Daily average demand indexed growth in consumer durable loans increased to 189 in 2025, from 128 in 2024

FinTech BizNews Service

Mumbai, 15 December 2025 – The Goods and Services Tax (GST) rationalisation in September 2025, just before India’s festive season, seems to have helped boost the retail credit market. With improved affordability, retail borrowers sought more credit. As a result, the Credit Market Indicator (CMI)1 rose to 99 for July to September 2025, up from 98 in April to June 2025, according to TransUnion CIBIL’s December 2025 Credit Market Report.

The CMI is a comprehensive measure of data elements that are summarized monthly to analyse changes in credit market health, categorized under four pillars of demand, supply, consumer behaviour and performance. These factors are combined into a single, comprehensive CMI Indicator, and pillars can also be viewed in more detail individually. A higher CMI reading indicates improving credit market health, while a lower reading indicates a decline.

Credit Market Indicator (CMI) Sept 2023 – Sept 2025

The rationalisation of GST (known as GST 2.0) appears to have contributed significantly to increased credit demand from retail consumers, which reflects a strong alignment between policy reforms and consumer behaviour, underscoring the resilience of India’s retail credit ecosystem. As lenders respond to this momentum, maintaining a balance between credit expansion and responsible lending will be critical to sustaining long-term financial health.

“GST 2.0 was a much-needed step to stimulate economic growth, and its positive impact is evident in the improvement of consumer sentiment and the upward trend in credit demand. While fostering and sustaining this credit demand is crucial, it is equally important to promote responsible borrowing practices. Lenders must engage with consumers at multiple touchpoints to ensure financial discipline and sustainability to support healthy growth of credit in India,’’ said Mr. Bhavesh Jain, MD and CEO, TransUnion CIBIL.

Revival in Credit Demand Led by GST 2.0 and Festive Season

Increased retail loan demand signalled renewed consumer confidence and market optimism. This improvement was particularly evident in segments such as vehicle finance (two-wheeler loans and auto loans) and consumer durables, which showed robust incremental year-over-year (YoY) growth during the pre-festive period (post-GST 2.0 implementation). This led to an increase in CMI for demand to 95 in the quarter ending September 2025, compared to 93 in the quarter ending September 2024.

CMI Demand September 2023 – September 2025

While the CMI covers the period July to September 2025, TransUnion CIBIL has additionally analysed demand trends for October 2025 to capture the early impact of GST 2.0 and the festive season on consumer credit behaviour. It compared the festive period demand in 2024 and 2025 and GST impact in 2025 for consumer durable loans, two-wheeler loans and auto loans. The indexed growth trends (indexed to 100 for the January to June period of each year) indicate that the daily average demand indexed growth in consumer durable loans increased to 189 in 2025, from 128 in 2024. Similarly, the demand growth in two-wheeler loans increased to 272 in 2025 from 249 in 2024, and the demand growth in auto loans increased to 133 in 2025 from 115 in 2024.

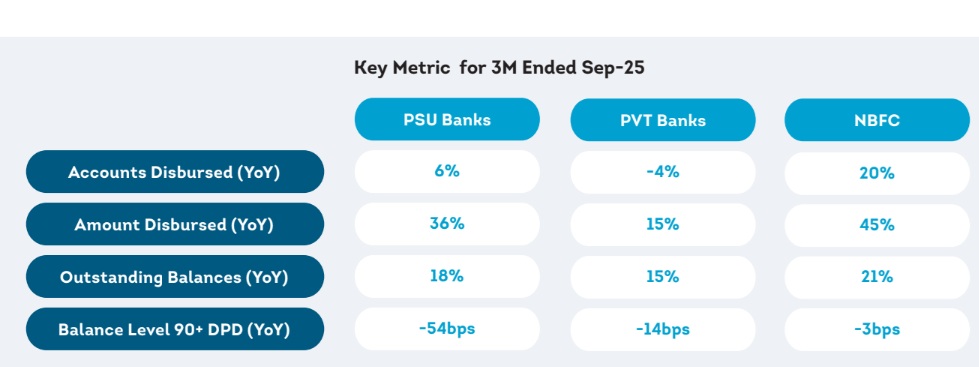

Credit Supply Driven by Secured Assets, Semi-Urban and Rural Regions

The CMI for supply increased to 97 during the third quarter of 2025, compared to 91 in the same quarter of 2024, primarily driven by consumption loans (except credit cards) and gold loans.

Credit supply of secured assets such as home loans, auto loans and consumer durable loans showed positive momentum in the September 2025 quarter, despite experiencing a decline last year.

Origination Volumes by Product Type

Semi-urban and rural regions continued to outperform metro and urban areas in both credit demand and supply, a trend that was witnessed in the previous quarter as well. The share of semi-urban and rural consumers in overall credit supply remained higher at 61% during the quarter ended September 2025.

“For lenders, this presents an opportunity to focus on pockets where supply is strong while simultaneously analysing regions showing muted growth to identify underlying challenges. Leveraging granular data and insights will be key to aligning strategies with evolving consumer needs and ensuring balanced credit expansion,’’ Mr. Jain said.

Emerging Geographies Seeing Higher Credit Growth from New-to-Credit and Younger Borrowers

The YoY rate of growth among new-to-credit borrowers increased by 5% in the September 2025 quarter after declining 14% YoY last year in the same period, reaffirming the turnaround. However, this was lower than the high YoY growth rate of 17% noted in the September 2022 quarter.

The rate of growth among consumers younger than 35 years increased from 3% YoY in the September 2024 quarter to 12% YoY for the same period in 2025. The growth rate of younger borrowers in semi-urban and rural areas increased from 7% YoY to 15% YoY, while in metro and urban areas it increased to 8% YoY after falling by 3% YoY last year.

“The resurgence in new-to-credit borrowers, coupled with the sharp increase in younger consumer participation — particularly in semi-urban and rural regions — signals a shift in lenders’ focus towards these segments. Lenders must capitalize on these emerging segments by designing targeted lifecycle strategies to ensure they support borrowers’ evolving financial needs. This approach will be critical to sustaining growth and fostering responsible credit behaviour,” Mr. Jain said.

Overall Asset Quality Remains Stable with Signs of Stress in Certain Loan Segments

Balance-level delinquencies2 remained stable for key product segments, with the CMI for performance increasing to 105 for the quarter ending September 2025, compared to 100 for the quarter ending September 2024. This marginal increase in CMI for performance indicates an overall stable or improving delinquency picture among consumers. However, product-level performance reveals stress in certain segments—particularly in micro-loan against property and small-ticket housing—which merit closer attention.

While property loans’ performance improved with balance-level 90+days delinquencies at 1.4%, improving by 29 basis points YoY, early signs of stress were noted in the micro-loans against property (LAP) segment3, where delinquency increased 45 basis points YoY, reaching 3.3% as of September 2025. In the micro-LAP segment early delinquencies measured as 90+ days past due reported in 12 months on book rose 29 bps YoY to 2.2% for originations in the quarter ended September 2024, which is higher than the overall LAP early delinquencies at 1.6%. In small-ticket housing loans4, early delinquencies rose 19 bps YoY to 0.8% for originations in the quarter ended September 2024, which is higher than overall housing loan early delinquencies at 0.5%.

“While overall asset quality remains stable, recent trends indicate emerging stress in specific loan segments such as micro-LAP and small-ticket housing loans. As a facilitator of credit inclusion, TransUnion CIBIL is committed to equipping lenders with actionable insights and advanced analytics to navigate these challenges. Our solutions enable lenders to identify early warning signals, assess risk effectively, and engage borrowers responsibly. By leveraging these capabilities, lenders can mitigate stress, maintain portfolio health, and continue fostering a robust and inclusive credit ecosystem,” Mr. Jain added.