Consolidated Financial Statements For the year ended 31 March 2025.

FinTech BizNews Service

Mumbai, April 22, 2025: HCL Technologies Limited today announced Q4 & Annual FY 2025 results.

FY 2025 Highlights

Revenue

• INR Revenue of Rs 117,055 Crores, up 6.5%

• Constant Currency (CC) Revenue up 4.7%

• USD Revenue of $13,840M, up 4.3%

• HCLTech Services CC Revenue up 4.8%

• Digital CC Revenue up 8.6%; contributes 39.0% of Services

• HCLSoftware CC Revenue up 3.5%

• HCLSoftware ARR at $1.03B, up 1.8% CC 2

Profitability & Return Metrics

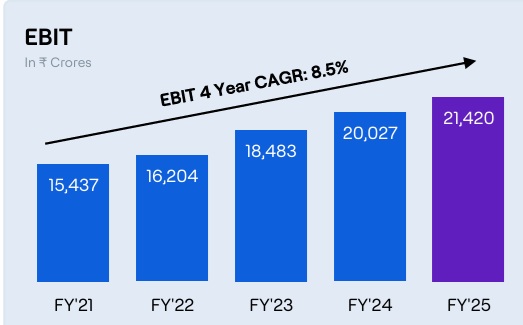

• EBIT at Rs21,420 Crores (18.3% of revenue), up 7.0%

• Net Income at Rs17,390 Crores (14.9% of revenue), up 10.8%

• EPS (Diluted) at Rs64.09, up 10.8%

• ROIC – Company at 37.9%, up 411 bps; Services at 45.5%, up 376 bps

• OCF at $2,632M and FCF at $2,501M

• FCF/NI at 123%

• Full Year Dividend at Rs60/- per share. Payout ratio of 93.5% for FY’25 3 Bookings

• TCV (New Deal wins) at $9,268M 4 People

• Total People Count at 223,420; Net addition of (4,061)

• Reduction in headcount due to divestiture: 7,398

• Added 7,829 freshers

• LTM Attrition at 13.0%* (up from 12.4% in Q4 of last year) *Note: Attrition excludes involuntary attrition and digital process operations. FY26 Guidance 5

• Company Revenue growth expected to be between 2.0% - 5.0% YoY in CC

• Services Revenue growth expected to be between 2.0% - 5.0% YoY in CC

• EBIT margin to be between 18.0% – 19.0%

Q4 FY 2025 Highlights

Revenue

• INR Revenue of Rs30,246 Crores, up 1.2% QoQ & up 6.1% YoY

• Constant Currency (CC) Revenue down 0.8% QoQ & up 2.9% YoY

• USD Revenue of $3,498M, down 1.0% QoQ & up 2.0% YoY • Services CC Revenue up 0.7% QoQ & up 2.7% YoY • Digital CC Revenue up 12.6% YoY; contributes 40.7% of Services

• HCLSoftware ARR at $1.03B, up 1.8% YoY CC 2 Profitability & Return Metrics

• EBIT at Rs5,442 Crores (18.0% of revenue), down 6.5% QoQ & up 8.4% YoY

• Net Income at Rs4,307 Crores (14.2% of revenue), down 6.2% QoQ & up 8.1% YoY

• ROIC (on LTM basis) – Company at 37.9%, up 411 bps YoY; Services at 45.5%, up 376 bps YoY

• OCF at $2,632M and FCF at $2,501M (on LTM basis)

• FCF/NI at 123% (on LTM basis)

• Dividend of Rs18/- per share, 89th consecutive quarter of dividend pay-out 3 Bookings

• TCV (New Deal wins) at $2,995M 4 People

• Total People Count at 223,420; Net addition: 2,665

• Added 1,805 freshers

• LTM Attrition at 13.0%*, (up from 12.4% in Q4 of last year) *Note: Attrition excludes involuntary attrition and digital process operations. 5 ESG

• HCLTech has been included in the S&P Global Sustainability Yearbook 2025 for the 2nd year in a row, recognizing our commitment to sustainability.

• HCLTech was recognized as one of the World’s Most Ethical Companies by Ethisphere for the 2nd consecutive year.

Leadership Comments

Roshni NadarMalhotra, Chairperson, HCLTech: “HCLTech has delivered another year of robust growth with its future ready portfolio. We also marked the 25th anniversary of HCLTech going public and achieved the distinction of delivering best-in-class TSR over the past decade. We remain committed to creating value for all our stakeholders.”

C. Vijayakumar CEO & Managing Director, HCLTech: “HCLTech grew the fastest among our peers for the second year in a row as we witnessed yet another year of disciplined execution. We delivered on our FY25 guidance with revenue growth of 4.7% in constant currency and EBIT margin of 18.3%. HCL Software growth continues to accelerate as it grew 3.5% CC this year. During this quarter, our services business delivered healthy growth of 0.7% QoQ CC amidst volatile market conditions. We saw very strong new bookings of $3B this quarter catalyzed by our AI propositions and integrated GTM organization that was set up at the start of the fiscal year. The strength of our execution should present us good medium-term opportunities emerging out of global uncertainties while we navigate the short-term cautiously.”

Shiv Walia Chief Financial Officer HCLTech:

“HCLTech delivered 6.5% INR revenue growth in FY25, yet another year of best-in-class performance. Our revenue came in at Rs117,055 Crores, up 6.5% and EBIT at Rs21,420 Crores, up 7.0%. HCLTech service revenue crossed a new milestone at Rs 105,398 Crores, up 6.6%. Our Net Income (NI) for the year came in at Rs17,390 Crores, up 10.8%, translating to an EPS of Rs64.09. Our Board is pleased to declare Rs18/share as the Dividend for the quarter, bringing the total to Rs60/share for FY25, which is 93.5% of the EPS. ROIC stands at 37.9% for the Company up 411 bps; at 45.5% for Services, up 376 bps. Our cash generation remains robust with OCF/NI at 129% and FCF/NI at 123%.”

Exclusive AI and GenAI Deals

A US-based automotive OEM selected HCLTech to transform its service desk operations by enabling an Agentic AI solution to resolve level 1 issues at the desk via a conversational interface integrated with automation solutions. The Agentic AI solution dynamically acquires new skills when needed, leading to efficient issue resolution and enhanced ITSM capabilities.

A Europe-based retail company selected HCLTech to implement Agentic Process Automation (APA) powered by GenAI and autonomous agents to streamline order and contract management, enhance forecasting, optimize inventory and automate customer queries. HCLTech’s solution is enabled in partnership with Automation Anywhere, resulting in significant margin improvements and operational efficiency for the retailer.

A US-based MedTech company selected HCLTech to support its greenfield software defined manufacturing project leveraging its AI Engineering and AIoT offerings. HCLTech’s SmartTwin solutions on the NVIDIA Omniverse platform will improve production efficiency and quality through real-time monitoring, predictive maintenance and operational insights. The deployment will deliver up to 30% improvement in final assembly testing efficiency and accuracy and reduce workforce training time from 120 to 60 days.

A Europe-based global financial services company selected HCLTech to leverage GenAI to streamline document processing and data extraction to improve efficiency and accuracy. HCLTech’s AI Force will deliver 25-30% efficiency improvement, 95% accuracy (F1 Score) in extracting data from invoices, contracts and custody documents, and automates 70% of complex document workflows, driving significant productivity gains.

A US-based financial services company selected HCLTech as its strategic partner to streamline its data science and analytics projects using HCLTech’s AI Foundry offering. The engagement involves developing prediction models, forecasting models, and model governance and monitoring. It also includes ideation, piloting AI and GenAI related use cases and feature stores. Carrix, the world’s largest independent marine and rail terminal operator, selected HCLTech to improve its global port operations with HCLTech’s advanced suite of AI Engineering and AIoT offerings. HCLTech will leverage its expertise in automation, AIoT and Vision AI to unify Carrix’s various terminal management tools into one optimized system to help implement a scalable, AI powered approach to safe and secure port operations.

A US-based financial services company selected HCLTech to enhance GenAI capabilities, data processing and orchestration, and address experimentation challenges within its AI platform. HCLTech will deliver Summarization-as-a-Service, set up an experimentation zone, build an orchestrator and refactor the data pipeline using HCLTech’s AI Foundry offering. The solution leverages OpenAI technology to streamline AI workflows and improve data-driven decision making.

A European financial services company selected HCLTech as an AI-based transformation partner to transition its SAS-based data application to the Azure Databricks platform. HCLTech's AI Foundry will reduce license and operational costs while ensuring compliance with complex financial regulations.

A US-based global aerospace major selected HCLTech to enhance passenger safety and cabin crew experience through AI-assisted cabin monitoring systems that will leverage HCLTech’s AI Engineering offering.

A Middle East-based financial services company selected HCLTech’s AI Labs offering to build CoEs for key technologies like GenAI and Data, enhance IT capabilities and drive operational efficiency.

A Europe-based manufacturing company selected HCLTech to implement a GenAI-powered chatbot to automate workflows. The solution enhanced productivity and ensured compliance with regulations by offering advanced document search, summarization, comparison and alignment.

A US-based payments and financial technology company selected HCLTech to implement AI driven solutions to automate manual sales tasks, streamline reporting, build conversational AI agents and provide sellers with the tools they need to manage their portfolios effectively.