Interesting report titled "Global Fintech 2024: Prudence, Profits, and Growth," jointly published by Boston Consulting Group (BCG) and QED Investors

FinTech BizNews Service

Mumbai, June 26, 2024: A new report titled "Global Fintech 2024: Prudence, Profits, and Growth," has been jointly published by Boston Consulting Group (BCG) and QED Investors. This comprehensive analysis draws upon interviews with over 60 fintech CEOs and investors worldwide, providing a unique perspective on the forces currently shaping the fintech industry and its trajectory towards innovation and profitability.

Key highlights from the report include:

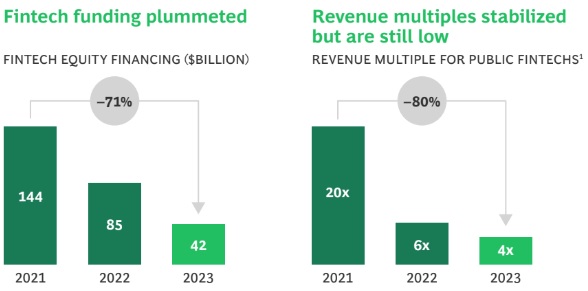

· A robust annual growth of 14% in global fintech revenues from 2021 to 2023, despite significant shifts in funding and valuations

· An emerging shift from a "growth at all costs" model to one emphasizing profitable growth, with notable improvements in operational margins

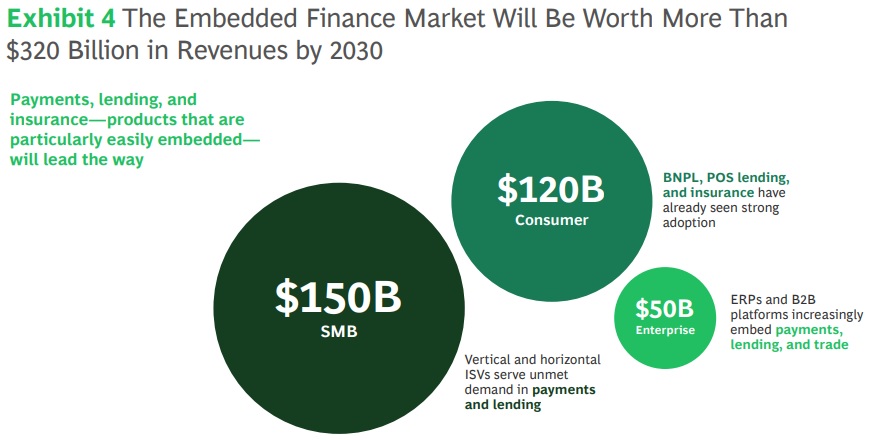

· The identification of four major trends set to drive fintech innovation: embedded finance, connected commerce, open banking, and generative AI

Insights on India:

1. Growth in Real-Time Payments:

· In India, the number of monthly real-time payments has grown by five times in the last three years, from 2.6 billion to 13.3 billion. The availability of an alias directory and QR codes on top of RTP infrastructure was critical to propelling innovation

2. Digital Public Infrastructure (DPI):

· India’s DPI stack has government-defined protocols throughout three layers, which in turn enable private innovation: foundational national digital ID, platform for interoperable instant and cheap payments, and consent-based exchange of federalized data

· India has really taken the best of breed in its approach to fintech: capitalism driving innovation from the US, the need for regulatory oversight from Europe, and the importance and value of home-grown tech players from China and APAC

3. Impact of Regulatory Frameworks:

· India, for example, has released new notifications to reemphasize and clarify know-your-customer (KYC) and co-lending standards for fintechs

4. Bank Fraud Reduction:

· The Reserve Bank of India reported a six-year low of bank fraud, which declined by 86% in value from April 2022 through September 2023