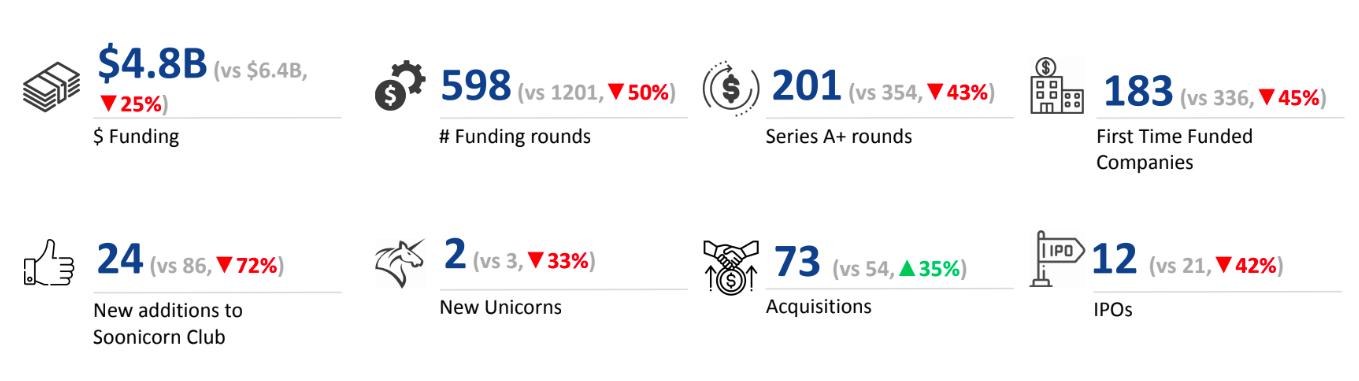

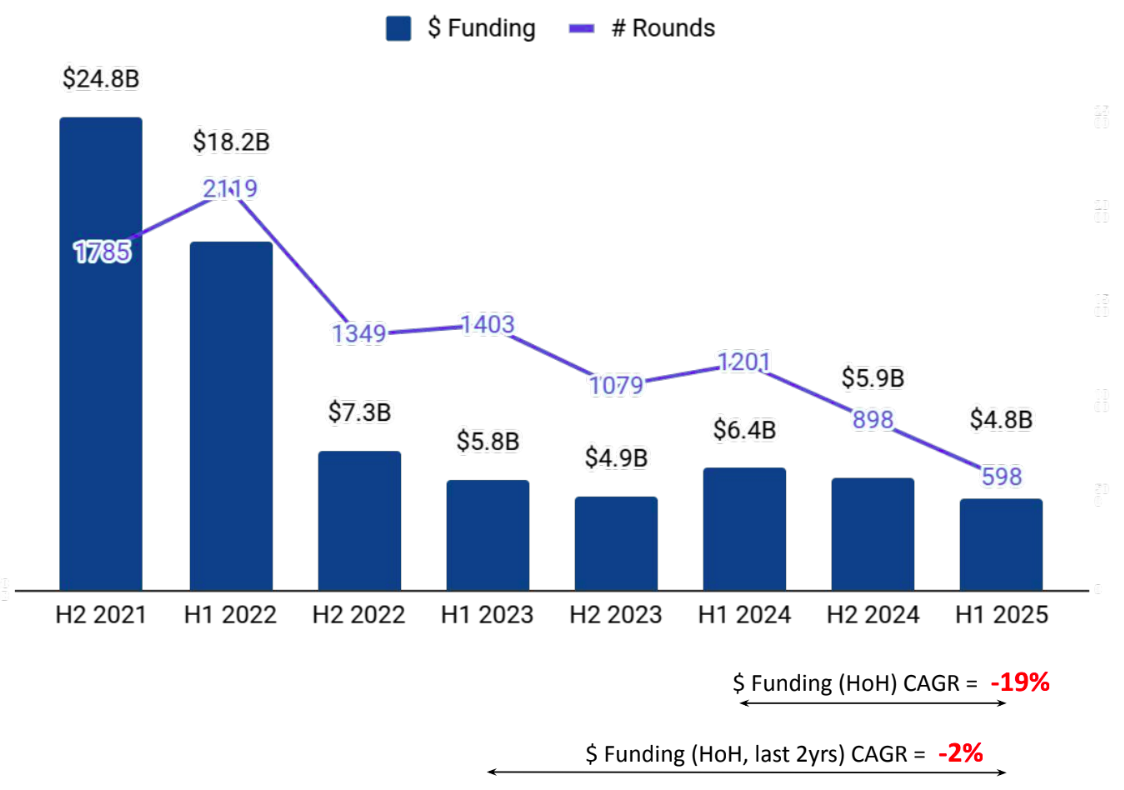

India’s tech startup ecosystem raised $4.8B in H1 2025, a 25% decline from H1 2024 and 19% from H2 2024

FinTech BizNews Service

Mumbai, June 26, 2025: India Jumps to 3rd Place in Global Tech Startup Funding, Raising $4.8B in H1 2025, as per Insights by Tracxn’s India Tech - Semi Annual Funding Report - H1 2025. Tracxn's Report provides a detailed analysis of startup funding trends, sector performances and key developments shaping India’s technology ecosystem in the first half of 2025. Tracxn Technologies is among the leading global market intelligence providers for private company data and rank among the top five players globally [in terms of number of companies profiled] offering data of private market companies across sectors and geographies.

According to the report, Indian tech startups raised $4.8B in H1 2025, a 25% decline from $6.4B in H1 2024 and a 19% drop from $5.9B in H2 2024. Despite the slowdown, India ranked third globally in tech startup funding, ahead of Germany and Israel and trailing the United States and the United Kingdom.

Commenting on the findings of their report, Neha Singh, Co-Founder, Tracxn, said, “While the funding volumes have come down compared to the previous year, India’s tech ecosystem continues to show resilience and maturity. Strong interest in sectors like transportation, retail, and enterprise tech signals investor conviction in solving large, structural challenges. We are also seeing quality IPOs and landmark acquisitions, which reflect the ecosystem’s ability to create long-term value”

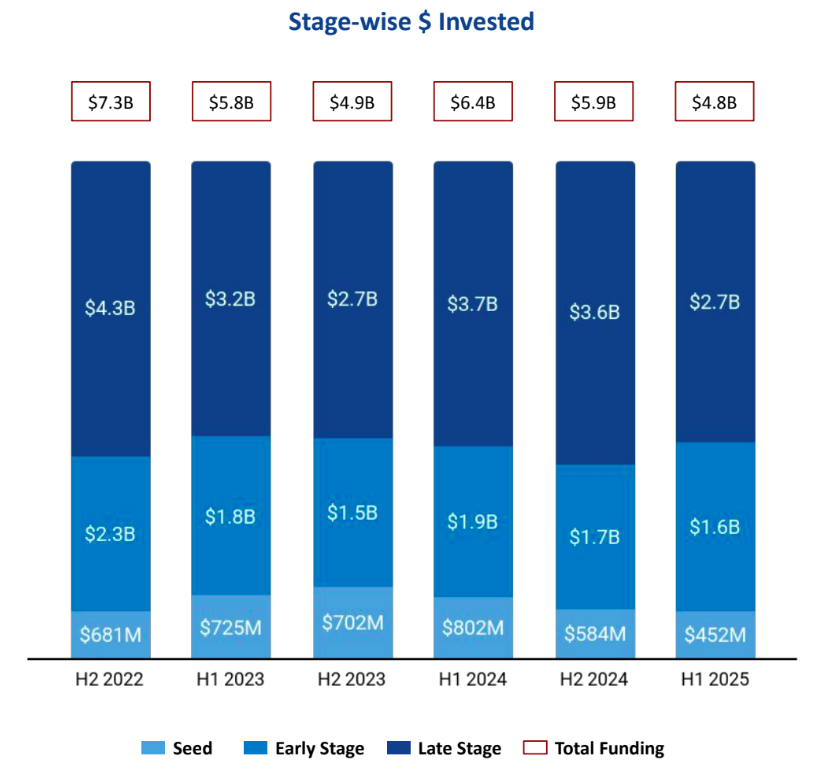

The funding landscape across different stages showcased a consistent downward trend: Seed-stage funding declined to $452M, a 23% decline from $584M in H2 2024 and 44% lower than $802M in H1 2024. Early-stage startups raised $1.6B, a decrease of 6% from $1.7B in H2 2024 and down 16% compared to $1.9B in H1 2024. Late-stage funding stood at $2.7B, marking a 25% decline from $3.6B in H2 2024 and a 27% drop compared to $3.7B in H1 2024.

Despite the funding slowdown, H1 2025 witnessed 5 funding rounds exceeding $100M compared to 9 such rounds in H2 2024 and 10 in H1 2024. Some of those who raised these large rounds included Erisha E Mobility’s $1.0B Series D round, GreenLine’s $275M Series A round, and Infra. Market’s $222M Series F round. Other companies that secured major funding included Spinny and Darwinbox. A major part of these $100M+ funding rounds were from Transportation and Logistics Tech, Retail and Real Estate and Construction Tech.

The leading sectors in terms of performance in H1 2025 were Transportation and Logistics Tech, Retail and Enterprise Applications. The Transportation and Logistics Tech sector saw a strong recovery, raising $1.6B, a 104% increase from $799.3M in H2 2024 and a 54% rise from $1.1B in H1 2024. The Retail sector also showed signs of an uptick, securing $1.2B in funding. While this was a 32% decline from the $1.8B raised in H1 2024, it increased by 25% from $990.1M in H2 2024. The Enterprise Applications sector secured $1.1B in funding, a 21% decrease from $1.4B in H2 2024 and a 26% drop from $1.5B in H1 2024.

There were 12 startups that went public in H1 2025, as compared to 21 in H1 2024. Some of the notable ones included Ather Energy, Tankup, SS Innovations International and Infonative Solutions going public. Two unicorns emerged in H1 2025, a 33% decline from 3 unicorns in H1 2024.

Acquisitions in the Indian startup ecosystem saw a significant rise, with 73 acquisitions in H1 2025, compared to 54 acquisitions in H1 2024. The most notable acquisition was Magma General Insurance, acquired by DS Group and Patanjali Ayurved for $516M, followed by Minimalist, acquired by HUL for $350M.

Bengaluru emerged as the leader in total funds raised during this period, accounting for 26% of the overall funding, followed by Delhi at 25%.

The overall top investors in H1 2025 were LetsVenture, AngelList and Accel. In the seed stage, the most active investors were Venture Catalysts, 100X.VC and Antler. Peak XV Partners, Accel and Lightspeed Venture Partners led investments at the early stage, while Sofina, Premji Invest, and SoftBank Vision Fund were the leading investors in late-stage investments.

Among venture capital firms, Accel (U.S.) led the most number of investments, with 30 investment rounds, while Blume Ventures (India) added seven new companies to its portfolio during this period.