AI, Payments Modernization, Cybersecurity Fuel Demand

FinTech BizNews Service

Mumbai, August 21, 2025: Quess Corp, India’s largest staffing and workforce solutions provider, has unveiled its latest comprehensive new report titled ‘BFSI GCC Talent Report 2025’ that has captured the dynamic landscape of Banking, Financial Services and Insurance GCCs in India which are emerging as the pillars of financial innovation for global enterprises.

According to the report, the country’s BFSI GCC sector was valued at $40-41 billion in 2023 and is projected to grow to a staggering $125-135 billion by 2032 which reflects a CAGR of 12-13%. India is home to nearly 190 BFSI GCCs which employ nearly 540,000 professionals who account for one-fourth of the nation’s total GCC workforce. This robust growth highlights the country’s position as the global hub for GCC innovation, resilience and digital-first transformation.

Key findings of the report state:

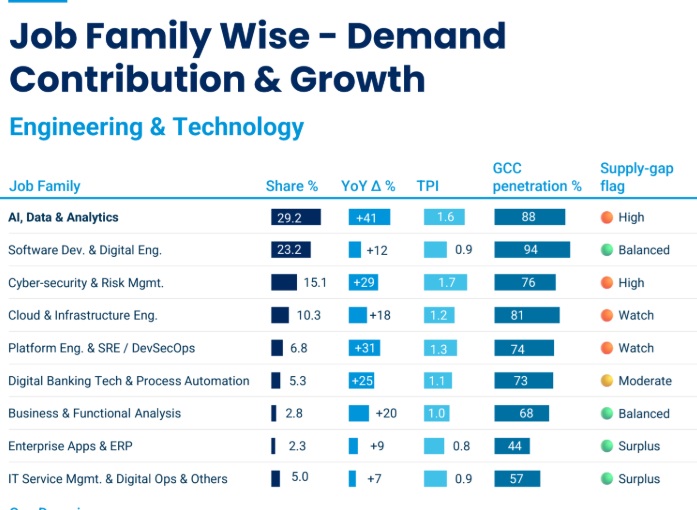

AI, ML and Data Engineering Dominate BFSI Hiring Mandates

AI and data engineering have accounted for almost 29% of all new roles across BFSI GCCs. AI is no longer restricted to pilots or innovation labs by companies but is being actively scaled for core functionality such as fraud detection, regulatory reporting, credit risk modelling and customer service automation. GenAI has evolved into production environments with application such as KYC, reconciliation and predictive compliance making XAI (explainable AI) a must-have layer for BFSI adoption. The acute shortage of AI and data talent is evident with a 42% skill gap which is resulting in a strong pressure for higher salary packages.

Surge in Demand for Cybersecurity and RegTech Roles

BFSI GCCs are beginning to invest significantly in zero-trust architectures, advanced cryptography and regulatory technology. With cyberthreats and regulatory scrutiny intensifying, AI-based fraud analytics, identity governance and compliance monitoring are among the fastest growing areas of demand. Skilled professionals in this space are commanding premium salaries of 1.5x to 4x times over convention IT roles which underscored the importance of cybersecurity talent in India today.

Spotlight on Modernization of Payments

ISO 20022 standards, real-time payments and embedded finance are being adopted rapidly by Indian BFSI GCCs. This transition has given rise to industry demand for payments engineers, system integrators and compliance specialists especially in tier-1 metros such as Bangalore and Chennai. These roles also command some of the highest compensation packages reflecting the critical nature of importance in BFSI operations.

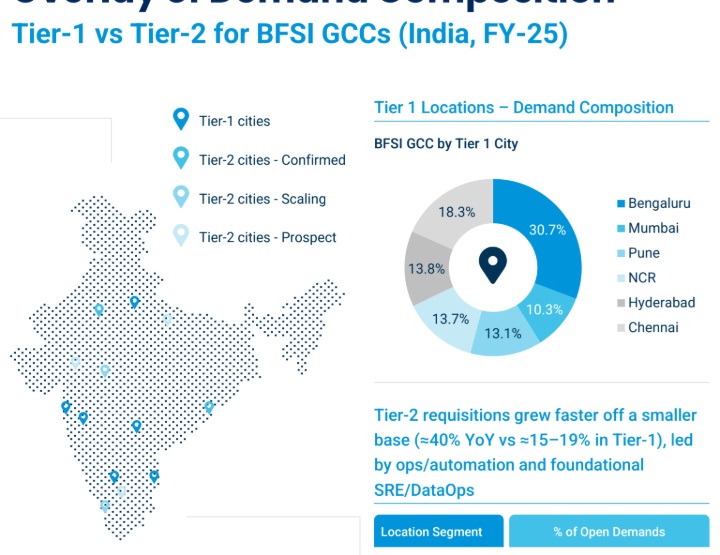

Tier-2 Cities Leading the Way

Tier-2 cities are changing the way in which hiring is being viewed by companies as these regions are showing a 42% year on year growth in job postings. Even though tier-1 hubs contribute to 88% of total demand, Jaipur, Vizag and Kochi have emerged as strong hubs for hiring while cities such as Indore and Coimbatore are steadily gaining momentum. The compensation gap in tier-2 cities which is 12-15% lower than tier-1 regions is making the former attractive for scaling operations as they offer cost advantages and access to untapped talent.

Salary or Compensation Trends

The most lucrative roles fall in categories such as GenAI, payments modernization, cloud site reliability engineering and zero-trust security. While tier-1 markets such as Bangalore (30.8%), Chennai (18.3%) and Mumbai (10.3%) remain dominant, tier-2 regions are experiencing demand for higher compensation making them an attractive destination for new entrants.

Kapil Joshi, CEO – IT Staffing, Quess Corp quoted, “We have noticed that the BFSI GCC sector has moved beyond its traditional role to a new decisive phase of growth. These units are no longer back-office extensions but have transformed into the heart of innovation, compliance and resilience for the world’s financial ecosystem. AI, cloud and payments are no longer experimental skills but are core business functions that are being executed at scale by GCCs in India. As the sector is projected to grow up to $135 billion by 2032, these roles are critical in the functioning of global finance. However, we must make note of the challenges that lie in the talent ecosystem. Shortage in skills in AI and platform engineering has exceeded by 40% and companies must rethink their workforce strategies. Though tier-1 cities are leading in high-value innovation, tier-2 cities are the new flavour of the season and are emerging as credible sites with the support of improved infrastructure and cost-savings. The future of the BFSI GCC sector will depend on how swiftly enterprises will build resilient and capability driven teams who can deliver on innovation, leadership and cost advantage.”