Investments in Mixed, Extended Reality, To Drive EMEA’s AR/VR Market, Says IDC

FinTech BizNews Service

Mumbai, May 27, 2025: EMEA (Europe, Middle East and Africa) augmented reality (AR) and virtual reality (VR) spending will reach $8.4 billion by 2029, reflecting 16% five-year compound annual growth rate (CAGR). The consumer sector will lead investment in the AR/VR market, and this trend is expected to persist throughout the forecast period. However, enterprise adoption is also anticipated to rise due to the growing demand for headsets, according to the Worldwide Augmented and Virtual Reality Spending Guide published by International Data Corporation (IDC).

Alexandra Rotaru, Data & Analytics manager at IDC Data and Analytics, Europe

“The AR/VR market in the EMEA region is still in its early stages and remains sensitive due to economic volatility, which slightly hampers broader adoption,” says Alexandra Rotaru, Data & Analytics manager at IDC Data and Analytics, Europe. “However, in the short to mid-term, growth in the AR/VR market is expected to be driven by investments in mixed reality solutions to enhance remote collaboration, training activities, and immersive experiences in sectors like engineering, healthcare, manufacturing, and retail.”

Industries such as engineering, healthcare, manufacturing, and retail are poised to lead the way in spending on AR/VR solutions, accounting for over half of the market by 2025. Engineering, construction, and real estate are using AR/VR to boost productivity, collaboration, and customer experiences through enhanced visualisations and improved training capabilities. In healthcare, AR/VR is enhancing diagnostics and patient empowerment, while manufacturers are investing in these technologies to streamline operations and improve product quality. Consumers will continue to be the biggest spenders, largely due to investments in the AR/VR-fueled gaming solutions.

As the market transitioned to include two new hardware categories, such as Mixed Reality (MR) and Extended Reality (ER) headsets, IDC estimates that MR headsets will contribute the most towards the overall hardware spending in EMEA.

According to the IDC’s Worldwide AR/VR Headset Tracker, the linked product with the above-mentioned spending guide, MR headset volumes are expected to rise steadily due to higher customer demand, new models from Meta and Apple and the entry of new vendors in the market. IDC also predicts that the VR headsets will cease shipping by mid-2025 as the vendors will transition their products to mixed reality (MR) or extended reality (ER) headsets.

"Meta remains the undisputed leader in the category, but competition is gaining momentum," says Diogo Santos, Data & Analytics analyst at IDC Data and Analytics, Europe. "In 2024, Meta accounted for three-quarters of the EMEA AR/VR market. However, new brands focusing on Extended Reality (ER), such as Even Realities and Xreal, are entering the scene. These products are increasingly appealing to consumers due to their design, portability, and innovative use cases. Although these brands currently ship relatively small volumes compared to Meta, their growth rate is extraordinary. Any stakeholder in this market should pay close attention to these rising stars."

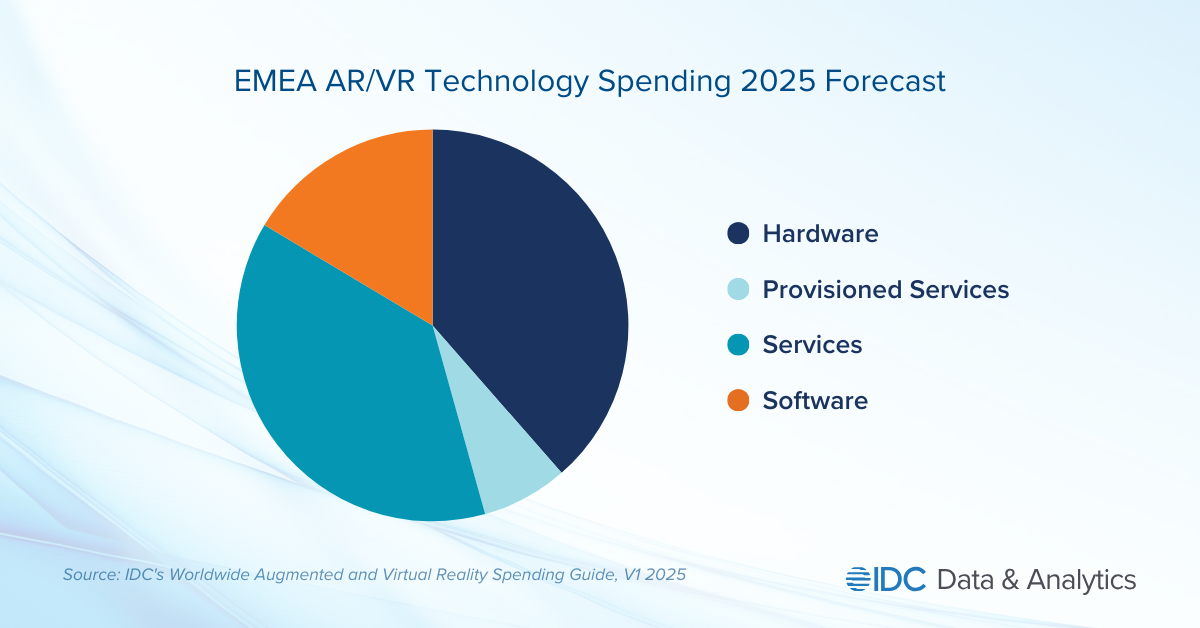

When it comes to technology spending, the hardware category, including the headsets, remains a significant component of the AR/VR market in EMEA, while the software and provisioned services segments are experiencing the fastest growth, propelled by the development of MR applications, social VR platforms, and AR cloud technologies that facilitate shared digital experiences in physical spaces.

In terms of regional spending, Western Europe remains the largest market in terms of spending, while Middle East and Africa presents the fastest growing demand, with more than 20% five-year CAGR.