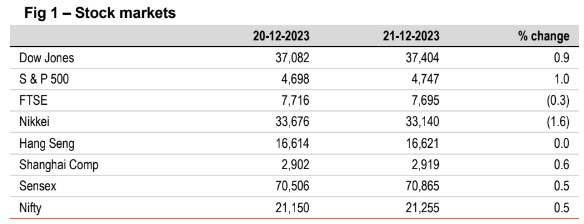

Barring FTSE And Nikkei, Other Global Indices Closed Higher

The focus will now turn towards upcoming PCE report to offer more guidance on inflation movement

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, December 22, 2023: Economic data from the US fuelled expectations of monetary easing by Fed with investors pricing in a 71.3% likelihood of 25bps rate cut as per FEDWATCH tool. US GDP for Q3 was up by 4.9% much lower than expectations (5.2%). Additionally, US jobless claims also inched up to 205,000 for the week ending Dec 16. However, they continued to remain historically lower. The focus will now turn towards upcoming PCE report to offer more guidance on inflation movement. Separately, the BoJ minutes noted that members discussed on better communicating the policy stance (including the YCC) in order to avoid any speculation. Furthermore, inflation rate in Japan slowed down to its lowest level at 2.8% in Nov’23 (3.3% in Oct’23).

- Barring FTSE and Nikkei, other global indices closed higher. US indices rose led by gains in stocks of semiconductor and ahead of the release of inflation data. Investors will closely track the ‘Santa clause rally’ (gains on final 5-trading days) which has historically signalled market movement for the coming days. Sensex recovered and climbed higher led by strong gains in power and oil & gas stocks. However, it is trading flat today, while other Asian markets are trading higher.

- Barring INR (lower) and China (flat), other global currencies ended higher against the dollar. DXY fell by 0.6%, as labour market showed signs of cooling (jobless claims), giving wind to expectation of rate cut by Fed in Mar’24. EUR and JPY gained the most. INR ended flat, eyeing stickiness in oil prices. However, it is trading higher today, in line with other Asian currencies.

- Global yields closed mixed. Varied signals from the US (softer than expected Q3 GDP and jobless claims; improving home sales, consumer confidence), has impacted investor sentiments. Market participants now await core PCE data for more cues on Fed’s rate trajectory. India’s 10Y yield rose by 2bps, as oil prices hover around US$ 79/bbl. However it is trading flat today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)