Pure-Play BPO Services: Healthy Growth Likely

ERD companies should report a mixed performance

FinTech BizNews Service

Mumbai, 6 January 2026: Kotak Institutional Equities has come out with an insightful research report with 3QFY26 preview of IT Services:

3QFY26 preview: Stable trends

We expect a moderate performance in a seasonally weak period for IT services companies. Pure-play BPO services are likely to demonstrate healthy growth. ERD companies should report a mixed performance, with KPIT and TTL lagging on organic revenue growth. EBIT margins are likely to remain rangebound for most companies, partly aided by rupee depreciation. Demand continues to be led by cost takeout deals but not net-new for the industry. Deal wins would be better, aided by large and mega-deal wins. The risk-reward is in balance, with TechM, Coforge, Sagility, Indegene and TCS being our key picks.

Moderate performance in a seasonally weak period

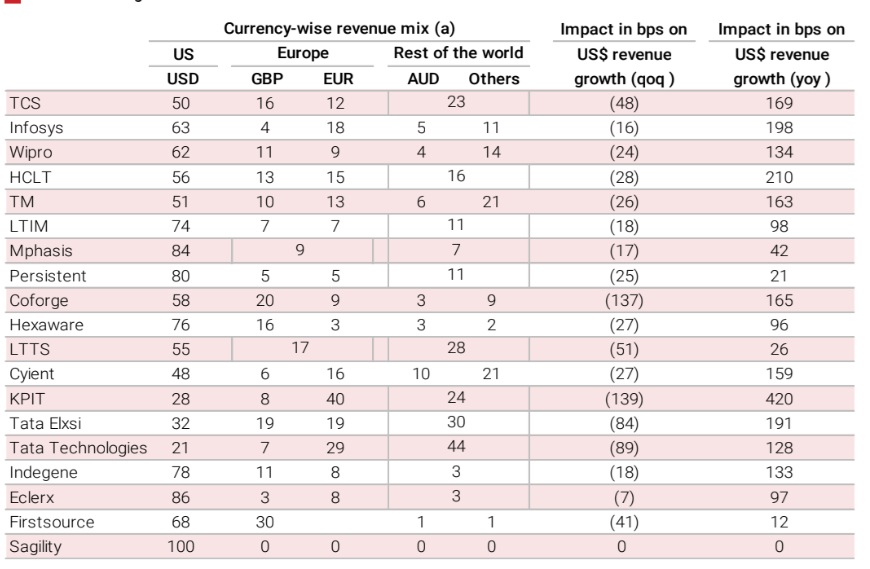

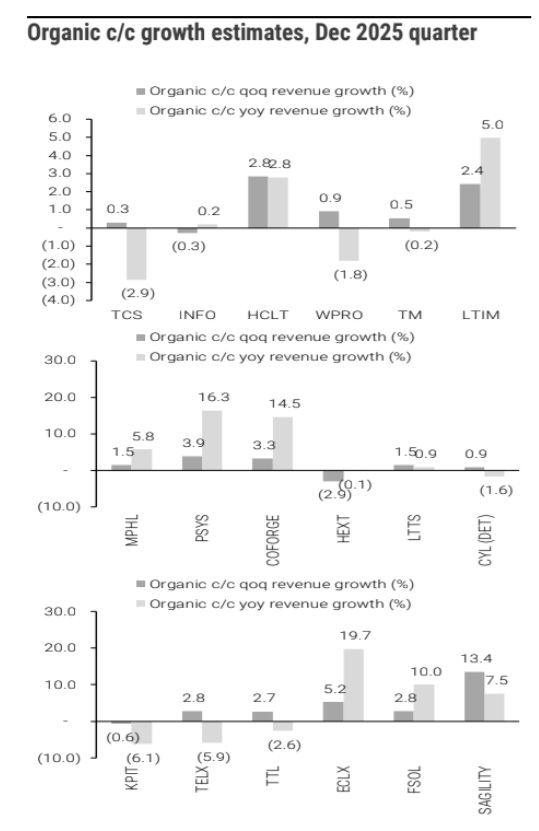

Demand has remained broadly on expected lines in the past couple of quarters with furloughs at normal levels. Seasonal trends should drive a strong performance at HCLT (2.8%) and a weak performance at Infosys (0.3% qoq decline). Organic revenue growth of TCS, Wipro and TM is expected to be in the 0.3-0.9% range. Persistent and Coforge should continue to lead among mid-tier companies, with 3.9% and 3.3% qoq growth, respectively. Hexaware will likely report a 2.9% organic revenue decline, impacted by seasonal weakness and lower license revenues. Sequential growth trends should be mixed for ERD services pure-plays, while yoy growth should remain uninspiring across companies due to subdued demand in the automotive vertical. BPO services companies will likely report a healthy quarter, with organic revenue growth in the 2.8-13.4% range. Sagility is likely to outperform, aided by seasonal strength. Currency would be a 20-50 bps headwind across most companies sequentially.

Broadly stable margin trajectory for most companies

EBIT margins would be rangebound qoq across most companies. The wage hikes could impact profitability by 30-100 bps for KPIT, Persistent, TTL and Coforge. We expect mixed trends on yoy profitability but sharp declines across ERD companies. Incremental margin levers are limited for most IT services companies, with the exception of TechM, which remains on track to achieve its stated aspirations by FY2027. We do not factor in any impact from likely provisions related to new labor code effective Nov 2025.

FY2026E outlook—moderate tweaks likely

We expect Infosys to narrow FY2026 revenue growth guidance toward the upper end of 2.5-3.0% c/c yoy (from 2-3%). This does not include the contribution from Versent Group acquisition, which is yet to close. The guidance likely implies -2% to flat revenues qoq in 4QFY26. HCLT too might revise services growth outlook to 4.5-5.0% (from 4-5%), implying 0.5-2.3% c/c qoq in the March 2026 quarter. Overall revenue growth outlook would be narrowed to 3.5-4.5% (from 3-5%), implying ~2-5% c/c yoy revenue decline in the products segment in FY2026E. Wipro could guide for 1.5-3.5% c/c qoq revenue growth in 4QFY26, including a 200 bps contribution from the DTS acquisition.

Stable demand environment, led by cost takeout deals

Demand drivers remain unchanged, with limited improvement in discretionary spends, and primarily driven by cost optimization priorities of clients. The recent upmove factors in optimism of revenue growth acceleration in FY2027. TechM, Coforge, Sagility, Indegene and TCS are our key picks.

CY2026 spend outlook—a few things to consider

Enterprise tech spends are likely to remain broadly stable in CY2026 with limited willingness of clients to commit incremental spends for large transformation programs. Vendor consolidation and cost optimization will continue to remain in focus, in our view. The set-up for FY2027 is interesting for the sector. Firstly, FY2026 revenue growth was impacted by tariffs in retail and manufacturing verticals. Stabilization in these verticals, coupled with a largely unchanged demand scenario in most of the other verticals, would drive 100-200 bps acceleration in revenue growth across most larger companies despite a muted uptick in discretionary spends, which remains our base case and a more likely outcome.

Second, AI adoption would continue to pick up. CY2024 was a year of experimentation, while CY2025 marked initial enterprise adoption of Gen AI. We expect wider adoption in CY2026 focused on established uses cases, such as the improving efficiency of SDLC, legacy modernization, testing and knowledge management.

Third, competitive intensity is likely to remain higher, more so for renewal deals, which might not be incremental wallet spends for Indian IT. Companies have been aggressive in defending wallet share, but that would come at a cost. We believe companies that have higher dependence on large deals could have a trade-off between growth and profitability imperatives.

Fourth, while uncertainties related to immigration policies remain, so far revised regulations have had limited adverse impact and companies have positioned themselves well, reducing H-1B dependence to contain the extent of disruption.

Mixed performance at ERD companies but near-term demand headwinds persist

Auto ERD demand recovery remains uncertain and hinged on a select few OEMs that have lagged competition in their technology transformation and could increase offshoring for better R&D efficiencies. Broader demand uncertainties remain, leading to a reprioritization of spends by most clients. Macro uncertainties impacted spends in CY2025, but the absence of those could be a marginal positive for CY2026, yet it would not indicate a broader improvement in demand. We believe that the sector is past peak R&D spend intensity, limiting growth rates for Indian pure-play ERD services peers. Nonetheless, we expect some improvement in the performance of the companies in the next few months as greater visibility emerges on R&D spends.

Indian pure-play BPO services companies continue to execute well despite rising AI adoption

Pure-play BPO services companies are leveraging their challenger positioning to continue to scale at a healthy rate despite broader deflationary risks from Gen AI adoption impacting customer management and horizontal BPO services. ECLX would report a robust 5.2% c/c qoq revenue growth, led by healthy deal bookings in recent quarters. Sagility would benefit from business seasonality, driving 13.4% c/c qoq growth in the quarter. FSOL is likely to have relatively lower organic growth at 2.8% c/c qoq, while overall revenue growth would be 4.9% c/c qoq, including the full-quarter consolidation of PDC. EBIT margin should improve moderately on a sequential basis for ECLX and FSOL, while increased contribution from BroadPath is likely to drive some moderation in profitability during the quarter.

Key metrics to track

- Deal wins. Multi-year vendor consolidation deals have driven healthy TCV wins for companies. We expect Infosys to report a robust increase in deal wins during the quarter, aided by the NHSBSA mega deal win. According to unconfirmed media reports, TCS has won a US$1 bn, 10-year engagement with Telefonica UK. The robust pipeline build-up in Europe could lead to more large deal wins in upcoming quarters.

- Headcount. Employee headcount growth is a leading indicator for improvement in demand. In the past couple of years, companies have relied on utilizing bench strength in a muted demand environment. Utilization rates are near peak levels and employee pyramid has been impacted by constrained fresher hiring. Campus hiring is now picking up, which would moderate utilization rates but also aid in optimizing employee pyramid.

- Gen AI. Brownfield implementations are yet to deliver the desired results to justify the RoI for enterprises, given the associated complexities. Improved model capabilities could lead to a gradual increase in penetration in the upcoming quarters. TCS and HCLT have started disclosing a few datapoints around the scale of their AI businesses. More companies could follow suit to demonstrate their positioning for the upcoming tech cycle.

- M&A. With the exception of TM and LTIM, IT companies in our coverage have all announced acquisitions in CY2025, primarily aimed at strengthening capabilities and some for market access. More inorganic investments are likely as companies continue to address white spaces to scale up businesses. Many assets would be available at reasonable valuations in a moderate demand environment.

- Labor code revisions. New labor codes in India were made effective from Nov 2025. One of the key changes is redefinition of wages which are used for calculation of employee benefits such as gratuity, leave encashment etc. Companies would need to recalculate these benefits based on new definitions and make additional provisions, if any, accordingly. We expect most companies to catch-up on this in 2HFY26 and possibly have a one-time cost related to increased provisions. We do not bake in any incremental impact of new labor codes in our estimates.

Discussion on individual companies

- TCS. We forecast flat revenues qoq, driven by 0.7% qoq growth in the international business and partly offset by a decline in the India business (down 4.5% c/c qoq). We expect stable EBIT margins, with the impact of planned investments offset by rupee depreciation. P&L charges from employee separation are not baked into our estimates. We expect TCV of US$10-11 bn for the quarter. According to unconfirmed media reports, TCS has won a mega deal in the telecom vertical. Focus will be on the company's renewed aggression and investments to accelerate growth. We expect investor focus on: (1) measures underway to accelerate revenue growth and wallet share shifts in developed markets, (2) deal pipeline and overview of client budgets for CY2026, (3) Gen AI revenues, enterprise adoption and deflationary impact on spends; (4) impact of GCC ramp-up on growth of companies and GCC as a growth lever, (5) progress on planned data center investments, (6) areas of strategic importance for inorganic investments and (7) margin aspirations in light of elevated competitive intensity.

- Infosys. We forecast a revenue decline of 0.25% qoq, primarily due to lower billing days and the absence of mega deal wins in earlier quarters. We do not assume any incremental revenues from the sale of third-party items. We expect gradual EBIT margin improvement qoq, primarily driven by benefits from Project Maximus. We expect large deal TCV of US$4.5-5 bn (~2X yoy), led by GBP1.2 bn mega deal win from NHSBSA. We believe Infosys will revise FY2026E revenue growth guidance to 2.5-3.0% (from 2-3%). The guidance will imply (-)2% to flat revenues qoq in 4QFY26. Our guidance estimate does not include the Versent Group acquisition, which is yet to close. We expect investor focus on: (1) tech spend outlook for CY2026, (2) competitive intensity and pricing pressure in large deals, (3) the willingness of clients to take up large transformation programs that are margin-dilutive initially, (4) the pace of enterprise AI adoption and the resultant pricing and deflationary pressure and (5) incremental benefits that can accrue from Project Maximus.

- HCL Tech. We forecast 1.0% qoq growth in the services business, led by the ramp-up of large deals won during the quarter. Seasonality in the products business would have 180 bps qoq incremental contribution to overall revenue growth. We forecast an underlying EBIT margin increase of 100 bps qoq to 18.5%, after baking in a 70 bps impact of restructuring charges. We expect healthy TCV of deal wins in the US$2.5 bn range. We expect the company to narrow the overall revenue growth guidance to 3.5-4.5% (from 3-5% earlier) and revise services revenue growth to 4.5-5.0% (from 4-5%) for FY2026 while retaining the 17-18% EBIT margin guidance. We expect investor focus on: (1) the path of margin recovery to the 18-19% band, (2) profitability in cost take-out and vendor consolidation deals, (3) deal pipeline and conversion timelines, (4) the state of discretionary spending, (5) the pace of enterprise Gen AI adoption, new opportunities consequent to AI adoption and the likely deflationary impact, (6) drivers behind recent investments in ERD services and products businesses and (7) the underlying environment for growth to accelerate to high-single digits.

- Wipro. We expect organic revenue growth above the midpoint of guidance at 0.9% c/c qoq, primarily aided by the ramp-up of the Phoenix deal; the DTS acquisition was consolidated for one month during the quarter. We expect flat qoq reported EBIT margin. Note that one-off related to client bankruptcy impacted margin in 2QFY26 by 50 bps. On adjusted basis, we expect 50 bps EBIT margin decline primarily due to dilution from DTS acquisition; Wipro has not awarded wage hikes during the quarter. We expect healthy large-deal TCV in the US$2 bn range, aided by aggression on large deal pursuits. The translation of TCV into revenues to be a focus area. We expect revenue growth guidance of 1.5% to 3.5% (~2% inorganic contribution). The residual ramp-up of the Phoenix mega deal and the recent deal wins would aid growth. We expect organic revenue growth guidance of -0.5% to +1.5%. Wipro has distributed excess cash in the past through buyback. Even as the company has increased its dividend payout ratio, we do not think the approach to distributing excess cash will change. Any announcement related to buyback would be in focus. We expect investor focus on (1) the state of demand in the impacted sectors of retail, energy and manufacturing, (2) pricing pressure in large deals and profitability impacts, (3) large deal pipeline and win rates, (4) the pace of Gen AI adoption and its deflationary impact on services spends, (5) GCC growth strategy and (6) catch-up timeframe on growth with peers.

- Tech Mahindra. We forecast c/c revenue growth of 0.5%, led by retail and Comviva businesses. EBIT margin expansion of 60 bps will be led by operating efficiencies and rupee depreciation. We forecast net new deal wins of US$875-900 mn, up 10% qoq and 20% yoy. New deals are likely to have higher margins. We expect further margin improvement and expect the company to exit FY2026E with 13%+ EBIT margins. We expect investor focus on: (1) the path to achieve 15% EBIT margin in FY2027, given the elevated competitive intensity and cost takeout deals, (2) deal pipeline and conversion timelines in light of some pickup in Europe, (3) the performance of impacted verticals, such as hi-tech and manufacturing, and the outlook of the telecom vertical, (4) factors that would drive growth convergence with peers in FY2027, (5) any revenue leakage in existing accounts and (6) TechM's point of view on Gen AI, expected productivity benefits and the likely disruption in the BPO business.