Never disincentivize digital payments/UPI

FinTech BizNews Service

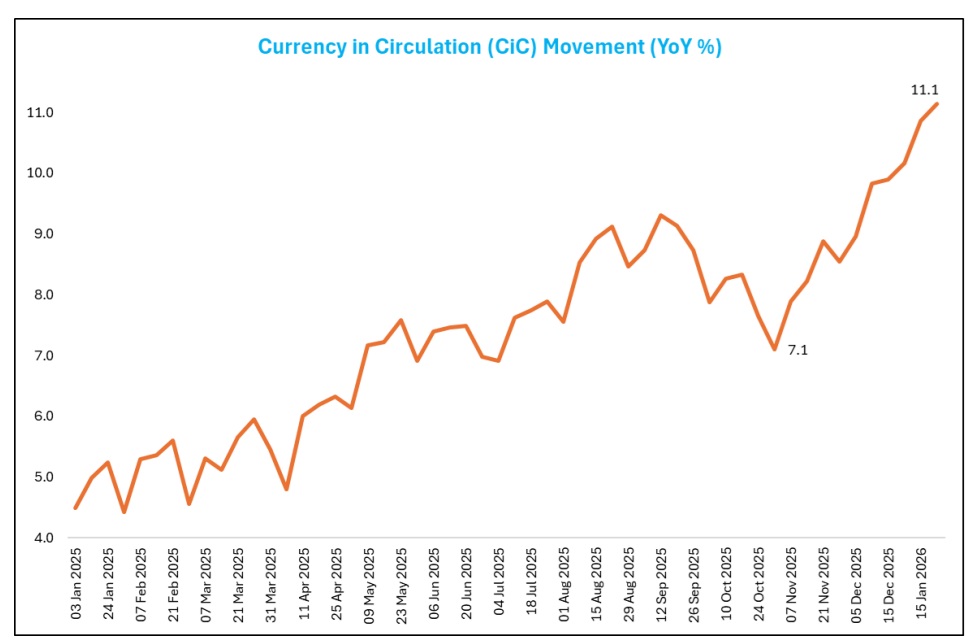

Mumbai, 16 February 2026: Currency in circulation (CiC) in India has continued to rise, reaching new, record-high levels in late 2025 and early 2026, of Rs 40 lakh crore for the month ended Jan 2026, with a YoY growth of 11.1% (vis-à-vis 5.3% last year). On incremental basis (YTD), CiC has increased by Rs 2.76 lakh crore (Rs 88,517 crore) in the same period /3.11 times

❑ In the similar line, the currency with public (CWP), which is ~97.6% of the CiC, also reached all time high of Rs 39 lakh crore for the month ended Jan’26, (11.5% vis-à-vis 5.4%. Going by current trends, CWP will surpass the post pandemic FY21 incremental growth of Rs 4.6 lakh crore

❑ Intriguingly, though the volume of cash in circulation has continued to grow but the "cash-to-GDP" ratio has declined in recent years to 11% in FY26 from 14.4% in FY21. Our estimated money demand model reveals that GDP coefficient is insignificant and expectedly UPI is significant …which means the direction of change of currency and GDP may be same, but incremental GDP growth is now being less financed by cash and more through UPI

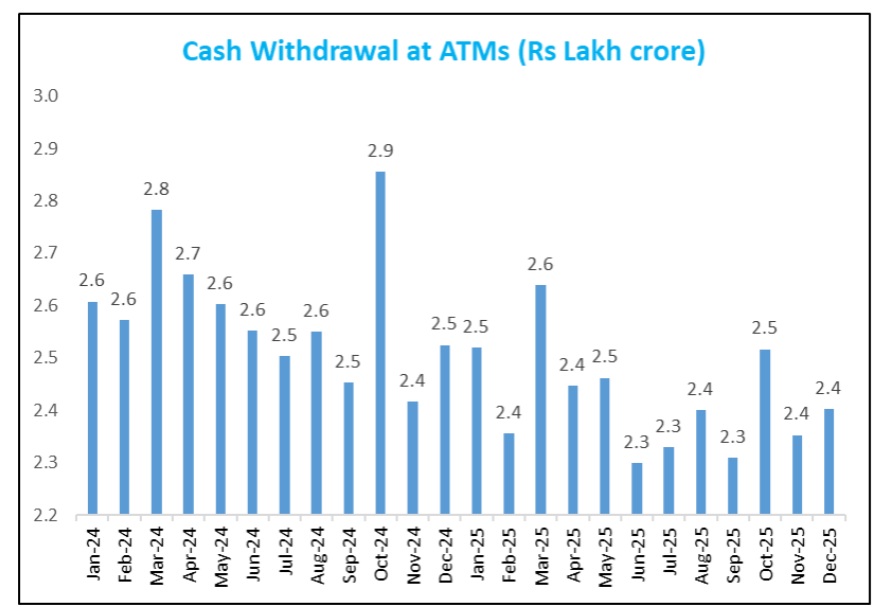

❑ The puzzle is why the UPI transaction has surged and currency in circulation has also jumped…In fact, the overall ATM data, sourced from RBI, indicates that the per-month cash withdrawal from ATM could surpass the long-term average of Rs 2.5 lakh, with States like Karnataka, Tamil Nadu, WB are showing an increasing trend in cash withdrawal at ATMs.

Firstly, in July 2025, the Karnataka Commercial Taxes Department had issued around 18,000 GST notices to small traders and vendors for UPI transactions exceeding the ₹40 lakh registration threshold between 2022 and 2025..This might have acted a disincentive to UPI transactions

• To test the hypothesis that whether such event pushed consumers and small traders into the shadows of cash in Karnataka and even in other states through the news channel (selected randomly), we have employed the intensity-based Difference-in-Differences (DiD) framework in five select States on ATM withdrawals data

• The estimated results from DiD indicate that in Karnataka, post GST notice in July 2025, the districts in the treatment group experienced a significant additional increase of Rs 37 crore in ATM withdrawals per month, on an average, relative to districts in the control group

• The estimated results are also significant for West Bengal and Kerala

❑ Secondly, the motive to hold cash has also jumped particularly in rural areas with low interest rates and the penchant for consumption.. deposits growth remained sluggish during the current FY and grew by 10.6% as of end-Jan 2026

• Our estimated augmented money demand function using GDP, UPI and other variables reveal demand for money is positively correlated to GDP, though statistically insignificant and negatively correlated to interest rate. In otherwards, with the rise in GDP, currency demand increases but not in same proportion with UPI and cash substitution. Declining interest rates may have also resulted into higher precautionary demand for money

Thirdly, with the rise in precious metals prices, there could have been rising currency in circulation through recycling of gold/silver from households.. Households have found recent surge in prices to cash out some holdings, leading to the rise of cash in circulation (CiC) in the economy. The cut in GST and income taxes has acted as an inventive to boost household consumption

❑ Fourthly, with the withdrawal of Rs 2000 note (RBI announced on 19 May 2023) and as on end-March 2025 the share of Rs 500 note has increased by 8.9% in terms of value to 86.0% and by 3.0% in terms of volume to 40.9%. In terms of value, the share of Rs 100 note has increased by 1.0% to 4.7% and Rs 200 note by 0.8% to 0.8% in 2025, from 2023

• For public convenience, RBI has directed banks on 28 April 2025 to increase Rs 100/200 denomination notes in ATMs and ensure that 96% of the ATMs should dispense 100/200 notes by end-March 2026

• Subsequently, we used the currency chest data to study the behavioral changes in the use of currency denominations. The analysis indicates that the share (in value terms) of Rs 500 note might have increased by 4.4% in the current fiscal (Apr’25-Jan’26). However, the share of all other big denominations (like Rs 100/200) exhibited decline during the same period

• However, as per NPCI, based on volume, the average ticket size of P2M transaction of less than Rs 500 has a whopping share of 86% in overall UPI transactions. Thus the substitution of low denomination notes with UPI is unlikely to happen completely

❑ With the database upgradation, we believe RBI may look at providing quarterly/half-yearly denomination wise data.

Additionally, the Sate-wise distribution of volume and value of key denominations will help facilitate research and insights to analyse the behavioral pattern of currency usage & provide guidance regarding evolving tenets of digital payments