The regulations address operational frictions

FinTech BizNews Service

Mumbai, October 6, 2025: Kotak Institutional Equities has come out with a noteworthy report on the banks in the light of the latest regulatory changes.

Rules are changing but the ground is not shifting

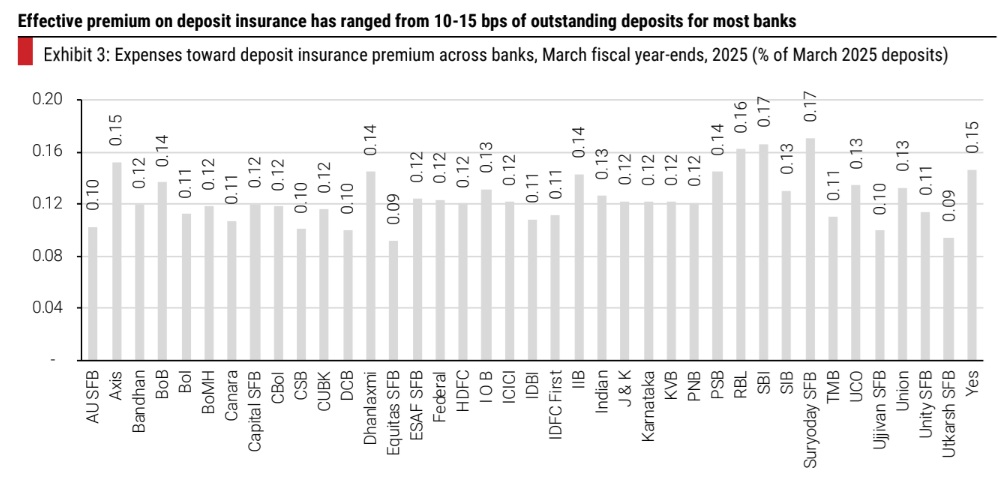

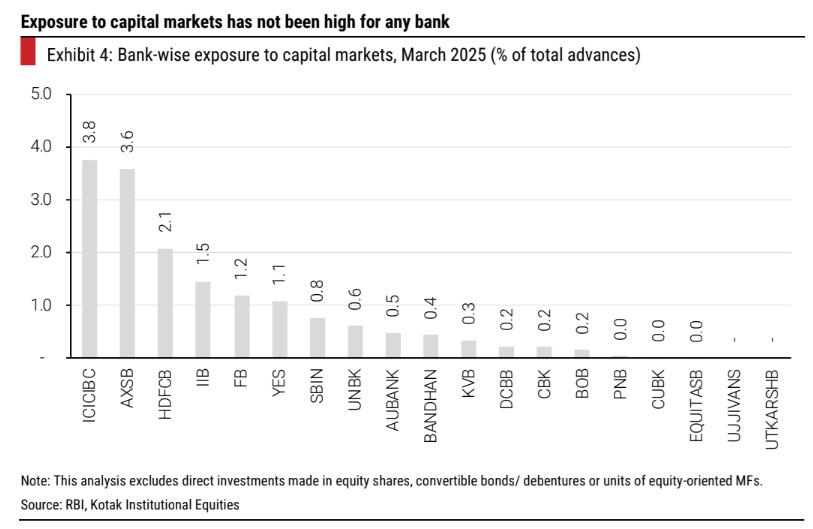

The RBI has proposed regulatory reforms to enhance the systemic resilience and ease norms where progress is evident and risk is lower. The key measures include the shift to the Expected Credit Loss (ECL) framework, revised Basel III norms, streamlined investment rules and a risk-based deposit insurance premium. The ECL transition appears manageable, with a limited impact on net worth and credit cost. Other regulations address operational frictions but are unlikely to boost credit growth. Investor caution persists around acquisition financing and capital market lending, but we see a lower risk in the near term.

Strengthening resilience while easing norms where progress is evident

The RBI has announced the following key regulatory reforms to enhance the resilience and improve credit flow. (1) the adoption of the Expected Credit Loss framework for provisioning, replacing the incurred loss model; (2) revised Basel III guidelines aimed at normalizing risk weights with best international practices; (3) finalized norms on business and investment forms will streamline operations and remove overlap restrictions; (4) a risk-based premium model for deposit insurance will reward sound banks with lower premiums; (5) capital market exposure norms will be updated, enabling broader lending options; (6) guidelines restricting credit supply to large borrowers will be withdrawn, with system-level risks managed through macroprudential tools; (7) NBFCs will benefit from a principle-based framework for infrastructure lending; (8) a discussion paper on licensing new Urban Co-operative Banks will be released; and (9) restrictions on transaction accounts will be eased to offer banks greater flexibility, especially for regulated entities.

ECL transition is likely to be less disruptive

Banks will implement ECL norms from April 1, 2027 (FY2028), with a glide path of four years to smoothen the one-time impact of higher provisions. The model requires higher stage-1 and stage-2 provisions but lower-than-current provisions for stage-3 loans. Our previous note on this topic broadly suggests that the transition impact is negligible unless there is any significant change in assumptions (look-back period, probability of default and loss-given default). The balance sheets of Indian banks show negligible stress in stage 2 loans. From a transition standpoint, a more-than-adequate coverage on stage 3 loans suggests that the eventual impact could be restricted to 0-4% of net worth and 0-60 bps of credit cost (for most banks) during this transition.

Other announcements address friction points but unlikely to drive loan growth

We observe investor concerns around the proposed relaxations in acquisition financing, single borrower exposure norms and capital market lending, given the lingering caution from the past credit cycles. It is important to note that these relaxations aim to unlock marginal opportunities, rather than signal a broad-based push for accelerated loan growth. While investor caution is understandable, a shift in lender behavior toward these segments must be evident before concerns warrant a more cautious stance.