Lenders Getting Stronger: NIM In Spotlight

FinTech BizNews Service

Mumbai, 8 January 2026: Kotak Institutional Equities has come out with an insightful research report on the banking sector:

Lenders getting stronger

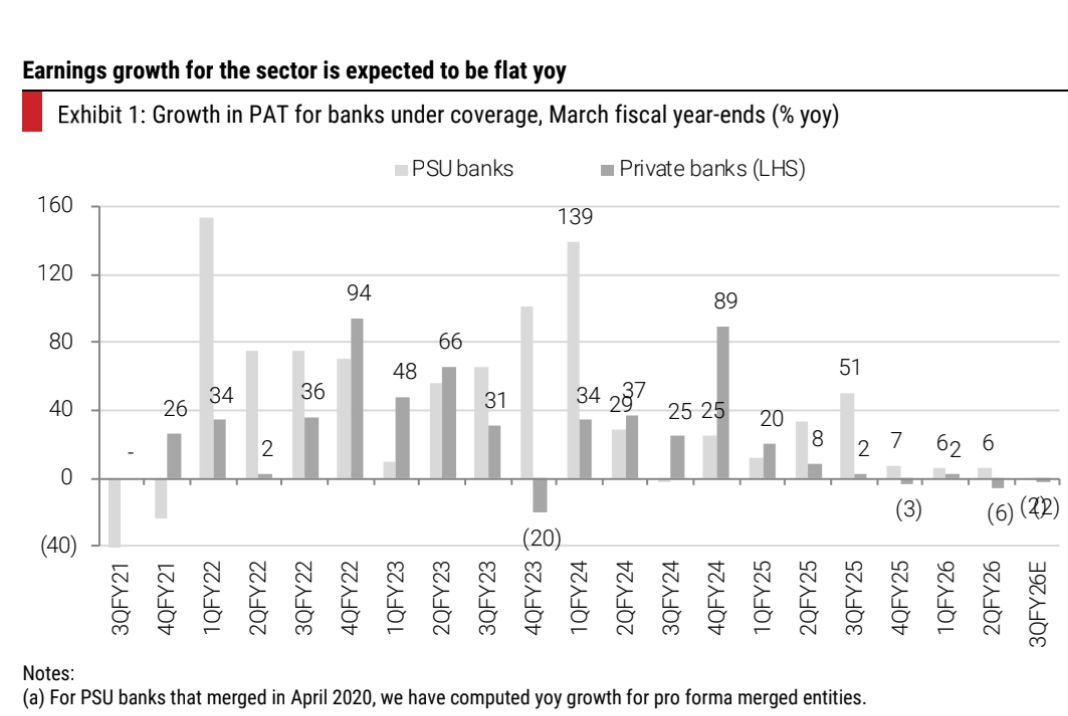

Headline earnings growth for banks is likely to be weak, but internals are getting fundamentally better, led by (1) a recovery in loan growth and (2) better trends on slippages/credit costs. The NIM is likely to be flat. The performance of NBFCs remains strong. Steady SIP flows and retail resilience supported AMC AUM, wealth managers held firm on recurring revenues, RTAs faced margin pressure despite stable growth and rating agencies saw modest gains.

NIM in the spotlight as growth and credit costs are likely to stay supportive

We expect flat earnings, led by muted revenue growth across banks. The provisional updates signal loan growth recovery at ~12% yoy in 3QFY25. Growth rebound implies slippages are unlikely to pose any risk this quarter (including unsecured loans), as lenders remain confident about the portfolio quality. NIM should remain flat sequentially, though commentary on any improvement from current levels may turn cautious amid headwinds from intensifying competition, slower deposit accretion and pending rate-cut pass-through. Overall, margin dynamics and funding trends will be key drivers of near-term performance. We see mid- and small-tier private and public banks well-positioned for this quarter.

NBFCs: The growth story continues

3QFY26 is likely to be a strong quarter, following weakness in 1H, buoyed by GST cuts and seasonal/festive strengths. Growth is holding on well, with sequential improvement in disbursements for most players. Margin trends are mixed, with large NBFCs poised for further liability-side tailwinds on complete transmission of rate cuts; yield reduction remains restricted to select segments such as mortgages. Credit costs are improving for most with the exit from challenges in the personal and microfinance loan segments; stress in small ticket MSME remains a pain point. Opex ratios are likely to inch up a bit, following the implementation of the new labor code.

Capital markets: Core strengths sustain earnings momentum

3QFY26 is likely to be an unexciting quarter overall. Among AMCs, HDFC and Nippon are likely to report relatively healthier core earnings growth (~10% yoy), while RTAs are likely to report a weak quarter due to revenue (CAMS) or cost (Kfin) pressures. 360 One is also likely to report ~10% yoy earnings growth, with a focus on expectations of higher net new money for the quarter. Angel One’s earnings will be sequentially stronger (base quarter impacted by regulations), with growth in orders and the MTF book. Rating agencies are likely to see moderate earnings growth, as ratings stay steady and non-ratings remain subdued.