Inflation in both Germany and France moderated, inching closer to ECB’s target of 2%. In China, exports and import growth contracted in Mar’24 by 7.7% and 1.9% respectively.

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, April 15, 2024: Geo-political tensions in the Middle East escalated amidst increased hostilities between Iran and Israel, which is likely to weigh on investors’ sentiments. While oil prices jumped up amidst supply concerns, gold and dollar also inched up due to safe-haven demand. In US, University of Michigan’s inflation expectation survey also noted an uptick for both 1Y and 5Y period. Separately, inflation in both Germany and France moderated, inching closer to ECB’s target of 2%. In China, exports and import growth contracted in Mar’24 by 7.7% and 1.9% respectively. In India, CPI remained in line with our estimate at 4.9%, stickiness in food inflation remained while core was benign. FY24 headline CPI averaged at 5.4%, in line with RBI’s estimate. IIP growth picked up to 5.7% in Feb’24 from 4.1% in Jan’24.

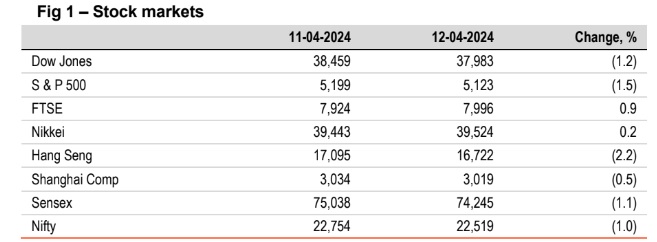

§Global stocks ended mixed. Markets remained cautious monitoring geopolitical tension. In US, 1-year ahead inflation expectations firmed up raising doubts about the timing of rate cut by Fed. Hang Seng fell the most, followed by US stocks. FTSE inched up supported by better macro print in UK. Sensex fell by 1.1% dragged down by consumer durables and oil and gas stocks. It is trading further lower today, while Asian stocks are trading mixed.

Global currencies ended weaker against the dollar. DXY rose by 0.7% as expectations of Fed rate cut in Jun’24 diminished. EUR depreciated by 0.8% as ECB hinted at rate cuts. GBP too depreciated even as UK’s GDP expanded in Feb’24. Higher oil prices weighed on INR. It is trading further weaker today, in line with other Asian currencies.