index 2024. Her co-founding of Ecom Express underscores the lasting spirit and entrepreneurial drive of women in India's start-up ecosystem.

Most of the Cheetahs and Gazelles Founders graduated from IIT Delhi, post-graduation in IIM Ahmedabad and Wharton/ HBS for international masters

IIT Delhi leads as the top undergraduate institute with 22 co-founders of future Unicorns, followed closely by IIT Kharagpur with 20 co-founders. In the post-graduate category, IIM Ahmedabad is the preferred choice with 10 co-founders. Among foreign universities, The Wharton School and Harvard Business School stands out with 4 co-founders each, and Stanford University with 3 co-founders highlighting their substantial contributions to the start-up ecosystem.

The Revenue Growth of Indian Gazelles and Cheetahs

The combined revenue of companies in the ASK Private Wealth Hurun India Future Unicorn Index 2024 surged by 71% to INR 51,422 crore. Mumbai based startup KukuFM witnessed a remarkable 10-fold increase in their top line. Similarly, Future Unicorn Battery Smart, experienced an astounding 8-fold increase in revenue in FY2023. 30% of the index's companies doubled their revenue compared to the previous year. Furthermore, 7 Gazelles and 15 Cheetahs featured in the index achieved profitability in FY2023.

Top funded Gazelles and Cheetahs

Gazelles and Cheetahs featured in the index collectively raised a total of US$22bn, marking a 17% increase compared to the previous year. Among them, Navi Technologies secured the highest funding of US$660mn, making it the most funded future Unicorn in India. Following closely is Northern Arc with a funding of US$638mn.

Foreign headquartered Indian Gazelles and Cheetahs

Out of the 35 companies featured in the index, comprising 14 Gazelles and 21 Cheetahs, 31 have their headquarters located in the USA, 2 in Singapore, and one each in the UK and Vietnam. Leading the pack among these overseas-based companies is the USA-based Artificial intelligence startup Observe.ai, closely followed by SaaS start-up MoEngage.

ESOP pool - Indian future Unicorns

With an ESOP pool size of 18%, Bounce, the EV startup, holds the distinction of being the top creator of ESOP pool in ASK Private Wealth Hurun India Future Unicorn Index 2024. Following closely behind is FinTech startup JusPay, the online Payment platform, with an 16.0% ESOP pool.

How many do they employ?

The start-ups featured in the ASK Private Wealth Hurun India Future Unicorn Index 2024 collectively employ over 1,50,000 individuals, averaging 1,060 employees per company. Among them, 36 future Unicorns stand out with a workforce of over 1,000 employees, with Ecom Express leading the way with 18,000 employees and VVDN Tsechnologies with 10,000 employees.

Some of the notable exits from the list – Promotions and “Pink Slips”

Zepto, Incred, and Porter have exited the ASK Private Wealth Hurun India Future Unicorn Index 2024 after achieving Unicorn status. Online travel aggregator Ixigo, also made its exit after going for an IPO this year. 25 other companies were dropped from the list due to their valuation dipping below the required threshold.

Future Unicorns with international presence

Over 34 percent of the future Unicorns highlighted in the ASK Private Wealth Hurun India Future Unicorn Index 2024 have expanded their presence overseas. Servify and LocoNav led the way with operations in 42 and 25 countries respectively, showcasing their global footprint and strategic international expansion.

Interesting facts

Methodology

The ASK Private Wealth Hurun India Future Unicorn Index 2024 is compiled by the Hurun Research Institute with 31st May 2024 as the cut-off. Hurun defines a ‘Future Unicorn’ as a start-up founded in the 2000s that has reached of valuation of less than US$1bn and greater than US$200mn, but is not yet listed on a public exchange.