Tracxn Q1 Fintech Report: The quarter received $366M in total funding

FinTech BizNews Service

Mumbai, April 8, 2025: Tracxn, a leading market intelligence platform, has released its Quarterly India FinTech Report- Q1 2025. The report provides insights into funding trends, sector performances, and notable industry developments.

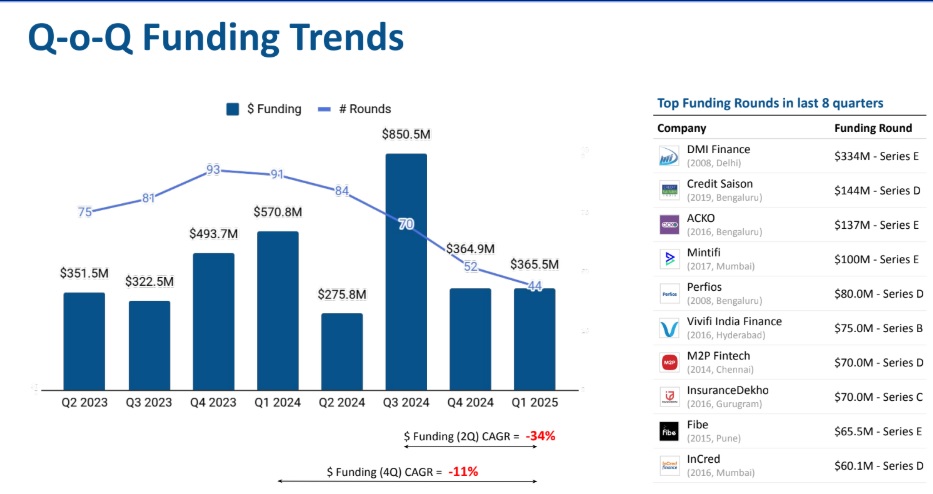

As per the report, India secured the third position globally in terms of funding raised for the FinTech sector in Q1 2025, following the United States and the UK. Q1 2025 witnessed a total funding of $366M, marking a decrease of 35% compared to the $571M raised in Q1 2024. However, similar funding of $365M was raised in the previous quarter (Q4 2024).

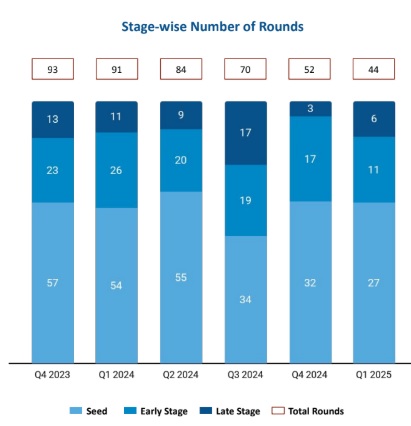

The majority of the funding in this space has been seen in the late-stage rounds. Late-stage funding witnessed a 47% increase to $227M, compared to $154M raised in Q4 2024 and a 21% decrease from $286M raised in Q1 2024.

Q1 2025 witnessed a significant 56% drop in early-stage funding, which is at $92.6M compared to $210M in Q1 2024 and a 41% decrease from the $157M raised in Q4 2024. Seed-stage funding witnessed $45.9M in funding, a decline of 39% compared to $75.5M raised during Q1 2024 and a 16% decline compared to $54.6M raised in Q4 2024.

After peaking in Q4 2021, the fintech funding has steadily declined, with minor spikes in Q1 2023 and Q3 2024. This decline can be attributed to several factors, including macroeconomic challenges and geopolitical headwinds. The Indian economy faced bearish stock trends, U.S.-imposed tariffs, global trade tensions, and rising inflation, discouraging venture capital inflows. Additionally, large FinTech deals, which typically drive overall funding volumes, were absent in Q1 2025. As the FinTech landscape becomes more crowded, market saturation has intensified competition among startups, reducing returns on investment and making investors hesitant to commit funds to new ventures. This period saw only 10 companies securing first-time funding, compared to 29 in Q1 2024.

Despite these challenges, India's GDP growth for FY 2025 is projected to remain resilient at approximately 6.5%. Furthermore, the rising acceptance of UPI beyond Indian borders in countries like Singapore, Nepal, and Sri Lanka presents a significant opportunity for Indian FinTech players to expand operations overseas and attract more capital into the sector.

March was the most funded month of the quarter, with $187M raised, accounting for 51% of the total funds.

The report highlights that the sector witnessed significant growth in specific segments, with Banking Tech, Internet First Insurance Platforms, and Investment Tech emerging as top performers in Q1 2025.

Banking Tech, the highest-funded sector, received a funding of $108M, a 9% increase compared to the $99M observed in Q1 2024 and a substantial increase of 1700% compared to $6M raised in Q4 2024, accounting for 29.59% of the total funds raised in Q1 2025 in this ecosystem.

Zolve, a provider of a cross-border neo-bank for individuals, raised $51M in Series B funding, accounting for 47% of the funding in this space.

The Internet First Insurance Platforms, the second-highest funded sector, witnessed $87M in funding in Q1 2025, a 1391% increase compared to $5.84M raised in Q1 2024 and no funding raised in Q4 2024.

Also, 97% of the funding in this space was due to the $84.5M funding raised across multiple rounds by InsuranceDekho, an insurance comparison platform for individuals.

The Investment Tech segment was the third-highest funded sector with a funding of $76.6M in Q1 2025, a decline of 38% compared to the $123M raised in Q1 2024, but a 53% rise from $50.5M raised in Q4 2024.

Smallcase, an online platform offering smart investment portfolio products, raised $50M in a series D funding round, accounting for the majority of the funds in this segment.

Speaking at the launch of their report, Neha Singh, Co-Founder Tracxn, said, "The Indian FinTech sector continues to evolve despite market fluctuations. While funding levels have declined, the industry's long-term growth potential remains strong. With increasing regulatory clarity, digital payment expansion, and a rising global footprint, we anticipate exciting opportunities for FinTech startups in the coming years."

The quarter witnessed ten acquisitions, reflecting a 67% and 100% increase compared to that of 6 and 5 acquisitions in Q1 2024 and Q4 2024, respectively. Notably, two acquisitions had a valuation exceeding $100M. Magma General Insurance, a multi-category insurance provider, was acquired by DS Group and Patanjali Ayurved for $516M. Axio, a Bengaluru-based online lending platform offering point of sale financing, was acquired by Amazon for a price of $150M.

The quarter did not witness any $100M+ funding rounds in Q1 2025, unlike Q1 2024 and Q4 2024, which each had one such round.

Q1 2025 did not witness any unicorns in Q1 2025, compared to that of 1 Unicorn in Q1 2024.

No IPOs emerged in Q1 2025, compared to 1 IPO in Q1 2024 and 2 IPOs in Q4 2024.

Bengaluru emerged as the leader in total fintech funding raised during Q1 2025, followed closely by Gurugram and Mumbai, reaffirming the significance of these cities as fintech hubs in India's startup landscape.

Peak XV Partners, Angel List, and LetsVenture are the all-time top investors in the space. 100Unicorns, Blume Ventures, and Antler led the seed investments in Q1 2025, while Peak XV Partners, Accel, and Beams FinTech Fund were prominent in early-stage investments.