India ranks third globally in FinTech funding in 2025

FinTech BizNews Service

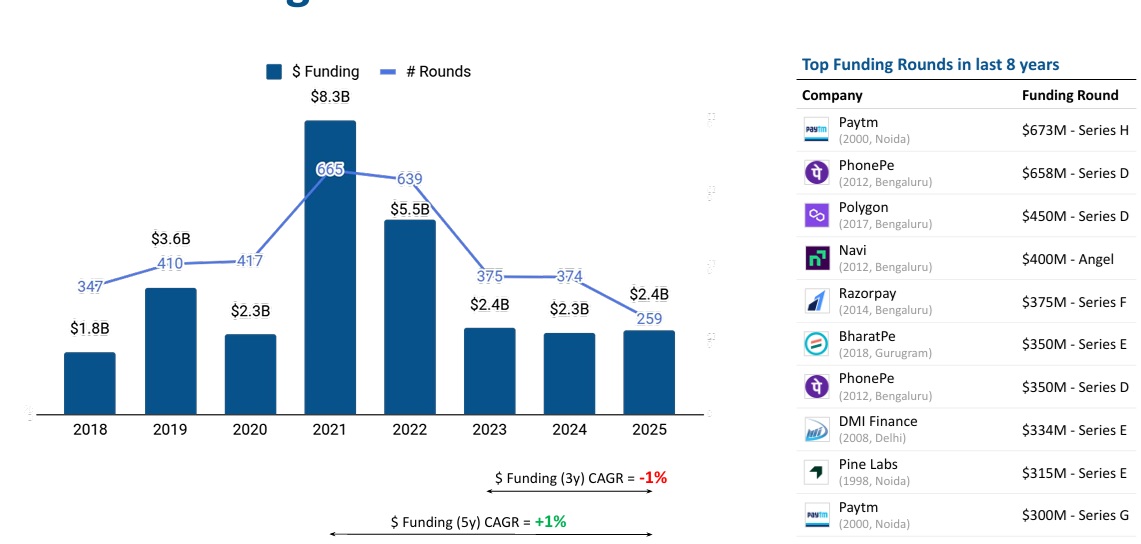

Mumbai, 16 January 2026: The Indian FinTech sector raised a total of $2.4 billion in 2025, representing a 2% increase from the $2.3 billion raised in 2024. India ranked 3rd globally, behind the US and the UK, according to Tracxn, a leading market intelligence platform.

Tracxn has released its Geo Annual India FinTech Report 2025. This proprietary report provides comprehensive insights into the Indian FinTech ecosystem, highlighting funding activity, sector performance, acquisitions, unicorns, IPOs, investor participation, major players, and the key trends shaping the sector’s landscape in 2025. Tracxn Technologies Ltd. is a data intelligence platform for private market research, tracking 5+ million entities through 2900+ feeds categorised across industries, sub-sectors, geographies, and networks globally. It has become one of the leading providers of private company data and ranks among the top five players globally in terms of the number of companies and web domains profiled.

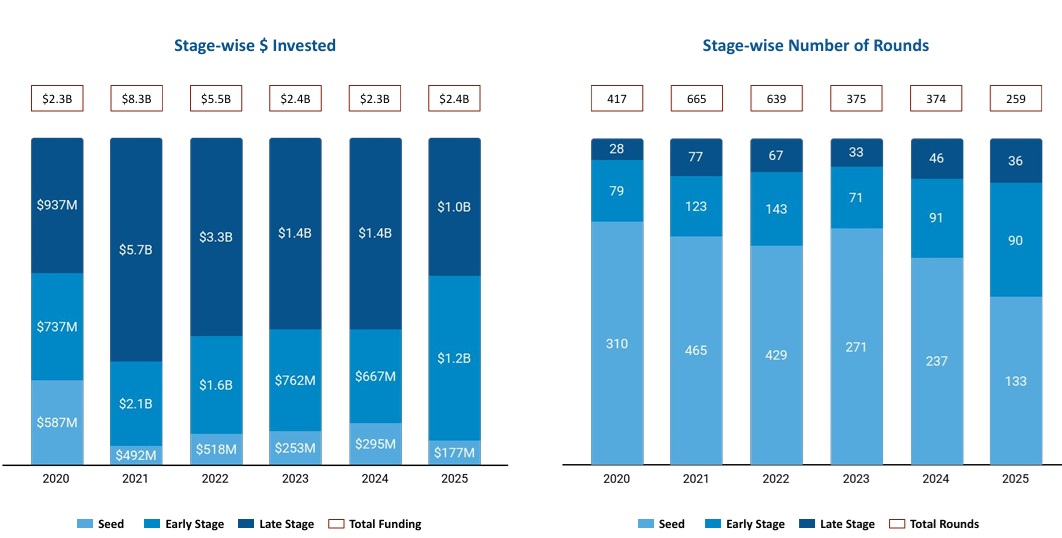

Funding trends varied across stages. Seed-stage funding stood at $177M, reflecting a 40% decline from $295M in 2024 and a 30% drop compared to $253M in 2023. In contrast, early-stage funding demonstrated strong momentum, reaching $1.2B in 2025, a significant 78% increase over $667M raised in 2024 and a 56% rise from $762M in 2023. Late-stage raised funding of $1.0B in 2025, a 26% decline from the $1.4B raised in both 2024 and 2023.

Commenting on the insights, Neha Singh, Co-Founder of Tracxn, said, “India's FinTech ecosystem continues to demonstrate resilience amid a period of funding moderation.

While overall investments have seen a dip, the consistent activity at the early stage and the emergence of new unicorns highlight sustained investor confidence in the sector's long-term potential. The continued dominance of Bengaluru and Mumbai as key innovation hubs underlines the maturity of India's startup ecosystem. As the industry evolves, we expect to see increased focus, deeper technological innovation, and stronger participation from both domestic and global investors.”

In 2025, the FinTech sector witnessed 4 funding rounds of $100M+, unchanged from 2024 and 2023. Large deals during the year were led by companies including Groww, Weaver, and Raise, with Groww raising $202M in a Series F round, Weaver securing $170M in an unattributed round, and Raise raising $120M through a Series B round.

In 2025, India’s FinTech sector recorded 22 acquisitions, a 21% decline compared to 28 acquisitions in 2024 and a 31% drop from 32 acquisitions in 2023. The largest deal of the year was Fisdom’s $150M acquisition by Groww, making it the highest-valued FinTech acquisition in 2025, followed by Stocko’s $35M acquisition by InCred Money.

On the exit front, India FinTech recorded 4 IPOs in 2025, marking a 50% decline from 8 IPOs in 2024 and in line with 2023. The companies that went public during the year included Pine Labs, FinanceBuddha, Groww, and Seshaasai.

There were 3 unicorns created in 2025, marking a 50% increase over 2 unicorns in 2024 and a 200% rise compared to 1 unicorn in 2023.

Bengaluru maintained its dominance as the premier hub, accounting for 42% of all funding seen by FinTech firms in India, followed by Mumbai at 29%.

Among investors, Antler, Blume Venture, and Venture Catalysts led seed-stage investments. Peak XV Partners, Accel, and Elevation Capital dominated early-stage funding, while SoftBank Vision Fund, Lathe Investment, and Sofina were the top late-stage investors.

India’s FinTech sector raised a total of $2.4B in 2025, ranking 3rd globally after the US and the UK. The ecosystem witnessed 4 $100M+ funding rounds, led by Groww, Weaver, and Raise.

Early-stage funding stood at $1.2B in 2025, up 78% from $667M in 2024.

The year recorded 22 acquisitions, 4 IPOs, and 3 new unicorns Fisdom’s $150M acquisition by Groww was the largest FinTech deal of the year.

Bengaluru and Mumbai emerged as the top-funded FinTech cities.