On the revenue receipt side, direct tax collection is expected to miss the FY25BE by INR 2.2 tn. Income tax collections are likely to be lower by INR 1.4 tn due to the income-tax rate cuts announced in the previous Budget

FinTech BizNews Service

Mumbai, 31 January 2026: The latest edition of YES BANK’s ‘Ecologue’, provides a useful macro–fiscal analysis of the FY27 Union Budget. The research report, has been authored by Indranil Pan, Chief Economist; and Khushi Vakharia as well as Shreya Anurakti, YES BANK:

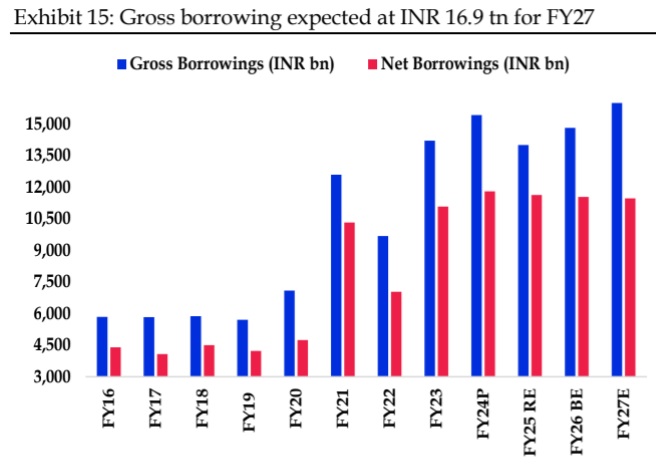

From this budget the targeting variable becomes public debt/GDP rather than GFD/GDP, thereby affording some breathing space from the relatively sharp corrections that were undertaken in the past few years. The task is made easier by a likely rise in the nominal GDP in FY27 to 10% (from 8% in FY26) while the government needs to be conscious of maintaining some space within the glide path of public debt/GDP to accommodate a likely Central Pay Commission award in FY28. For FY27 we see the government being able to achieve a 4.2% with a 1% glide path in public debt/GDP. However, the challenge for this Budget would be to find a new lever for growth, given that room for growing capital expenditure further would be restricted, while private investment demand is yet to become broad-based. The Budget has already delivered on consumption oriented fiscal push in FY26. The broad strategy of reforms is unlikely to change. We estimate Centre and State gross borrowings to be INR 30 tn, that is expected to keep the yield curve steep. 10-year G-sec is likely at 6.60-6.85% in H1FY27.

From this budget the targeting variable becomes public debt/GDP rather than GFD/GDP, thereby affording some breathing space from the relatively sharp corrections that were undertaken in the past few years. The task is made easier by a likely rise in the nominal GDP in FY27 to 10% (from 8% in FY26) while the government needs to be conscious of maintaining some space within the glide path of public debt/GDP to accommodate a likely Central Pay Commission award in FY28. For FY27 we see the government being able to achieve a 4.2% with a 1% glide path in public debt/GDP. However, the challenge for this Budget would be to find a new lever for growth, given that room for growing capital expenditure further would be restricted, while private investment demand is yet to become broad-based. The Budget has already delivered on consumption oriented fiscal push in FY26. The broad strategy of reforms is unlikely to change. We estimate Centre and State gross borrowings to be INR 30 tn, that is expected to keep the yield curve steep. 10-year G-sec is likely at 6.60-6.85% in H1FY27.

Budget focus on reforms process to continue; challenge will be to search for a growth driver:

While FY26 is expected to end with real growth at >7%, broad FY27 estimates indicate GDP growth slowing to <7%. Budget has already delivered the tax bazooka (both direct and indirect taxes) to boost private consumption demand and measures on similar lines are unlikely. After a few good years of ramp up in capital expenditures, the space to boost growth through government capex is also limited. On the other hand, private capital expenditure was expected to be crowded in by public capital expenditure, but that has not happened due to lower visibility of demand on account of global risks.

We expect this Budget to continue to focus on its strategic efforts to push the economy towards Viksit Bharat by generating inclusive growth by pushing forward rural development schemes and empowering all segments of the population. Having said, critical focus will have to be laid on creating employment to harness the demographic dividends. With a trade deal between India and US still hanging in balance, the focus world would be to protect the export MSME sectors (probably by working out an additional credit guarantee scheme for sectors critically hurt by the tariffs), reskill displaced worker from specific sectors, finding newer export markets etc. Centre should work with State Governments to push capex expenditure at the state levels and focus on efficiency gains for the capital employed, including measures to contain the cost and time overruns in projects.

Public debt/GDP for FY27BE to be brought down by 1% as envisaged:

Starting this Budget, the government has moved the yardstick for fiscal targeting to public debt/GDP ratio – to be brought down from an estimated 56.1% in FY26 to 50 +/- 1% by 2031.

We see the Centre targeting to reduce the public debt/GDP by 1% to 55% in FY27, likely consistent with a GFD/GDP of 4.2%, helped by another year of bumper dividend from the RBI (Yes Bank estimate at INR 2.4 tn) and improving nominal GDP growth at 10.5% for FY27 from 8% in FY26. We model direct tax growth at 16% while indirect tax growth is estimated at 7.2% for FY27. Total expenditure is anticipated to rise by 9.1% with capital expenditure growth at 7.1% and revenue expenditure growth at 9.6%. Details of our expectations of individual items of taxes and expenditures are provided below. Overall, fiscal deficit is expected at INR 16625 bn.

Funding G-sec borrowings for FY27BE could pose some challenges:

We see gross and net borrowings via G-secs at INR 17 tn and INR 11.5 tn, as redemptions are high at INR 5.5 trn. For States, we anticipate a 3% fiscal deficit as % of GDP, and calculate a net borrowings by States at INR 8.9 trn while gross borrowings are likely at INR 12.9 trn (INR 4.1 trn redemptions). Thus total borrowings by States and Centre via dated securities are likely at INR 29.9 tn compared to INR 27 trn in FY26). While supplies are high, demand side factors may play the spoilsport. FPI investments in debt have seen outflows in recent times while hopes of India getting included in the Bloomberg Index have been dashed. Further, demand from banks and other financial institutions could be lower as banks deposit growth and financial institutions’ AUM growth have been under pressure. Banks have also seen a rise in credit, leading to lower investments in G-secs and SDLs. Moreso, starting 01 April 2026, new LCR regulations will be operational, that would benefit banks by 6-7% on the LCR. Thus banks’ demand for G-secs could be lower. Further, G-secs were supported in FY26 through RBI’s easing of monetary policy and OMO purchases of securities. With BoP deficit likely to come down in FY27, size of OMOs may come down in FY27. Overall, we expect the steepness in the yield curve to persist with the 10-year locked in a 6.60-6.85% range in H1FY26.

EMERGING GROWTH-INFLATION MIX

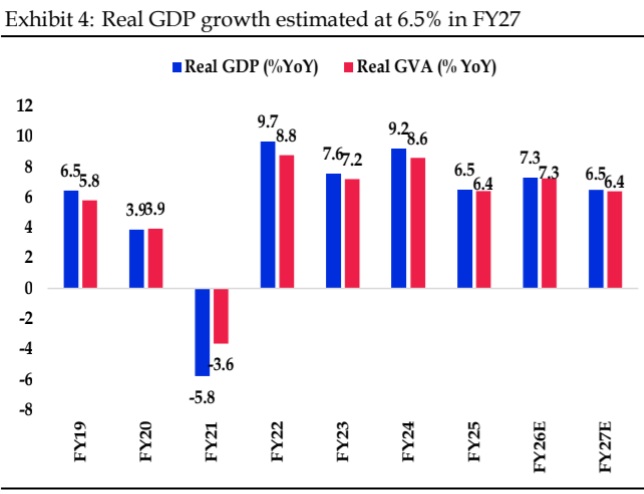

India’s growth surprised on the upside at a five quarter high of 8.2% YoY in Q2FY26 following a 7.8% YoY growth in Q1FY26. The higher growth was supported by an upswing in the services sector as well as the manufacturing sector. On the expenditure side, centre’s frontloading of capex was a positive for growth while data on the private capex indicated that new project proposals by the private sector grew 30.4% in H1FY26, seen as early signs of crowding in of the private sector investments. Private consumption has shown some rebound supported by the rural sector as real wages (both agri and non-agri) witnessed an uptick with falling food inflation. While GST cuts and monetary easing have led to some revival in the urban demand, the sustanence of the same looks difficult due to job losses and lower wage growth. High frequency indicators continue to show mixed signals and we expect Q3FY26 real GDP growth at 7.0% and Q4 growth at 6.3%, implying annual GDP growth at 7.3% for FY26 (7.4% as per First Advance Estimates)

For FY27, we expect growth to be steady albeit lower than FY26 as the initial support from consumption boost on account of GST rationalization and IT cuts will wear out. On the investment side, while some revival is seen in private capex, lack of good visibility of demand could impede a broad-based pick-up in private investments. Government spending will continue to be a growth driver, though the space is getting limited. In fact, at the last year’s Budget, Hounarable FM had indicated that the government will not be in a position to push capital investments hugely, and would expect the private sector capex to start kicking in. On the other hand, external headwinds continue in the form of tariffs as US and India remain deadlock on a favourable deal. We estimate FY27 GDP growth at 6.5-6.7%.

On the inflation front, the comfort from lower food prices is expected to continue into the next few months. As per the NHB data, in January MTD, vegetable prices have declined by 14.9% MoM. Further, fruits, cereals, and pulses also registered sequential declines in January MTD. Oil prices have registered a growth of 0.3% in January MTD. Rabi sowing has been robust and should help keeping food prices in check. For FY26, we expect CPI inflation to average at 2.0 2.2% with Q4 average higher at 3.0% YoY from 0.8% in Q2 while Headline CPI is expected to head higher to 3.8-4.0% in FY27. Core CPI ex-gold & silver appears to be settling around 2.3 2.5% YoY. The above understanding of the economy into FY27 is based on the current GDP and CPI series and can change consequent to the launch of the new series in February 2026.

FY26: Deficit glide path adhered to despite tax collection pressures

We expect the Central government to achieve its fiscal deficit commitment for the year, with the GFD/GDP ratio projected to be broadly in line with the budgeted target of 4.4%. On the revenue receipt side, we expect direct tax collection to miss the FY25BE by INR 2.2 tn. Income tax collections are likely to be lower by INR 1.4 tn due to the income‑tax rate cuts announced in the previous Budget. On the other hand, Corporate tax collection is higher at INR 10.5 tn compared to FY25P but is likely to still fall short by ~ INR 320 bn from the FY26BE. Similarly, indirect tax revenues are likely to fall short of FY26BE by ~ INR 1.4 tn, driven by weaker GST collections due to rationalization of the GST rates. The discontinuation of the compensation cess for all goods except tobacco products from September 2025 is also expected to impact indirect tax collections. The CGST collection is expected to be at INR 9.43 tn vs FY26BE of INR 10.1 tn. Consequently, gross tax collections are also likely to fall short of FY26BE by ~INR 3.3 tn After accounting for the state’s share and surcharge for NCCF, net taxes are likely at INR 26.12 tn for FY26E (FY26BE : INR 28.4 tn). On the non-tax revenue front, higher than expected RBI dividends is expected to lead to FY26BE being surpassed by INR 186 bn. Non-debt capital receipts are assumed to fall short of FY26BE of INR 760 bn by INR 220 bn, principally driven by lower disinvestment receipts. In FY26 so far, the government has carried INR 250 bn of disinvestments lower than the FY26BE target of miscellaneous capital receipts of INR 470 bn. Overall, we see total receipts to fall short of FY26BE by ~INR 2.3 tn. A contraction in total expenditure by INR 2.2 trn from FY26BE is expected to help contain any overshoot on the fiscal deficit despite weaker total receipts. Importantly, capex is expected to undershoot the FY26BE by INR 488 bn and expected to be at INR 10.7 tn (a mild shortfall at 3.0% of GDP vs 3.1% assumed in the budget) with momentum easing in the second half after heavy front‑loading in H1FY26. Under the major heads, we expect slippages in “Roads & Highways” and “Others”, given the current trajectory of spending in these areas. Revenue expenditure is seen at INR 37.67 tn reporting a slip of INR 1.75 tn from FY27BE. However, subsidies are expected to overshoot the FY26BE by 133 bn on account of higher demand for

the soil nutrients in the last kharif and rabi seasons, leading to surge in fertilizer imports in FY26. On the other hand, “Rural development”, is expected to miss the FY26BE target by INR 364 bn as delays in identifying beneficiaries slowed the latest phase of PMAY‑G, with completions at 1.8 million houses against a 3.51 million target. Similarly, we expect “Interest Payments” and “Transfer to States” to miss the budget targets. Overall, while both total receipts and total expenditure are expected to fall short of the FY26BE, the near‑offsetting nature of these deviations suggests that the fiscal deficit is likely to remain broadly aligned to the Budget target. Therefore, we see the Gross Fiscal Deficit at INR 15.77 tn vs FY26 BE of INR 15.72 tn.

Budget FY27: Balancing Fiscal Discipline with focus on growth‑critical investment and reforms

India’s economic momentum improved in Q2 FY26, with real GDP rising 8.2% up from 5.6% YoY earlier driven by robust Secondary and Tertiary sector activity. This strength is further corroborated by firm industrial activity, with IIP rising to 6.7% in November 2025, and by subdued inflation, with CPI at 1.33% in December 2025, well within the RBI’s tolerance band. However, global headwinds persist: sustained rupee depreciation signals external vulnerability, while the absence of a US trade deal poses risks to labour‑intensive export sectors already facing pressure from tighter global conditions. In this setting, the FY27 Union Budget has the task of balancing the requirements of fiscal consolidation with the need to sustain public investment push for growth‑critical sectors. Accordingly, we see FY27 Budget to achieve a 1% reduction in the public debt/GDP ratio, consistent with a 4.2% GFD/GDP target. For FY27 BE, we expect total receipts to amount to 9.2% of GDP, supported by higher net tax revenues driven by growth in personal income taxes, stronger corporate earnings, and sustained buoyancy in GST collections (on the back of a lower base in FY26 due to the GST cuts). Additionally, on the indirect tax front, excise revenues are expected to receive a further boost following the government’s approval of the Central Excise (Amendment) Bill 2025, which introduces a revised excise duty structure on cigarettes ranging from ₹2,700 to ₹11,000 per 1,000 sticks based on product length, effective February 1, 2026. Alongside the Health Security to National Security Cess, introduced in December 2025, is expected to support the revenues by providing a stable, capacity based levy on tobacco and pan masala manufacturers, ensuring predictable collections and continuity of sin tax revenues post expiry of the GST compensation cess. On the expenditure side, we expect capital expenditure as a % of GDP to drop a tad to 2.9% in FY27BE from ~3.0% in FY26E – this signals that the aggressive capex push of the previous budgets are unlikely to be repeated and the government should allocate the resources for sectors such as education and healthcare. The higher nominal growth assumed for FY27 also is a factor that will dent the capex as a % of GDP, without reducing the actual size of the expenditure. The revenue expenditure in FY27BE is expected to grow at a slower pace (5% from the FY26BE) compared to the nominal GDP growth. Within revenue expenditure, we expect fertiliser subsidy outlays to remain high in FY27BE compared to FY26BE, as continued volatility in global prices of key inputs keeps price of fertilizer imports high. Given the rising pressures of climate variability, higher input costs, and persistent market‑access bottlenecks, the FY27BE is expected to place greater emphasis on the agricultural and allied activities, with higher allocations aimed at strengthening productivity, improving sustainability, and supporting farmer incomes. The government schemes and allocations have already created significant headroom for innovation through the launching of RDI scheme in November 2025(INR 1 tn) and continued support through Skill India Program (outlay of INR 88 bn from the period 2022-23 to 2025 26). However, the focus must now shift to ensuring better outcomes from this spending. In this context, in the upcoming Budget we expect greater emphasis on targeted spending towards innovation alongside higher allocations for skilling and vocational training. This is essential to the workforce capability building, central to generating productive employment and strengthening productivity and resilience across value chains. Looking ahead to the FY27 Union Budget, we expect trade‑facilitation reforms to take centre stage with a sharper focus on insulating Indian exporters from the escalating tariff pressures in key markets such as the US. We do expect simplifying the tariff structure, modernising customs procedures, and revisiting SEZ rules to allow smoother domestic integration.

Together with targeted support for labour‑intensive exports and stronger incentives for technology upgrading, these reforms would help firms better absorb rising global tariff pressures and reinforce a shift toward deeper, more resilient export-based manufacturing. For FY27BE our fiscal calculations are based on an expected nominal GDP growth of 10%. Our detailed expected numbers for FY27BE for various components of revenues and expenditures are enumerated below.

RBI dividend expected at INR 2.4 tn, lower than FY26

In FY27, we estimate direct tax collection to grow by 15.9% YoY to INR 27.1 tn (or 6.8% of GDP). Indirect tax collection is estimated to grow by 7.2% to INR 17.0 tn . Overall, we expect gross tax collections to grow to INR 44.3 tn. After accounting for the state’s share and surcharge for NCCF, net taxes are estimated at INR 29.4 tn. 1) 2) 3) 4) Within direct tax, income tax is expected to grow by 19.5% YoY (or 3.9% of GDP) to INR 15.4 tn. Corporate tax is expected at INR 11.7 tn, registering a growth of 11.5% YoY (or 2.9% of GDP). Given the improved profitability of the private sector, we expect a revival in corporate tax collections. In FY26E we expect a shortfall in direct tax collections. Within indirect tax, CGST is expected at INR 10.7 tn, registering a growth of 12.8% YoY (or 2.7% of GDP). Customs duty and excise duty collection are expected at INR 2.7 tn and INR 3.5 tn, respectively. Non-tax revenue is expected at INR 6.0 tn, and we expect RBI dividend to provide cushion for the centre to achieve the target of 4.2% fiscal deficit for FY27. We calculate the RBI dividend to be at INR 2.4 tn for FY27. Non-debt capital receipts are assumed to grow by INR 766 bn, with miscellaneous capital receipts (that would incorporate disinvestment receipts) target anticipated to remain unaltered at INR 450 bn.

Capex to support growth albeit expected to be lower than FY26

We estimate total expenditure to grow by 9.1% YoY in FY27BE to INR 52.8 tn (or 13.4% of GDP). For FY27BE, we expect revenue expenditure at INR 41.3 tn (or 10.5% of GDP). Subsidy bill is expected at INR 4.7 tn (1.2% of GDP), with higher subsidy outgo for food at INR 2.1 tn and fertilizer subsidy at INR 2.2 tn. “Education” spend is estimated at INR 1.4 tn (or 0.3% of GDP) while allocation for “Agriculture and allied activites” is estimated at 1.5 tn (0.4% of GDP). We estimate “Health and Family welfare” at INR 1.1 tn (or 0.3% of GDP). Interest payments for FY27BE is penciled at INR 13.0 tn (or 3.3% of GDP). We model capital expenditure of the centre to be at 2.9% of GDP in FY27 vs 3.1% in FY26BE. We have budgeted for a INR 1500 bn of long-term loan to states, similar to the level assumed in FY26BE, and linked to States’ reforms programme. We expect “Roads & Highways” outlay to grow by 8.3% YoY while Total Capex is expected to increase by 7.1% YoY to INR 11.5 tn.

Centre’s net market borrowings expected at INR 11.5 tn in FY27BE

Overall, we model a reduction in Centre’s public debt/GDP by 1%, consistent with a GFD/GDP for FY27BE at 4.2%. We calculate GFD at INR 16.6 tn for FY27BE, higher than our FY26E of INR 15.7 tn. For FY27BE, we expect the government to meet around 69% of its fiscal deficit through borrowings of dated securities, assuming small savings collections at around INR 3800 bn. Consequently, net borrowings of the Central government via dated securities for FY27BE are estimated at INR 11.5 tn, almost equivalent to the net borrowings of FY26E. Redemptions in FY27BE are at INR 5.5 tn (media reports indicate that the budgeted switching of maturities are now over, hence we do not assume any further switches to be conducted by the RBI to bring down the FY27 redemptions). Gross borrowing of the centre through dated securities is estimated at INR 17 tn (much higher than the gross borrowings of INR 14.8 tn in FY26E). Net short-term borrowings for FY27BE are estimated at INR 500 bn. For FY27E, we work with a 3% GFD/GSDP for states, given some likely challenges for state governments on the revenue side after GST rate cuts. Net Borrowings of States for FY27E are likely at INR 8.8 tn, assuming 74% of GFD will be covered through SDL issuances. With redemptions of SDL at INR 4.1 tn for FY27, gross SDL issuances will be around INR 12.9 tn. Total gross supplies of government papers through dated securities (G-Secs + SDLs) for FY27 thus amount to around INR 30 tn (approximately INR 29 trn in FY26). Net supplies are expected at INR 20.3 tn.

In FY26TD, 10Y yield traded in a range of 6.16-6.68%. Yields dipped in the early part of the FY26 on account of RBI’s rate cutting cycle, push by the RBI to increase rupee liquidity in the system, including proactively announcing a CRR reduction of 100 bps at its June 2026 policy. However, the drop in the yields failed to sustain as markets started to price in a pause by the RBI at its rate cutting cycle post the June 2026 policy itself after the RBI frontloaded its easing action with a 50 bps repo rate reduction. Despite a surprise 25 bps cut at its December policy, sentiments for bond yields continued to remain negative as 1) global yields remained under pressure as G3 economies witnessed high debt levels, 2) increase in credit demand but in an atmosphere of lower deposit growth, implying lower bank appetite for G-secs, 3) FPI net outflows from debt markets due to low interest differential and deprectiating INR.

We expect yield curve to remain steep in FY27. Inflation in India has bottomed out and the bar for further cuts in repo rate in FY27 remains high, given that we expect Headline inflation to align to the 4% inflation target. On the other hand, the RBI is expected to continue to infuse liquidity into the system through various measures at its disposal. Longer tenor yields will depend on the demand supply dynamics of government securities. Given our current understanding, we expect the large supply pressure of government securities to outstrip demand for bonds. On the demand side, the negatives can be the following: 1) Net FPI flows likely to remain muted as India-US rate differential remains low and INR is likely to stay on a depreciation bias. Inclusion into the Bloomberg Global Bond Index has also been delayed; 2) despite liquidity injection by the RBI, banking sector deposit mobilisation has been low, leading to a lower NDTL growth and hence lower demand for bonds, 3) starting 01st April 2026, the new LCR rules are likely to kick in, which is expected to reduce the need for further shoring up HQLA, 4) credit growth of the banking sector has been more robust compared to deposit growth. Along with point 2 and 3, banks are likely to see a lowering of SLR. As of December 2025 SLR ratio is at 27.7%, down from 29% in December 2024. This is expected to get further lowered, global yields are likely to stay firm, given the large debt overhang and high fiscal in the globe. India and US 10-year yield sees a close correlation, implying sticy to firming India 10-year yield. The support to the India G-sec could come from continued OMO purchases by the RBI to neutralise its dollar sales to reduce INR volatility. However, the amout of OMO purchases is likely to be lower in FY27 compared to FY26 as our models indicate a lower BoP deficit in FY27 (thereby need for lower FX sales by the RBI) compared to FY26. We expect India 10Y to trade in the sticky range of 6.60-6.85%, but with an upward bias. Any restart of the RBI rate cutting cycle or a higher OMO purchase (both not our base case view) could lead to yields coming off from the current levels.