29% Central Banks say they will add more gold in the next 12 months

FinTech BizNews Service

Mumbai, June 18, 2024: The World Gold Council has completed the 2024 Central Bank Gold Reserves Survey. Central banks have been significant buyers of gold in recent years amid both economic and geopolitical uncertainty. Our survey, which received responses from a record-high 70 central banks, shows that:

An increasingly complex geopolitical and financial environment is making gold reserves management more relevant than ever. In 2023, central banks added 1,037 tonnes of gold – the second highest annual purchase in history – following a record high of 1,082 tonnes in 2022.

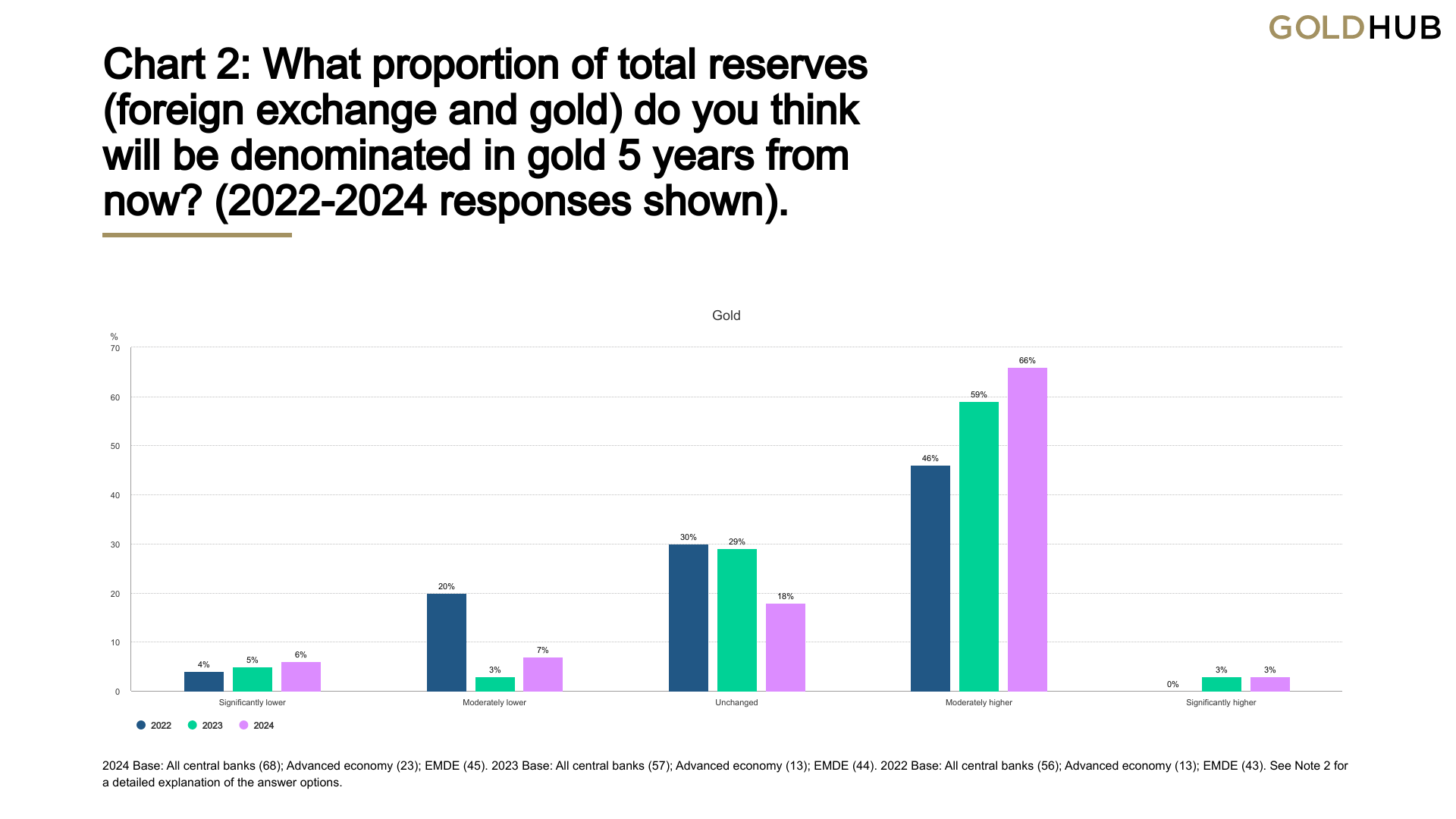

Following these record numbers, gold continues to be viewed favourably by central banks as a reserve asset. According to the 2024 Central Bank Gold Reserves (CBGR) survey, which was conducted between 19 February and 30 April 2024 with a total of 70 responses, 29% of central banks respondents intend to increase their gold reserves in the next twelve months, the highest level we have observed since we began this survey in 2018. The planned purchases are chiefly motivated by a desire to rebalance to a more preferred strategic level of gold holdings, domestic gold production, and financial market concerns including higher crisis risks and rising inflation.

An increasingly complex geopolitical and financial environment is making gold reserves management more relevant than ever. In 2023, central banks added 1,037 tonnes of gold – the second highest annual purchase in history – following a record high of 1,082 tonnes in 2022.

Following these record numbers, gold continues to be viewed favourably by central banks as a reserve asset. According to the 2024 Central Bank Gold Reserves (CBGR) survey, which was conducted between 19 February and 30 April 2024 with a total of 70 responses, 29% of central banks respondents intend to increase their gold reserves in the next twelve months, the highest level we have observed since we began this survey in 2018. The planned purchases are chiefly motivated by a desire to rebalance to a more preferred strategic level of gold holdings, domestic gold production, and financial market concerns including higher crisis risks and rising inflation.