8 Years of GST

FinTech BizNews Service

Mumbai, July 23, 2025: On 1 July 2025, the Goods and Services Tax (GST) completed eight years since its rollout. Introduced in 2017 as a major step towards economic integration, GST replaced a maze of indirect taxes with a single, unified system. It made tax compliance easier, reduced costs for businesses, and allowed goods to move freely across states. By improving transparency and efficiency, GST helped lay the foundation for a stronger, more integrated economy, states the Research Report from the State Bank of India’s Economic Research Department, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India.

❑ GST rates in India are determined by the GST Council, which includes representatives from the Union and State or Union Territory governments. The current GST structure consists of four main rate slabs: 5 percent, 12 percent, 18 percent and 28 percent. These rates apply to most goods and services across the country.

❑ In addition to the main slabs, there are three special rates: 3 percent on gold, silver, diamond and jewellery, 1.5 percent on cut and polished diamonds and 0.25 percent on rough diamonds. A GST Compensation Cess is also levied on select goods such as tobacco products, aerated drinks and motor vehicles at varying rates. This cess is used to compensate states for any revenue loss resulting from the transition to the GST system.

Global Situation

❑ Since the first introduction of a Value Added Tax in France in 1954,

VAT/GST has now been adopted by 175 countries around the world.

The latest is Guinea-Bissau, implemented VAT on 1 January 2025

❑ A further 19 other countries, notably the US, have instead adopted a

sales tax, a single-layer turnover tax

❑ It is important to note that a majority of these countries have exempted

certain essential goods such as food, education, and health services,

amongst others. Hence, the standard rates do not apply to such goods

Active GST Taxpayers in India

❑ The number of active taxpayers has also seen a sharp rise. As of 31st May 25, there are over 1.52 crore active GST registrations

Top 5 states accounted for ~50% of total Active GST Tax Payers

Surprisingly, some of the larger and

richer states like Telangana, Tamil Nadu,

Kerala, Andhra Pradesh and even

Karnataka have low share in active GST

taxpayers vis-à-vis the state’s share in

overall GSDP....Interestingly, states like

Uttar Pradesh, Bihar & Gujarat share in

total GST taxpayers is larger than the

state’s share in overall GSDP

This indicate that there is still a vast

untapped potential in GST in these

states

A break-up of state-wise gross GST

collection indicate that all the big

states (states having GST collection

of more than Rs 1 lakh crore) have

IGST share of more than 30% in

their total domestic collection...This

indicates the power of larger states

in enabling a higher IGST

settlement in other states also

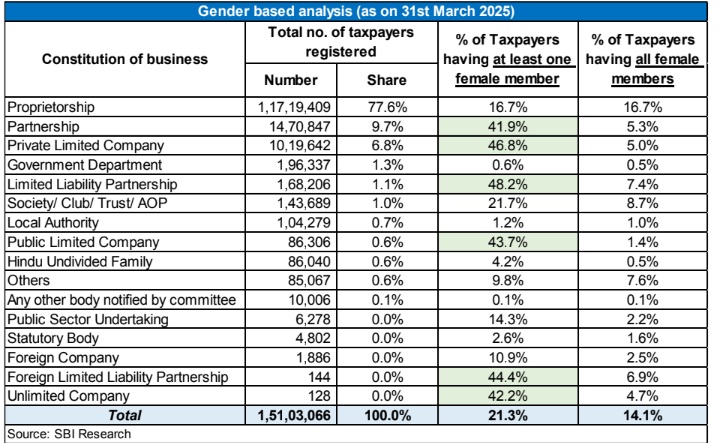

One-fifth of registered taxpayers having at least one female member

On the basis of constitution of business, almost one-fifth of registered taxpayers having at least one female member and 14% of registered taxpayers having all female member

❑ This data, along-with 15% share of women in overall Income taxpayers and 40% in overall deposits, mirrors women empowerment...The encouraging trends further get a thumping seal from substantial high numbers in Limited Liability Partnership (LLP) & Private Limited Companies, the vectors of increased formalization and momentum in corporate playbook

GST collection doubled in 5 years...Average monthly collection > Rs 2 lakh crore mark

❑ Since its rollout, the Goods and Services Tax has shown strong growth in revenue collection and tax base expansion. It has steadily strengthened India’s fiscal position and made indirect taxation more efficient and transparent

❑ In just five years (FY25 over FY21), gross GST collection doubled

❑ Even average monthly gross GST collection now Rs 2 lakh crore

ITC is a mechanism to avoid cascading of taxes

❑ Uninterrupted and seamless chain of input tax credit (ITC) is one of the key features of GST

❑ ITC is a mechanism to avoid cascading of taxes. Cascading of taxes, in simple language, is ‘tax on tax’

❑ Under the earlier system of taxation, credit of taxes being levied by Central Government was not available as set-off for payment of taxes levied by State Governments, and vice versa

❑ One of the most important features of the GST system is that the entire supply chain would be subject to GST to be levied by Central and State Government concurrently. As the tax charged by the Central or the State Governments would be part of the same tax regime, credit of tax paid at every stage would be available as set-off for payment of tax at every subsequent stage

❑ Hence, GST has mitigated cascading impact of taxes. Under the present system most of the indirect taxes levied by Central and the State Governments on supply of goods or services or both are subsumed under a single levy....This unique feature of GST has impact on state-wise inflation

❑ By using the state-wise GST Refund data (as proxy for ITC) and CPI inflation data we have endeavored to prove that ITC removed market distortions and improved the efficiency of resource allocation and hence has soothing impact on inflation

GST Refunds and Spatial Inflation Convergence

❑ We plot the average log deviation of state-level inflation from the national average against the average log GST

refunds received by each state during FY21–FY25. This scatterplot reveals a negatively sloped trendline, indicating that, on average, states receiving higher GST refunds have exhibited lower deviations from national inflation — a suggestive sign of stronger spatial convergence

❑ The smoothening of production costs and reduction in tax-induced distortions can anchor local inflation more closely to national price movements

❑ The graph shows that on average all state shave experienced convergence except Telangana and Orissa....Hence, this downward trend implies that GST refunds may have acted as a convergence enabler, especially by reducing inflation volatility across states

Objective: We investigate whether GST refunds have contributed to spatial inflation convergence across Indian states over the post-GST period

❑ Methodology: We implement a year-wise cross-sectional quantile regression framework over the period FY21–FY25. The dependent variable is the absolute log deviation of state-level inflation from the national average, serving as a proxy for spatial dispersion. By estimating separate quantile regressions, we allow the effect of GST refunds to vary across the conditional distribution of inflation dispersion—thereby uncovering heterogeneous convergence dynamics among states with low, median, and high deviations from the national benchmark. This approach enables us to test whether convergence is being driven uniformly or is concentrated among outlier states

In FY21, refunds did not aid convergence. Coefficients are positive across all quantiles

❑ Convergence pattern strengthens over time, peaking in FY25 across all quantiles. By FY25, convergence is strong across the spectrum, indicating a broad-based equalizing effect of GST

❑ FY23 is an outlier: convergence weakens again, possibly due to strong external factor such as Russia- Ukraine war and global uncertainty

❑ In the 3rd quantile, capturing states that were consistently above the national inflation average, the regression results reflect a noteworthy convergence dynamic over time. This evolution suggests that states with the largest inflation differentials; historically the most spatially disconnected from national price behavior; increasingly aligned their inflation trends with the national average in response to rising GST refunds

❑ The temporal deepening of convergence across all quantiles by FY25 suggests that GST refund mechanisms have matured and contributed to macro-spatial integration

Let’s Celebrate GST !!!

❑ GST has undoubtedly been a landmark reform in India’s fiscal landscape, fostering greater

transparency, unifying markets, and enhancing revenue efficiency

❑ Yet, as we celebrate its achievements, it is equally important to reflect on the emerging

challenges. A recent case from Karnataka illustrates this tension, where numerous small

traders and shopkeepers in Bengaluru have received disproportionately high tax notices

primarily based on digital footprints such as UPI transactions

❑ While the intent to capture a more accurate picture of economic activity and reduce tax

evasion is commendable, such enforcement must be balanced with sensitivity. The risk is that

overly aggressive scrutiny could drive small businesses back into the informal cash-based

economy undermining the very purpose of formalization

❑ GST has laid the foundation for greater accountability and revenue generation, but its

long-term success will depend on ensuring that it empowers all stakeholders especially

small traders instead of penalizing them. Inclusivity, transparency, and fair

implementation will be key to celebrating GST in both letter and spirit