FM Retains Same Rates For Direct Taxes, Indirect Taxes And Import Duties

Tax benefits to Start-Ups, investments made by Sovereign wealth funds or pension funds extended to 31.03.2025

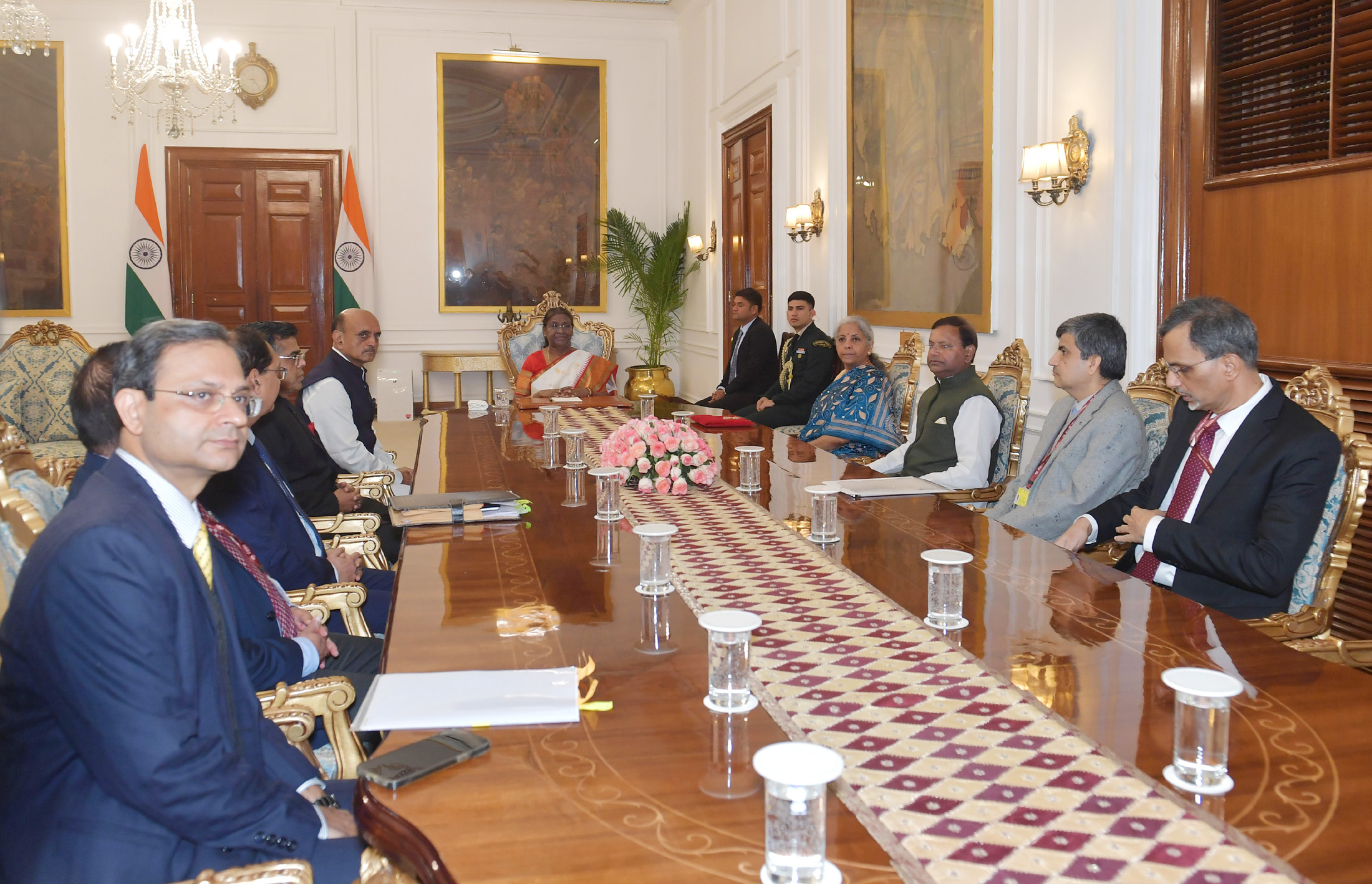

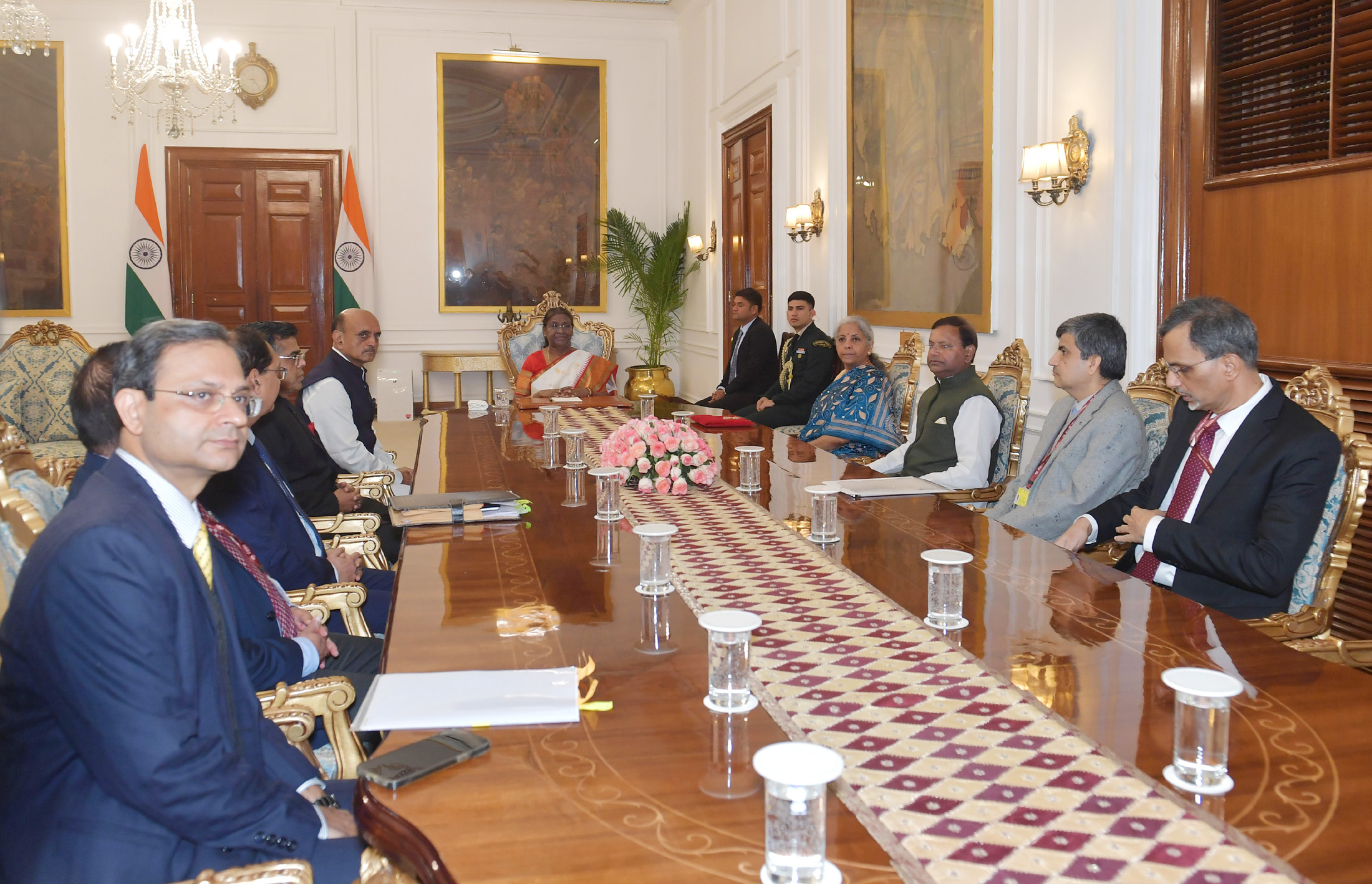

The Union Minister for Finance and Corporate Affairs Nirmala Sitharaman along with the Ministers of State for Finance and officials of the Ministry of Finance calls on the President of India, Smt. Droupadi Murmu before presenting the Union Budget on February 01, 2024

The Union Minister for Finance and Corporate Affairs Nirmala Sitharaman along with the Ministers of State for Finance and officials of the Ministry of Finance calls on the President of India, Smt. Droupadi Murmu before presenting the Union Budget on February 01, 2024

FinTech BizNews Service

Mumbai, February 1, 2024: The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman presented the Union Budget 2024-25, in the Parliament in New Delhi on February 01, 2024.

Direct taxes

- FM proposes to retain same tax rates for direct taxes

- Direct tax collection tripled, return filers increased to 2.4 times, in the last 10 years

- Government to improve tax payer services

- Outstanding direct tax demands upto Rs 25000 pertaining to the period upto FY 2009-10 withdrawn

- Outstanding direct tax demands upto Rs 10000 for financial years 2010-11 to 2014-15 withdrawn

- This will benefit one crore tax payers

- Tax benefits to Start-Ups, investments made by Sovereign wealth funds or pension funds extended to 31.03.2025

- Tax exemption on certain income of IFSC units extended by a year to 31.03.2025 from 31.03.2024

Indirect taxes

- FM proposes to retain same tax rates for indirect taxes and import duties

- GST unified the highly fragmented indirect tax regime in India

- Average monthly gross GST collection doubled to Rs 1.66 lakh crore this year

- GST tax base has doubled

- State SGST revenue buoyancy (including compensation released to states) increased to 1.22 in post-GST period (2017-18 to 2022-23) from 0.72 in the pre-GST period (2012-13 to 2015-16)

- 94% of industry leaders view transition to GST as largely positive

- GST led to supply chain optimization

- GST reduced the compliance burden on trade and industry

- Lower logistics cost and taxes helped reduce prices of goods and services, benefiting the consumers

Tax rationalization efforts over the years

- No tax liability for income upto Rs 7 lakh, up from Rs 2.2 lakh in FY 2013-14

- Presumptive taxation threshold for retail businesses increased to Rs 3 crore from Rs 2 crore

- Presumptive taxation threshold for professionals increased to Rs 75 lakh from Rs 50 lakh

- Corporate income tax decreased to 22% from 30% for existing domestic companies

- Corporate income tax rate at 15% for new manufacturing companies

Achievements in tax-payer services

- Average processing time of tax returns has reduced to 10 days from 93 days in 2013-14

- Faceless Assessment and Appeal introduced for greater efficiency

- Updated income tax returns, new form 26AS and prefilled tax returns for simplified return filing

- Reforms in customs leading to reduced Import release time

- Reduction by 47% to 71 hours at Inland Container Depots

- Reduction by 28% to 44 hours at Air Cargo complexes

- Reduction by 27% to 85 hours at Sea Ports

Economy-then and now

- In 2014 there was a responsibility to mend the economy and put governance systems in order. The need of the hour was to:

- Attract investments

- Build support to the much-needed reforms

- Give hope to the people

- The government succeeded with a strong belief of ‘nation-first’

- “It is now appropriate to look at where we were till 2014 and where we are now”: FM

- The Government will lay a White Paper on the table of the house.