Empowering Street Vendors: accelerated disbursement of loans, and digital onboarding of beneficiaries.

FinTech BizNews Service

Mumbai, 20 December 2025: Restructured PM SVANidhi Scheme aims to benefit 1.15 crore street vendors, including 50 lakh new beneficiaries.

Introduction: Empowering the Enablers

|

Street vendors are an important part of any city's informal economy. Street vending, a source of self-employment, has a prominent place in the urban supply chain as it provides convenient access to goods and services to all segments of the population close to their doorstep.

Lack of recognition, limited access to formal credit, low levels of education and skills, lack of designated areas, and limited access to emerging market opportunities are a few constraints faced by the street vendors. On account of being unorganized and self-employed, street vendors and their families often lack linkages to social security, welfare, and assistance schemes and initiatives of the government. This makes street vendors and their families vulnerable in difficult times or when they may require assistance for unforeseen circumstances.

Launched in June 2020, the PM SVANidhi scheme was formulated to assist the street vendors to overcome the adverse effects of financial constraints and to restart their lost businesses during the pandemic. However, since the inception of the scheme, it has proved to be more than financial support for street vendors and has given them a sense of identity & formal recognition for their contribution to the economy.

On August 27, 2025, the Union Cabinet, chaired by Prime Minister Shri Narendra Modi, approved the “Restructuring and extension of the lending period beyond 31.12.2024 of Prime Minister Street Vendor’s Atma Nirbhar Nidhi (PM SVANidhi) Scheme”. The lending period has now been extended until March 31, 2030. The total outlay for the scheme is Rs7,332 crore. The restructured scheme aims to benefit 1.15 crore beneficiaries, including 50 lakh new beneficiaries.

|

Loans Disbursal and Welfare Linkages

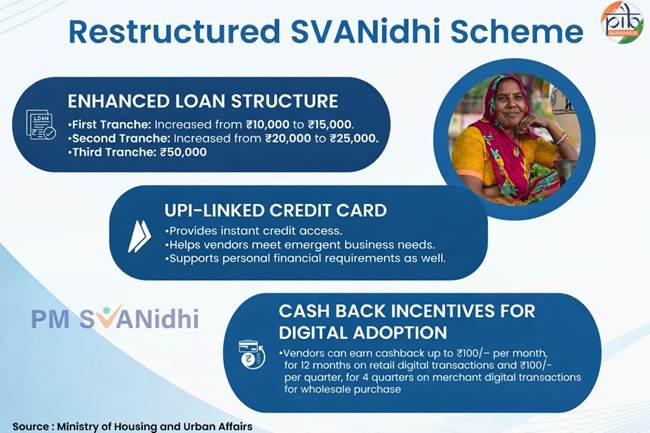

The key features of the restructured scheme include enhanced loan amount across the first & second tranche, provision of UPI-linked RuPay Credit Card for beneficiaries who have timely repaid the second loan, and digital cashback incentives for retail & wholesale transactions. The scheme’s coverage is being expanded beyond statutory towns to census towns, peri-urban areas, etc., in a graded manner.

The enhanced loan structure includes first tranche loans increased up to Rs15,000 (from Rs10,000) and second tranche loans increased up to Rs25,000 (from Rs20,000), while the third tranche is at Rs50,000.

The introduction of UPI-linked RUPAY Credit Card would provide immediate access to credit to the street vendors in order to meet any emergent business and personal requirements.

Further, in order to give a boost to digital adoption, the street vendors can avail a cashback on digital transactions:

The scheme has received national recognition, winning the Prime Minister’s Award for Excellence in Public Administration (2023) for Innovation (Central Level) for its outstanding contribution to boosting the economy, promoting livelihoods, advancing financial inclusion, and driving digital empowerment, and the Silver Award for Excellence in Government Process Re-engineering for Digital Transformation (2022).

From Relief to Growth: The Restructured PM SVANidhi Scheme

Started as micro-credit support during the COVID pandemic in 2020, the restructured scheme envisages the holistic development of street vendors by offering a reliable source of finance to support business expansion and opportunities for sustainable growth. The scheme not only fosters inclusive economic growth but also focuses on the socio-economic upliftment of street vendors and their families, enhancing their livelihoods and ultimately transforming urban spaces into a vibrant, self-sustaining ecosystem.

The scheme also focuses on building the capacity of the street vendors with a focus on entrepreneurship, financial literacy, digital skills, and marketing through convergence. Standard hygiene and food safety training would be conducted for street food vendors, in partnership with FSSAI.

Institutional Roles in Delivering PM SVANidhi Benefits

Implementation of the scheme would be the joint responsibility of the Ministry of Housing & Urban Affairs (MoHUA) and Department of Financial Services (DFS), with DFS being responsible for facilitating access to loans/ credit cards through banks/financial institution and their ground-level functionaries.

Though PM SVANidhi is a Central Government initiative, its effective implementation is made possible through close collaboration with States, Banks, and Urban Local Bodies (ULBs). State governments and ULBs play a key role by identifying street vendors, facilitating loan processes, and linking beneficiaries to welfare schemes. Banks ensure smooth loan disbursal, timely interest subsidy processing, and promote digital transactions. Together, these partners bring the scheme from policy to reality, creating opportunities and dignity for street vendors across the country.

Boosting Outreach and Loan Disbursement through Lok Kalyan Mela and SVANidhi Sankalp Abhiyaan

To further advance the holistic welfare and development of street vendors and their families, the ‘SVANidhi se Samriddhi’ component is being strengthened through periodic Lok Kalyan Melas. The objective is to ensure that the benefits of various Government of India schemes reach vendors and their families in a saturation approach, fostering a more inclusive and supportive ecosystem for their growth and well-being. As part of the Special Campaign, “Lok Kalyan Melas" were conducted from 17 September to 15 October 2025 across all Urban Local Bodies (ULBs) and monitored through a dedicated Lok Kalyan Portal. These Melas facilitated vendor mobilization, submission of loan applications, accelerated disbursement of loans, and digital onboarding of beneficiaries.

Svanidhi Se Samriddhi:

‘SVANidhi se Samriddhi' has connected beneficiaries to 8 welfare schemes of the Government of India. Profiling of more than 47 lakh street vendors and families has been completed, and more than 1.46 crore schemes have been sanctioned as of 9th December 2025.

Conclusion:

The extension of the PM SVANidhi Scheme not only ensures financial stability for street vendors but also reflects a broader vision of inclusive urban development. By integrating street vendors into the formal financial system through collateral-free bank credit, credit history creation, and access to UPI-enabled digital payment platforms, the scheme facilitates a transition from informal livelihoods to sustainable micro-entrepreneurship. At the same time, the scheme promotes access to social security and welfare linkages, reducing vulnerability and enhancing long-term livelihood security for vendors and their families. Through sustained digital inclusion, financial literacy, and capacity-building support, PM SVANidhi empowers one of the most vital segments of the urban informal economy, reaffirming the Central Government’s commitment to a resilient, self-reliant, and inclusive growth trajectory where every citizen has the opportunity to thrive.