TCS On Foreign Tour, Tax Penalty-Suit Rationalized

The simplified Income Tax Rules and Forms will be notified shortly.

FinTech BizNews Service

Mumbai, 1 February 2026: Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman tabled the Union Budget 2026-27 in the parliament on Sunday 1st February 2026 . While presenting the Union Budget 2026-27 in Parliament today, she said that the Government is inspired by 3 kartavya, out of which the first kartavya is to accelerate and sustain economic growth, by enhancing productivity and competitiveness, and building resilience to volatile global dynamics.

New Income Tax Act

· New Income tax Act ,2025 to come into effect from April 2026

· The simplified Income Tax Rules and Forms will be notified shortly. The forms redesigned for easy compliance of ordinary citizens.

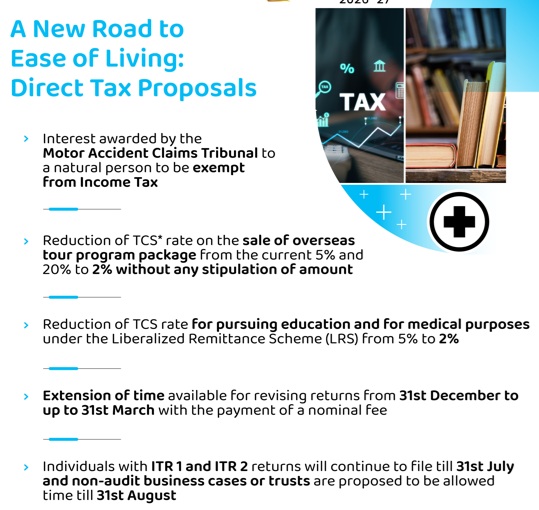

Ease of Living

- Interest awarded by the Motor Accident Claims Tribunal to a natural person will be exempt from Income Tax, and any TDS on this account will be done away with.

- TCS Rationalization

- Reduce TCS rate on sale of overseas tour program package to 2 % (from current 2-20%).

- Reduce the TCS rate to 2% (from current 5%) for LRS remittances for education and medical.

- Simplified TDS provisions for manpower supply will benefit labour intensive business.

- Scheme for small taxpayers wherein a rule based automated process for obtaining Lower or nil deduction certificate instead of filing application with the assessor.

- Single window filing with depositories for Form 15G or 15 H for TDS on dividends, interests etc

- Extend time available for revising returns from 31st December to upto 31st March with payment of nominal fees

- The timeline for filing of tax returns to be staggered .

- TAN for property transactions involving NRIs will be replaced with resident buyers PAN based challan.

- A one time 6 month foreign asset disclosure scheme for small taxpayers to disclose their overseas income or asset.

Rationalizing Penalty and Prosecution

- IT assessment & penalty proceedings are proposed to be integrated by way of common order for both.

- Taxpayers allowed to update their returns even after reassessment proceedings have been initiated to reduce litigations, at an additional 10 percent tax rate over and above the rate applicable for the relevant year.

- Penalty for misreporting of income also eligible for immunity with payment of additional income tax.

- Prosecution framework under the Income Tax Act to be rationalized.

- Non-production of books of account and documents, and requirement of TDS payment, where payment is made in kind, to be decriminalised.

- Non-disclosure of non-immovable foreign assets with aggregate value less than 20 lakh rupees to be provided with immunity from prosecution with retrospective effect from 1.10.2024.