A move expected to be followed by other lenders too

FinTech BizNews Service

Mumbai, 7 December 2025: Hours after the RBI slashed key policy rate, state-owned lenders, Bank of Baroda (BoB) and Bank of India, on Friday announced an interest rate cut on loans linked to repo rate by 25 basis points, a move expected to be followed by other lenders too.

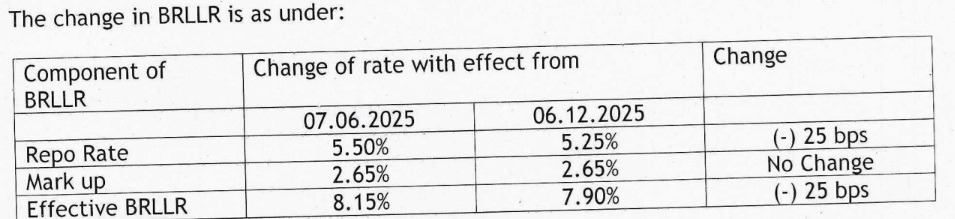

Following the Reserve Bank of India reducing the policy repo rate, Bank of Baroda (Bank), one of India’s leading public sector banks, has reduced its Baroda Repo Linked Lending Rate (BRLLR) by 25 basis points effective 06.12.2025. The Bank’s BRLLR now stands at 7.90%.

Bank of India reduced Repo Based Lending Rate (RBLR) to 8.10 per cent from 8.35 per cent effective Friday, Bank of India said in a regulatory filing.

Baroda Repo Based Lending Rate (BRLLR) to come down to 7.90 per cent as against the existing 8.15 per cent, BoB said in a separate filing.