As of 30 June 2025, there are 30 FinTech unicorns in India, mainly in payments and lending.

FinTech BizNews Service

Mumbai, October 19, 2025: Digital lending, payments and enabling tech together accounted for more than 70% of the total funding in the FinTech space in the last three years. The average funding round size in the FinTech sector was about USD 22 million in the same period, as per a PWC India research.

PWC India has come out with a special research report titled “Investing in India’s FinTech disruption.”

This India FinTech deals tracker report was released during the recently held GFF 2025 at Jio, BKC.

As of 30 June 2025, there are 30 FinTech unicorns in India, mainly in payments and lending. The start-up ecosystem raised about USD 100 billion funding in the last five years, with FinTech on the forefront accounting for 21% of the total funding.

According to Amit Nawka, Partner – TMT Deals, PwC India, “India’s financial services are undergoing a rapid transformation, driven by FinTech start-ups. These companies are increasingly adopting AI and new technologies to replace traditional banking practices and deliver more personalized products. The transformation is not just about going digital; it is about making finance more inclusive and accessible. With growing focus on regulatory compliance, the rise of global and ESG-driven investments, and the expansion of embedded finance, the next phase of FinTech in India is set to be driven by these forces.

This report dives into subsectors of FinTech – lending, payments, WealthTech, InsurTech and enabling tech – focusing on the funding trends as well as the future opportunities. We’ve also highlighted FinTech unicorns and their contribution to the FinTech ecosystem. The report further shows Bengaluru as the powerhouse of the Indian start-up ecosystem, attracting 48% of total sector funding and home to 50% of the total FinTech unicorns.

We hope that this report can be leveraged by FinTech builders and investors to spot opportunities and identify emerging themes and by regulators and policymakers to understand how the sector is evolving.”

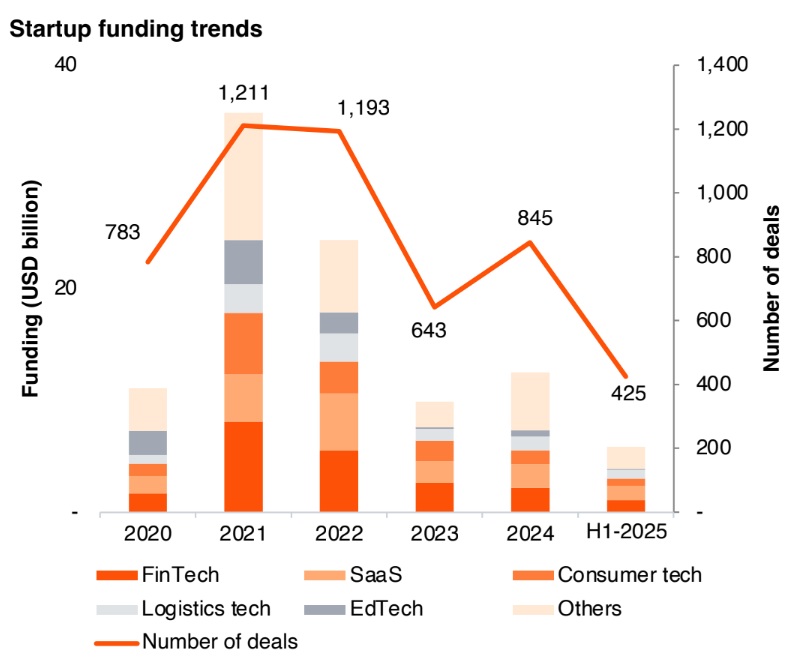

India start-up funding landscape

Over the past five years, India’s start-up ecosystem has raised about USD 100 billion.

At a sector level, FinTech accounted for 21% of the total accumulated funds raised, followed by SaaS (16%) and consumer tech (13%).

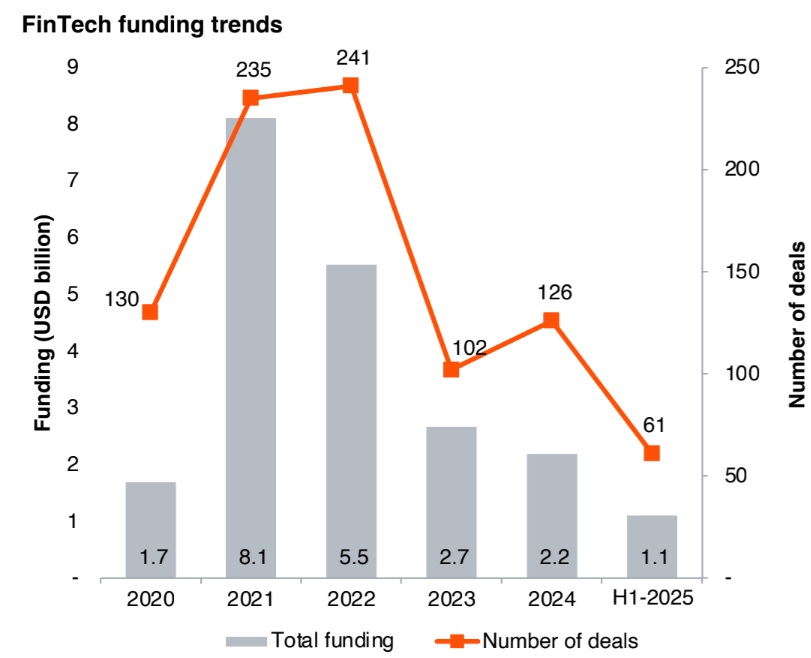

FinTech funding trends

India's FinTech sector has attracted more than USD 21 billion in funding in the last five years; the peak occurred in 2021.

FinTech sectoral view:

Digital lending, payments and enabling tech together accounted for more than 70% of the total funding in the FinTech space in the last three years. The average funding round size in the FinTech sector was about USD 22 million in the same period.

Share of FinTech subsectors:

Digital lending attracted the highest funding (41%) in the last three years among the FinTech subsectors. Payments (20%) and enabling tech (13%) were the next top subsectors.

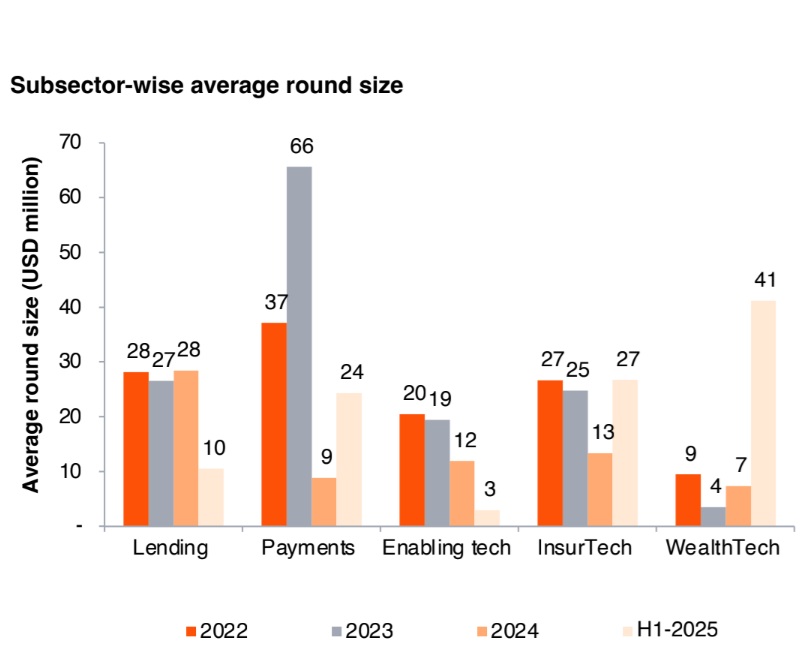

Average round size:

In H1-2025, ticket size of WealthTech (USD 41 million) and InsurTech (USD 27 million)

rose, while lending (USD 10 million) and enabling tech (USD 3 million) have fallen as compared to 2024. In 2023, payments had the highest average ticket at USD 66 million which subsequently declined to USD 9 million in 2024 and USD 24 million in H1-2025.

Stages of investment:

Share of growth-stage funding rose in H1-2025 after declining in prior years. Average deal sizes of growth stage deals reduced from about USD 49 million in

2022 and 2023 to about USD 22–24 million in 2024 and H1-2025.

Stage of funding:

In H1-2025, share of growth stage funding increased, which was offset by decline in the share of both early- and late-stage funding. However, average ticket size of growth investments declined to USD 22 million.

Average ticket size:

Early-stage funding ticket sizes are showing consistent increase and was at USD 8 million in H1-2025. In 2024 and H1-2025, growth-stage deals experienced a significant decline, with average ticket sizes dropping to around USD 22-24 million, compared to the historical USD 49 million. A similar trend occurred in late-stage deals, where the average ticket size fell to USD 38 million in H1-2025.

FinTech capital and unicorns:

As India’s start-up capital, Bengaluru’s FinTech companies attracted 48% of the total funding. As of 30 June 2025, there are 30 FinTech unicorns – mainly in payments, lending and enabling tech.

Investing in India’s FinTech disruption

Domicile of funded FinTech companies:

Bengaluru remains the start-up capital of India, with FinTech companies based in the city attracting 48% of the total funding. Other major locations are NCR and Mumbai.

FinTech unicorns:

As of 30 June 2025, there were 30 unicorns – with most of them in the payments and lending subsectors. No new unicorns emerged in H1-2025. In 2024, three unicorns were added to the list – Moneyview, Perfios and Navi.

FinTech soonicorns (soon to be unicorn):

There are six FinTech companies that have raised more than USD 200 million.

Basis past trends, the next round is likely to be a unicorn valuation round – of these six, four belong to the lending subsector, one belongs to InsurTech and one to enabling tech.

M&A transactions in the last five years:

A total of 149 M&A transactions were reported by 106

companies, with major FinTech firms in payments and

enabling tech leading the tally, including

five deals over USD 150 million.

Investing in India’s FinTech disruption

M&A transactions:

A total of 149 M&A transactions were reported by 106 companies.

Most transactions were in the payments and enabling tech space

with a rationale to acquire technology/product capabilities. Wealth and lending

were the other key sectors.

USD 150 million+ deals:

Five M&A deals were reported with valuation in excess

of USD 150 million each. The top two deals were

consummated by Polygon, a leading company in the

blockchain space.

Serial acquirers:

Major FinTech companies in the payments and enabling tech sectors lead the tally in the number of M&A transactions.

Sectoral deep dive

Digital lending attracted the most funding (41% of total) in the last three years.

Lending’s share of the total funding activity declined significantly from 66% in 2024 to 21% in

H1-2025. Average ticket size of deals in this space decreased from nearly USD 28 million in 2024 to

USD 10 million in H1-2025. In H1-2025, Leap Finance, Flexiloans and Propelld each raised more than

USD 30 million, which represented 60% of the subsector’s total funding. In 2024, DMI Finance, Mintifi and Finova Capital together raised USD 649 million, representing 46% of funding in this subsector.

• Payments’ share of total funding activity increased from 6% in 2024 to 33% in H1-2025. Average deal

size also increased, from USD 9 million in 2024 to USD 24 million in H1-2025. Funding in H1-2025

was led by Tonetag, CRED and Juspay, which together accounted for 58% of total funding in this

subsector. In 2024, Paymate and OneCard secured approximately USD 30 million each, representing

48% of the subsector’s total funding.

• Enabling tech’s share of total funding activity declined from 13% in 2024 to 2% in H1-2025. The

average ticket size dropped from USD 12 million in 2024 to USD 3 million in H1-2025. Hyperbots

secured the highest funding amounting to USD 7 million in H1-2025. In 2024, M2P Fintech, Perfios

and IDfy together raised USD 220 million, representing 80% of the funding in this subsector.

• WealthTech’s share of total funding increased from 8% in 2024 to 26% in H1-2025. The average deal

size also climbed from USD 7 million in 2024 to USD 41 million in H1-2025. Funding in H1-2025 was

mainly driven by Groww and Smallcase which raised USD 200 million and USD 50 million,

respectively, and accounted for 87% of total funding in this subsector. Dezerv and Zinc Money

contributed 46% of the funding deals in 2024.

• InsurTech’s share was around 5-7% during 2024 and H1-2025. In H1-2025, InsuranceDekho secured

funding of USD 70 million, accounting for 86% of total funding in this subsector. In 2024, Onsurity,

Zopper and Acko, each raised more than USD 20 million, collectively contributing to 86% of the

subsector's total funding.

• Others comprise neo-banks, web3 assets and regulatory tech start-ups.

Digital lending start-ups

Digital lending start-ups attracted approximately USD 2.6 billion funding since 2023.

Consumer lending investments were dominated by personal and home loan start-ups,

whereas SME lending focused on start-ups in business loans, supply chain finance and agri-tech.

Digital lending - funding trends:

• In 2023 and 2024 share of SME lending was 70%. However, in H1-2025, the split shifted to 42% for

SME and 58% for consumer lending.

• In SME lending, business loan start-ups attracted the highest funding, contributing 68% of the

total funding activity between 2023 and H1-2025, followed by supply chain financing (18%) and

agri loans (8%).

• In consumer lending, personal loan start-ups attracted the highest funding, contributing 38% of

the total funding activity between 2023 and H1-2025, followed by home loans (21%) and

education loans (17%).

Emerging trends

1. Stricter regulations for borrower protection: The Reserve Bank of India’s Digital Lending Directions (2025) require clear pricing, ban on hidden charges and hold intermediaries accountable. This increases compliance costs but makes digital lending safer and more transparent.

2. Embedded finance: Credit is now being built into digital platforms like e-commerce and payments, where loans are offered directly at the point of need. This makes borrowing more accessible and seamless for users.

3. Data-driven underwriting2: Lenders are using account aggregator data, GST records and AI models to assess creditworthiness. This helps bring thin-file consumers and small businesses into the formal credit system.

Funding in the payments segment was concentrated amongst a few select companies. Four companies each secured funding rounds exceeding USD 100 million, and one company, PhonePe, raised USD 850 million in 2023.

Payments - funding trends

• In H1-2025, funding was primarily driven by Tonetag,

CRED and Juspay, which collectively accounted for 58%

of the total investments in this subsector. In 2023,

PhonePe secured USD 850 million, which constituted

93% of all funding activities.

• Between 2023 and H1-2025, key segments in payments

included PSPs, which represented about 61% of total

funding activity. Following them, payment gateways

and co-branded card start-ups each contributed 15%.

Emerging trends

1. Cross-border UPI corridors3 – India is expanding UPI beyond its borders, starting with the UPI–PayNow link with Singapore. Such initiatives are creating faster and cheaper options for international remittances, with more global corridors expected in the coming years.

2. Rapid adoption of SoftPOS and QR4 – Digital acceptance is gaining momentum across country through SoftPOS (tap-on-phone) and interoperable codes. These affordable solutions make it simple for small kirana stores and retailers to integrate into digital payment ecosystem, boosting financial inclusion.

3. Connecting systems with API orchestration5 – API-based platforms are reshaping payments by enabling direct payments to the right place, matching transaction with records and sending money out to recipients. Payment companies are building the core systems businesses to rely on, making payment flows simpler and efficient.

WealthTech start-ups

WealthTech start-ups have raised significant funding in H1-2025 compared to previous years.

WealthTech - funding trends

• WeathTech segment has gained traction with significant

increase in funding from USD 39 million in 2023 to USD

143 million in 2024. Further, the funding increased two-

fold to USD 288 million in H1-2025.

• In H1-2025, Groww raised USD 202 million. In 2024,

Dezerv, Zinc Money and Centricity raised over

USD 20 million each, accounting for 46% of funding in

the period.

• Broking and trading segment raised the highest funding,

contributing to 45% of the total funding activity

between 2023 and H1-2025. Wealth management and

learning contributed to 29%, whereas alternative

investment start-ups contributed to 14%.

Emerging trends

1. AI-driven hyper-personalisation6 – Wealth management is being transformed by AI, enabling real-time, personalized financial advice aligned to each client’s investment goals and risk appetite. This enables wealth management to become more intuitive, responsive and tailor made as per individual needs.

2. Fractional and direct indexing – WealthTech platforms are increasingly enabling fractional ownership and direct indexing, giving retail investors the ability to build customised portfolios with smaller ticket sizes. This is making wealth creation more accessible and broad-based.

3. Global and ESG-oriented investments – Indian retail investors are showing growing interest in global

diversification – investing in equities and ETFs from other geographies. At the same time, sustainable and impact investing is becoming mainstream, with more platforms offering ESG-aligned portfolios.

InsurTech

InsurTech witnessed an increase in the overall funding in H1-2025. InsuranceDekho raised USD 210 million in 2023 and USD 70 million in H1-2025, contributing to 55% of the total funding activity in the period covered.

InsurTech - funding trends

• The players in the InsurTech value chain can be broadly

classified into insurance manufacturers, insurance

aggregators and distributors and others (claim

automation, customer service, underwriting

companies).

• Insurance aggregators and distributors accounted for

93%, 69% and 100% of funding activity in 2023, 2024

and H1-2025, respectively.

• Between 2023 and H1-2025, InsuranceDekho,

RenewBuy and Onsurity have raised USD 280 million,

USD 70 million and USD 50 million, respectively.

Emerging trends

1. Technology-driven innovation – Insurers are leveraging AI, automation and digital KYC to speed up onboarding, claims and servicing. Usage-based covers and collaboration with InsurTechs are boosting efficiency and elevating customer experience.

2. Rise of embedded insurance – Embedded insurance is growing fast across multiple sectors such as retail, travel, mobility and healthcare. Insurers are increasingly teaming up with apps and websites to ensure that the right cover is available with a single click at the time of purchase.

3. Emergence of climate-linked/parametric insurance models11 – Growing weather disruptions are driving increased interest in insurance models for agriculture and MSME sectors. Trial projects are in progress to explore how rainfall or temperature-based triggers provide quicker support to affected segments, especially for farmers.