GST 2.0 will enable the Centre to pursue reforms simplifying tax structure reducing compliance burdens & enhancing efficiency

FinTech BizNews Service

Mumbai, September 2, 2025: The State Bank of India’s Economic Research Department has come out with a special Research Report GST 2.0, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India:

The GST rate rationalisation is likely to result in stronger revenue collections validated by historical trends with the institutional framework of fiscal federalism embedded in the Constitution guarantees status quo in State finances through revenue and tax devolution while enabling the Centre to pursue reforms simplifying tax structure reducing compliance burdens & enhancing efficiency.

At the time of launch of the GST regime, the states were assured that a 14% increase in their annual revenue for five years of the transition period from July 1, 2017 to June 30, 2022 will be protected and also guaranteed that their revenue shortfall, if any, would be made good through a compensation cess levied on luxury goods and sin products such as liquor, cigarettes, other tobacco products, aerated water, automobiles, and coal

• As decided by the GST Council, States have been provided a total compensation of Rs 9.14 lakh crores as compensation for protecting their tax revenues post implementation of GST for the entire transition period of five years. This amount was almost Rs 63,265 crores (at an aggregate basis) more than the projected amount that states were expected to get from their assured 14% increas

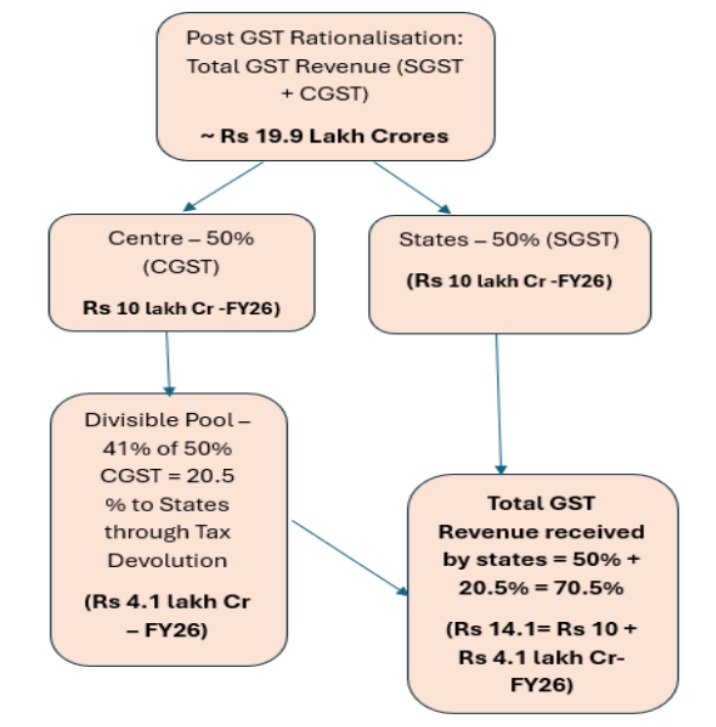

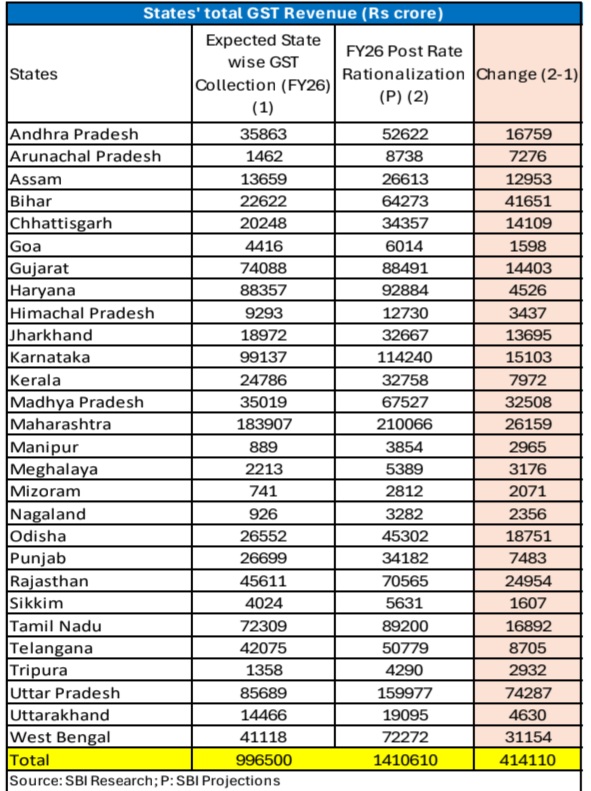

❑ We estimate that in FY26 as well, States will remain net gainers from GST collections, even under the proposed rate rationalization. This is because of the unique revenue-sharing architecture of the tax. First, GST is shared equally between the Centre and the States, with each receiving 50% of the collections. Second, under the mechanism of tax devolution, 41% of the Centre’s share flows back to the States. Taken together, this means that out of every Rs100 of GST collected, states ultimately accrue nearly Rs70.5 i.e., approximately 70% of total GST revenues

• Our projections for FY26 indicate that states are expected to receive at least ~ Rs 10 lakh cr in SGST plus Rs 4.1 lakh crore through devolution thereby making them net gainers. The gains accrues even when we do not take the additional consumption boost due to rate rationalization (At 9.5% effective GST rate, this translates into a revenue gain of Rs 52000 crore; Rs 26000 crore each to Centre and States)

❑ Evidence from earlier rounds of GST rate changes, such as those in July 2018 and October 2019, suggests that rationalization does not necessarily weaken revenue collections. Instead, the evidence points to a temporary adjustment phase followed by stronger inflows. While an immediate reduction in rates can cause a short-term dip of around 3–4% month-on-month (roughly Rs5,000 crore, or an annualized Rs60,000 crore), revenues typically rebound with sustained growth of 5–6% per month

States have received Rs 63,265 crores more in aggregate than the assured revenue in the GST regime.GST is an Unique Revenue sharing architecture. GST post rates Rationalization always results in higher revenue per se.

Other GST Reforms

The GST council will discuss several important matters including rationalization of tax rates, ease of compliance and restructuring of cess etc but we believe the following issues should be addressed

❑ With loans taken by the Centre to pay compensation cess to states getting recouped and fully repaid by November-December. As per our estimate around Rs 50,000 crore surplus will be in the compensation fund, we believe this amount could be used to compensate states for revenue loss due to rate rationalization

❑ The council should think about a plan to include Petroleum, Electricity and Aviation Turbin Fuel under GST over the medium term

❑ To promote ease of ‘living’, Government should use technology to speed-up and ease GST registration process and implement pre-filled returns, thus reducing manual intervention and eliminate mis-matches, while refunds could be processed in a faster and more automated manner

❑ The inverted tax structure (IDS), when GST rate on inputs are higher than output, in GST has many implications for business, particularly regarding the ‘refund of input tax credit (ITC). In otherwards, if the rate on tax on inputs (say solar panels@18%), is higher than outputs (Say, Green electricity @0%), business continue to face the issue of accumulated ITC.

Though, under GST law has the provision to refund the unutilized ITC but this unnecessarily burden businesses with higher tax cost, which lead to increase in prices for consumers. This issue may also be addressed.