Budget At A Glance: Total capital expenditure is estimated at Rs11,11,111 crore

Mumbai, February 1, 2024: The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman presented the Union Budget 2024, in the Parliament in New Delhi on February 01, 2024.

Earlier, the Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman departed from North Block to Rashtrapati Bhavan and Parliament House, along with the Ministers of State for Finance, Shri Pankaj Chaudhary, the Union Minister of State for Finance, Dr Bhagwat Kishanrao Karad and the senior officials of the Ministry of Finance to present the Union Budget 2024, in New Delhi on February 01, 2024.

Receipts And Expenditure

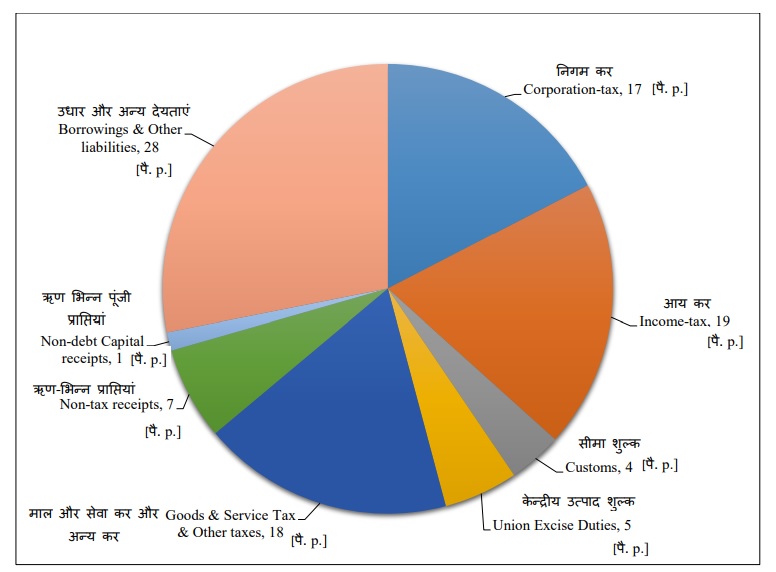

Budget at a Glance presents broad aggregates of the Budget for easy understanding. This document shows receipts and expenditure as well as the Fiscal Deficit (FD), Revenue Deficit (RD, Effective Revenue Deficit (ERD) and the Primary Deficit (PD) of the Government of India. It gives an illustrative account of sources of receipts and their expenditure through graphs and infographics. In addition, the document contains details with respect to the resources transferred to the States and UTs with legislature. The document also encompasses extracts of allocations for programme and schemes and giving insights on sources of deficit financing and composition of important budgetary variables.

Fiscal Deficit (FD) is the adverse fiscal balance which is a difference between the Revenue Receipts Plus Non-Debt Capital Receipts (NDCR) i.e. total of the non-debt receipts and the total expenditure. FD is reflective of the total borrowing requirement of Government. Revenue Deficit (RD) refers to the excess of revenue expenditure over revenue receipts. Effective Revenue Deficit (ERD) is the difference between Revenue Deficit and Grant-in-Aid for Creation of Capital Assets. Primary Deficit is measured as Fiscal Deficit less interest payments. Effective Capital Expenditure (Eff-Capex) refers to the sum of Capital Expenditure and Grants-in-Aid for Creation of Capital Assets. 3. The receipts and expenditure depicted in this document are net of receipts and recoveries as explained in the reconciliation statements provided in the Receipt Budget (Annex-3) and Expenditure Profile Document (Statement No. 17).

RE 2023-24

In RE 2023-24, the total expenditure has been estimated at Rs44,90,486 crore and is more than Actuals of FY 2022-23 by Rs2,97,328 crore. The total capital expenditure in RE 2023-24 is estimated at Rs9,50,246 crore.

The total expenditure in BE 2024-25 is estimated at Rs47,65,768 crore of which total capital expenditure is Rs11,11,111 crore. Budget 2024-25 reflects continuing strong commitment of the Union Government to boost economic growth by investing in infrastructure development leading to an increase in capital expenditure by 16.9 per cent over RE 2023-24. Effective Capital Expenditure, at Rs14,96,693 crore in BE 2024-25, shows an increase of 17.7 per cent over RE 2023-24. 6. Total resources being transferred to the States including the devolution of State’s share, Grants/Loans and releases under Centrally Sponsored Schemes, etc. in BE 2024-25 is Rs22,22,264 crore, which shows an increase of Rs4,13,848 crore over Actuals of FY 2022-23.