The Bank of India has implemented agile IT structure with cloud, microservices, AI/ML, and cybersecurity enhancements

FinTech BizNews Service

Mumbai, August 17, 2025: The Bank of India has been very pro-active on the digital transformation front. The Bank of India has undertaken a number of digital initiatives and specific measures to strengthen its cybersecurity during the Q1 FY26.

Fintech & Ecosystem Partnerships

Bank of India has a number of Fintech & Ecosystem Partnerships. The senior official of the bank states: “We are expanding collaborations for supply chain finance, credit on UPI, and AI-driven solutions. We have been developing frameworks for retail, agri, MSME partnerships to boost engagement. We have implemented agile IT structure with cloud, microservices, AI/ML, and cybersecurity enhancements; as well as established a scalable digital backbone with serverless computing.

Bank of India has established Resiliency Operations Centre (ROC)to be utilized for ensuring high uptime and rapid incident response with advanced Application Performance Monitoring tools.

Vendor Management, Capacity building

As part of Centralized Testing & Vendor Management, the bank has launched Functional Testing CoE for automated testing excellence; established Vendor CoE with RFPs and SLAs, integrating Gen AI solutions for enhanced automation and analytics. The official added: “Capacity building is undertaken for upskilling of IT Personnel on agile, design thinking, cybersecurity, and Gen AI for high-impact use cases in fraud detection, customer servicing, and operations.”

Business capabilities in Digital era

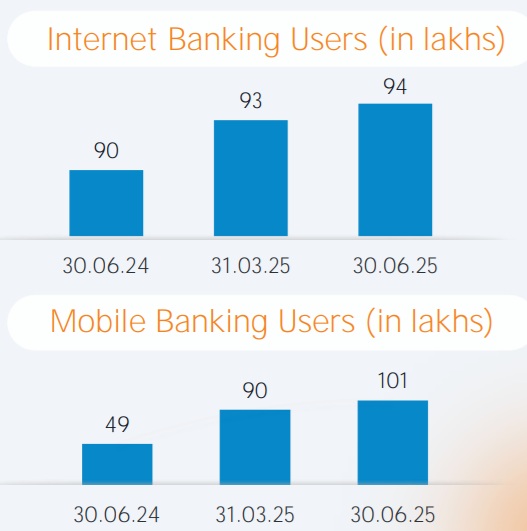

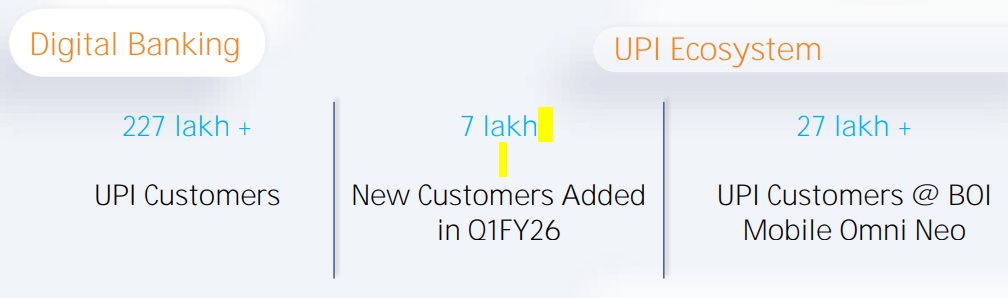

Bank of India has significant digital transaction volume. The senior official of the bank gave updates: “As of Q1 FY 2025–26, over 1 crore customers are registered on the Bank of India’s unified mobile application, BOI Omni Neo mobile app. Digital transactions account for more than 95% of total transaction volume, spanning mobile banking, internet banking, UPI, and other digital channels. Unified Payments Interface (UPI) functionality for credit cards has been enabled for eligible users A multi-mode payment interface has been rolled out, supporting 6+ digital payment options for improved user experience and operational flexibility.”

Accessibility, Digital Governance Standards

Bank of India has become the first Indian bank to obtain Standardization Testing and Quality Certification (STQC) for its public-facing website. The senior official adds: “The website conforms to GIGW 3.0 and WCAG 2.1 accessibility guidelines, reinforcing the Bank’s focus on compliant and inclusive digital infrastructure.”

Measures For Enhancing Cybersecurity

The Bank has implemented a number of cyber security measures and technologies to strengthen cybersecurity and protect against cyber threats, including malware and phishing attacks and other social engineering tactics. The Bank has migrated to NG-Security Operations centre (NG-SOC) for 24x7 monitoring of enterprise information systems (websites, applications, databases, servers, networks, desktops, and other endpoints) based on logs collected from complete IT infrastructure.

The senior official explains: “Implementation of SOAR (Security Orchestration, Automation, and Response) solution that helps our organization to manage and respond to security threats more efficiently. Threat Intelligence Platform has been integrated to aggregate, analyse & operationalize threat data from multiple sources, enabling us to proactively identify emerging threats, track adversary behaviours & enrich incident response with contextual threat intelligence. ‘Breach and Attack Simulation’ continuously tests & validates the effectiveness of our existing security controls. Simulates real-world attack scenarios to identify gaps in defences & prioritize remediation based on actual risk exposure.”

Attack Surface Monitoring has been deployed to provide real-time visibility into organization’s digital footprint. 24x7 Monitoring of all publicly exposed applications and Internal IT Infrastructure.

The official elaborates: “We regularly conduct Phishing testing exercises for staff members. Our Staff training colleges regularly conduct IS Awareness & Acceptable usage guidelines for IT resources for staff members. Our E Learning Module have courses on Information / Cyber Security, Business Continuity planning etc. for staff training & awareness. We send regular Emails / SMS for awareness of customers on safe usage practices.”

Before on boarding any application/product, security review is conducted & applicable security controls are validated before providing security clearance for Production movement. It applies to any new product or major change in application.

The official points out: “Major things in pipeline to strengthen cybersecurity include strengthening IT & IS Risk Management framework with coverage of risk appetite and risk tolerance limits; as well as strengthening BCP & DR framework of the bank with mapping of IT applications with underlying business processes & services delivered to customers.”