SCBs Can Save Rs15 Bn P.A. On Deposit Insurance Premium

FinTech BizNews Service

Mumbai, October 2, 2025: The State Bank of India’s Economic Research Department has come out with a research report, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India.

RBI MAINTAINS STATUS QUO

¨MPC has unanimously decided to keep the repo rate unchanged at 5.5% second time in a row. The MPC also decided to retain the stance at neutral, however not unanimously. Two members (both external) were of the view that the stance be changed from neutral to accommodative.

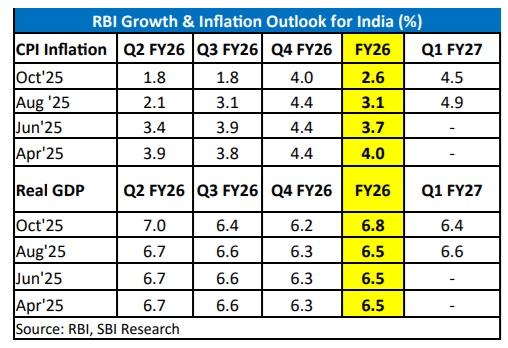

¨ Taking into consideration the factors like healthy progress of the monsoon, higher kharif sowing, adequate reservoir levels, comfortable buffer stock of foodgrains and most notably GST rate rationalization, RBI has revised downwards its FY26 CPI inflation projection by 50 bps to 2.6% (Q2: 1.8%; Q3: 1.8%; & Q4: 4.0%).

¨ RBI has revised upwards its projection for real GDP growth for FY26 by 30 bps to 6.8% owing to buoyancy in services sector coupled with steady employment conditions, rising capacity utilisation, conducive financial conditions and boost from the streamlining of GST. However, ongoing tariff and trade policy uncertainties will impact external demand for goods and services. Prolonged geopolitical tensions and volatility in international financial markets caused by risk-off sentiments of investors also pose downside risks to the growth outlook.

¨ RBI’s quarterly real GDP growth for FY26 are as follows: Q2 at 7.0 per cent, Q3 at 6.4 per cent, and Q4 at 6.2 per cent. Real GDP growth for Q1 FY27 is projected at 6.4 per cent.

IMPROVING THE FLOW OF CREDIT

¨ With reforms facilitating resilience and improved financial across Indian Banks with anti-fragile Balance sheets, it is but natural for them to look beyond the generic banking themes and expand the economy of scope by offering services in lucrative areas that have hitherto been exclusively a playfield for foreign banks / large NBFCs as also PE/VC firms. With the regulator agreeing in principle to expand the scope of capital market lending by banks, wherein an enabling framework for Indian banks to finance acquisitions by Indian corporates is on the cards it unlocks some value in corporate funding life cycle. M&A deals in FY24 were valued at over $120 bn, or Rs 10 lakh crore. Assuming debt component of 40% of M&A and 30% of this will be financed by banks, this translates into a potential credit growth of Rs 1.2 lakh crore.

¨ It is proposed to (a) remove the regulatory ceiling on lending against listed debt securities and (b) enhance limits for lending by banks against shares from Rs 20 lakh to Rs 1 crore and for IPO financing from Rs 10 lakh to Rs 25 lakh per person. With capital markets witnessing significant participation from retail investors, and an equity cult gaining traction for sustainable wealth creation for younger generations, the move promises to unlock value for both FIs as also participating holders of equities.

¨ It is proposed to withdraw the framework introduced in 2016 that disincentivized lending by banks to specified large borrowers (with credit limit from banking system of Rs 10,000 crore and above). This could boost corporate bank credit. Incremental corporate borrowing, including BOND, CP and ECB, was around Rs 30 lakh crore in FY25, if we assume 10-15% may come back to banking system it has the potential for banks to lend another Rs 3-4.5 lakh crore towards meeting corporate demands, subject to pricing of risks. ¨ To reduce the cost of infrastructure financing by NBFCs, it is proposed to reduce the risk weights applicable to lending by NBFCs to operational, high quality infrastructure projects.

STRENGTHENING THE RESILIENCE AND COMPETITIVENESS OF THE BANKING SECTOR

¨ Introduction of risk-based deposit insurance premium with the currently applicable flat rate of premium as the ceiling. As per the RBP method, premium for SCBs would save around Rs 1300/1500 crore per annum. Thus, banks which are “sound” would pay a lower premium, doing away with the flat rate premium being paid at present. So, this is a win-win situation for both DICGC and low-risk banks.

The Expected Credit Loss (ECL) framework of provisioning with prudential floors proposed should anchor Indian Bank’s quest to adapt and adopt best underwriting practices, in sync with evolving economic conditions as also siding with better monitoring and supervision mechanisms that together should also result in better pricing for credit to different borrower classes eventually.

¨ Since the time line is quite extensive beginning April’27, with a glide path (till March 31, 2031) to smoothen the one-time impact of higher provisioning, if any, on their existing books, the move should strengthen the sector’s systemic resilience.

¨ Postulating the Basel III Endgame in full through making the revised Basel III capital adequacy norms effective for commercial banks from April 2027 aims to address primarily excessive variability of risk-weighted assets (RWAs) across banks, improving confidence in capital ratios calculated / stipulated framework as desired by the BIS. In lockstep, draft guidelines on Standardised Approach for Credit Risk proposing lower risk weights on certain segments viz. MSMEs and residential real estate (including HLs) are expected to reduce the overall capital requirements, benefitting banks as also sectors by higher credit allocation.

¨ The revised circular on Forms of Business and Prudential Regulation for Investments does away with the previously proposed regulatory restriction (Draft in Oct’24) on overlap in the businesses undertaken by a bank and its group entity(ies), now allowing the strategic allocation of business streams among group entities to be left to the wisdom of Bank Boards. This reinforces the trust in supervisory mechanism of individual banks and enhanced governance guidelines perused though systemic risks and arms length policy should continue to be watched by the regulator.

PROMOTING EASE OF DOING BUSINESS

¨ To further strengthen the export sector and enhance ease of doing business: (a) the time period for repatriation from foreign currency accounts of Indian exporters in IFSC, is extended from one month to three months. This is a welcome initiative as it will further liberalise the foreign exchange management for exporters. It will supplement the existing Exchange Earners Foreign Currency (EEFC) provision. Since there are limited currencies where EEFC can be opened, opening FCA will facilitate the transactions in other cross currencies reducing the currency conversion burden.

¨ (b) the period for forex outlay for Merchanting Trade transactions is increased from four months to six months. MTT is usually bound by multiple stringent conditions. An increase in the payment outlay to six months will provide a cushion and increased flexibility. Reduction in cost of compliance will boost India’s trade transactions. (c) the process of reconciliation of outstanding entries related to exports and imports in the respective reporting portals (EDPMS/IDPMS) is also simplified.

¨ A large number of circulars and directions totalling about 9000, have been consolidated, subject wise, across 11 types of regulated entities.

¨ It is proposed to provide greater flexibility to banks for opening and maintaining transaction accounts of borrowers (viz. current accounts and CC/OD accounts).

SIMPLIFYING FOREIGN EXCHANGE MANAGEMENT

¨ Revision of External Commercial Borrowing Framework which provides for expansion of eligible borrower and recognized lender base, rationalization of borrowing limits, rationalization of restrictions on average maturity period, removal of restrictions on the cost of borrowing for ECBs, review of end-use restrictions and simplification of reporting requirements.

¨ While we await the draft guidelines for the revised framework, we expect that further liberalisation will increase the ease of access to ECBs for corporates, and help banks grow their forex business.

¨ Rationalisation of FEMA regulations regarding non-residents establishing their business presence in India.

ENHANCING CONSUMER SATISFACTION

¨ RBI plans to tighten the Internal Ombudsman framework to ensure banks and financial institutions handle complaints more effectively. In addition, rural cooperative banks will be brought under the RBI Ombudsman Scheme, expanding consumer protection beyond urban financial institutions.

¨ These measures are designed to enhance consumer satisfaction and improve trust in the financial system, signalling the RBI’s intent to make customer service a pillar of banking reform.

The Governor also emphasized that the central bank would remain vigilant and data-driven in its policy responses, with price stability and growth support remaining twin priorities.

INTERNATIONALISING INDIAN RUPEE

¨ Three measures are proposed by RBI in this regard: (i) permit AD banks to lend in Indian Rupees to nonresidents from Bhutan, Nepal and Sri Lanka for cross border trade transactions, (ii) establish transparent reference rates for currencies of India’s major trading partners to facilitate INR based transactions, (iii) permit wider use of SRVA balances by making them eligible for investment in corporate bonds and commercial papers.

¨ These measures will help reduce dependence on the US dollar and thus shield the economy from sudden exchange rate fluctuations and currency crises.

¨ Additional reference rates in addition to USD, EUR, GBP and JPY, against INR will be published by FBIL. It will encourage banks to quote directly in a larger set of currency pairs, thus eliminating the need for multiple currency conversions and making trade more efficient.