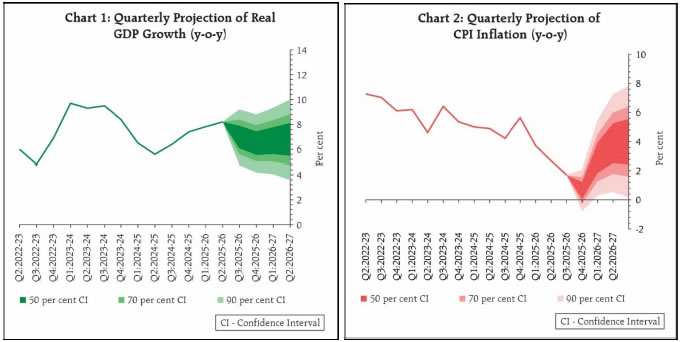

The real GDP growth for 2025-26 is projected at 7.3 per cent, with Q3 at 7.0 per cent; and Q4 at 6.5 per cent.

FinTech BizNews Service

Mumbai, 5 December 2025: The Monetary Policy Committee (MPC) held its 58th meeting from December 3 to 5, 2025, under the chairmanship of Shri Sanjay Malhotra, Governor, Reserve Bank of India. The MPC members Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Poonam Gupta and Shri Indranil Bhattacharyya attended the meeting.

2. After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, the MPC voted unanimously to reduce the policy repo rate under the liquidity adjustment facility (LAF) to 5.25 per cent. Consequently, the standing deposit facility (SDF) rate shall stand adjusted to 5.00 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 5.50 per cent. The MPC also decided to continue with the neutral stance.

Growth and Inflation Outlook

3. The global economy is holding up better than expected, though the earlier frontloading of trade is showing signs of normalising. Uncertainty has eased somewhat following the end of the US government shutdown and progress on trade agreements, yet it remains elevated. Global inflation dynamics remain uneven, with inflation trending above target in most major advanced economies. The US dollar strengthened primarily on safe haven demand while treasury yields remained range bound. Equity markets remain volatile, driven by shifting views on the monetary policy outlook and concerns surrounding stretched valuations in tech stocks.

4. In India, real gross domestic product (GDP) registered a six-quarter high growth of 8.2 per cent in Q2:2025-26, underpinned by resilient domestic demand amidst global trade and policy uncertainties. On the supply side, real gross value added (GVA) expanded by 8.1 per cent, aided by buoyant industrial and services sectors. Economic activity during the first half of the financial year benefited from income tax and goods and services tax (GST) rationalisation, softer crude oil prices, front-loading of government capital expenditure, and facilitative monetary and financial conditions supported by benign inflation.

5. High-frequency indicators suggest that domestic economic activity is holding up in Q3, although there are some emerging signs of weakness in a few leading indicators. GST rationalisation and festival-related spending supported domestic demand during October-November. Rural demand continues to be robust while urban demand is recovering steadily. Investment activity remains healthy with private investment gaining steam on the back of expansion in non-food bank credit and high capacity utilisation. Merchandise exports declined sharply in October amid subdued external demand, accompanied by softer services exports. On the supply side, agricultural growth is supported by healthy kharif crop production, higher reservoir levels and better rabi crop sowing. Manufacturing activity continues to improve, and the services sector is maintaining a steady pace.

6. Looking ahead, domestic factors such as healthy agricultural prospects, continued impact of GST rationalisation, benign inflation, healthy balance sheets of corporates and financial institutions and congenial monetary and financial conditions should continue to support economic activity. Continuing reform initiatives would further facilitate growth. On the external front, services exports are likely to remain strong, while merchandise exports face some headwinds. External uncertainties continue to pose downside risks to the outlook, while speedy conclusion of ongoing trade and investment negotiations present upside potential. Taking all these factors into consideration, real GDP growth for 2025-26 is projected at 7.3 per cent, with Q3 at 7.0 per cent; and Q4 at 6.5 per cent. Real GDP growth for Q1:2026-27 is projected at 6.7 per cent and Q2 at 6.8 per cent (Chart 1). The risks are evenly balanced.

7. Headline CPI inflation declined to an all time low in October 2025. The faster than anticipated decline in inflation was led by correction in food prices, contrary to the usual trend witnessed during the months of September-October. Core inflation (CPI headline excluding food and fuel) remained largely contained in September-October, despite continued price pressures exerted by precious metals. Excluding gold, core inflation moderated to 2.6 per cent in October. Overall, the decline in inflation has become more generalised.

8. Turning to the inflation outlook, food supply prospects remain bright on the back of higher kharif production, healthy rabi sowing, adequate reservoir levels and conducive soil moisture. Barring some metals, international commodity prices are likely to moderate going forward. Overall, inflation is likely to be softer than what was projected in October, mainly on account of the fall in food prices. Considering all these factors, CPI inflation for 2025-26 is now projected at 2.0 per cent with Q3 at 0.6 per cent; and Q4 at 2.9 per cent. CPI inflation for Q1:2026-27 and Q2 are projected at 3.9 per cent and 4.0 per cent, respectively (Chart 2). In fact, the underlying inflation pressures are even lower as the impact of increase in price of precious metals is about 50 basis points (bps). The risks are evenly balanced.

Rationale for Monetary Policy Decisions

9. The MPC noted that headline inflation has eased significantly and is likely to be softer than the earlier projections, primarily on account of the exceptionally benign food prices. Reflecting these favourable conditions, the projections for average headline inflation in 2025-26 and Q1:2026-27 have been further revised downwards. Core inflation, which had been rising steadily since Q1:2024-25, eased at the margin in Q2:2025-26 and is expected to remain anchored in the period ahead. Both headline and core inflation are expected to be around the 4 per cent target during the first half of 2026-27. The underlying inflation pressures are even lower as the impact of increase in price of precious metals is about 50 bps. Growth, while remaining resilient, is expected to soften somewhat.

10. Thus, the growth-inflation balance, especially the benign inflation outlook on both headline and core, continues to provide the policy space to support the growth momentum. Accordingly, the MPC unanimously voted to reduce the policy repo rate by 25 bps to 5.25 per cent. The MPC also decided to continue with the neutral stance. However, Prof. Ram Singh was of the view that the stance be changed from neutral to accommodative.

11. The minutes of the MPC’s meeting will be published on December 19, 2025.

12. The next meeting of the MPC is scheduled during February 4 to 6, 2026.