Provisions and contingencies for the quarter ended March 31, 2025 were Rs 31.9 billion as against Rs135.1 billion (which included floating provisions of Rs109.0 billion) for the quarter ended March 31, 2024.

FinTech BizNews Service

Mumbai, April 19, 2025: The Board of Directors of HDFC Bank Limited approved the Bank’s (Indian GAAP) results for the quarter and year ended March 31, 2025, at its meeting held in Mumbai on Saturday, April 19, 2025. The accounts have been subjected to an audit by the statutory auditors of the Bank.

CONSOLIDATED FINANCIAL RESULTS:

The Bank’s consolidated net revenue was Rs 732.8 billion for the quarter ended March 31, 2025. The consolidated profit after tax for the quarter ended March 31, 2025 was Rs 188.3 billion. The consolidated PAT adjusted for trading and mark to market gains, prior year one-off provisions and prior year tax credits, grew by approximately 10%. The consolidated PAT for the year ended March 31, 2025 was Rs 707.9 billion. Earnings per share for the quarter ended March 31, 2025 was Rs 24.6 and Rs 92.8 for the year ended March 31, 2025. Book value per share as of March 31, 2025 was Rs 681.9.

STANDALONE FINANCIAL RESULTS:

Profit & Loss Account: Quarter ended March 31, 2025 The Bank’s net revenue was Rs 440.9 billion for the quarter ended March 31, 2025 as against Rs 472.4 billion (which included transaction gains of Rs 73.4 billion from stake sale in subsidiary HDFC Credila Financial Services Ltd) for the quarter ended March 31, 2024. Net interest income (interest earned less interest expended) for the quarter ended March 31, 2025 grew by 10.3% to Rs 320.7 billion from Rs 290.8 billion for the quarter ended March 31, 2024. Net interest margin was at 3.54% on total assets, and 3.73% based on interest earning assets. Excluding Rs 7 bn of interest on income tax refund, core net interest margin was at 3.46% on total assets, and 3.65% based on interest earning assets. Other income (non-interest revenue) for the quarter ended March 31, 2025 was Rs 120.3 billion. The four components of other income for the quarter ended March 31, 2025 were fees & commissions of Rs 85.3 billion (Rs 79.9 billion in the corresponding quarter of the previous year), foreign exchange & derivatives revenue of Rs 14.4 billion (Rs 11.4 billion in the corresponding quarter of the previous year), net trading and mark to market gain of Rs 3.9 billion (gain of Rs 75.9 billion including transaction gains of Rs 73.4 billion in the corresponding quarter of the previous year) and miscellaneous income, including recoveries and dividend of Rs 16.7 billion (Rs 14.4 billion in the corresponding quarter of the previous year).

Operating expenses for the quarter ended March 31, 2025 were Rs 175.6 billion as against Rs 179.7 billion (which included staff ex-gratia provision of Rs 15.0 billion) during the corresponding quarter of the previous year. The cost-to-income ratio for the quarter was at 39.8%.

Provisions and contingencies for the quarter ended March 31, 2025 were Rs 31.9 billion as against Rs 135.1 billion (which included floating provisions of Rs 109.0 billion) for the quarter ended March 31, 2024.

Profit before tax (PBT) for the quarter ended March 31, 2025 was at Rs 233.4 billion. Profit after tax (PAT) for the quarter was at Rs 176.2 billion. PAT, adjusted for trading and mark to market gains, prior year one-off provisions and prior year tax credits, grew by approximately 10% over the quarter ended March 31, 2024.

Balance Sheet:

As of March 31, 2025 Total balance sheet size as of March 31, 2025 was Rs 39,102 billion as against Rs 36,176 billion as of March 31, 2024. The Bank’s average deposits were Rs 25,280 billion for the March 2025 quarter, a growth of 15.8% over Rs 21,836 billion for the March 2024 quarter, and 3.1% over Rs 24,528 billion for the December 2024 quarter.

The Bank’s average CASA deposits were Rs 8,289 billion for the March 2025 quarter, a growth of 5.7% over Rs 7,844 billion for the March 2024 quarter, and 1.4% over Rs 8,176 billion for the December 2024 quarter. Total EOP Deposits were at Rs 27,147 billion as of March 31, 2025, an increase of 14.1% over March 31, 2024. CASA deposits grew by 3.9% with savings account deposits at Rs 6,305 billion and current account deposits at Rs 3,141 billion. Time deposits were at 17,702 billion, an increase of 20.3% over the corresponding quarter of the previous year, resulting in CASA deposits comprising 34.8% of total deposits as of March 31, 2025.

Grossing up for transfers through inter-bank participation certificates, bills rediscounted and securitisation / assignment, average advances under management were Rs 26,955 billion for the March 2025 quarter, a growth of 7.3% over Rs 25,125 billion for the March 2024 quarter, and a growth of 2.6% over Rs 26,276 billion for the December 2024 quarter. Gross advances were at Rs 26,435 billion as of March 31, 2025, an increase of 5.4% over March 31, 2024. Advances under management grew by 7.7% over March 31, 2024. Retail loans grew by 9.0%, commercial and rural banking loans grew by 12.8% and corporate and other wholesale loans were lower by 3.6%. Overseas advances constituted 1.7% of total advances. Year ended March 31, 2025

For the year ended March 31, 2025, the Bank earned a total income of Rs 3,461.5 billion as against Rs 3,075.8 billion in the corresponding period of the previous year. Net revenues (net interest income plus other income) for the year ended March 31, 2025 were Rs 1,683.0 billion, as against Rs 1,577.7 billion for the year ended March 31, 2024. Profit after tax for the year ended March 31, 2025 was Rs 673.5 billion, up by 10.7% over the corresponding year ended March 31, 2024.

Capital Adequacy:

The Bank’s total Capital Adequacy Ratio (CAR) as per Basel III guidelines was at 19.6% as on March 31, 2025 (18.8% as on March 31, 2024) as against a regulatory requirement of 11.7%. Tier 1 CAR was at 17.7% and Common Equity Tier 1 Capital ratio was at 17.2% as of March 31, 2025. Risk-weighted Assets were at Rs 26,600 billion.

DIVIDEND

The Board of Directors recommended a dividend of Rs 22.0 per equity share of Rs 1 for the year ended March 31, 2025. This would be subject to approval by the shareholders at the next annual general meeting.

NETWORK

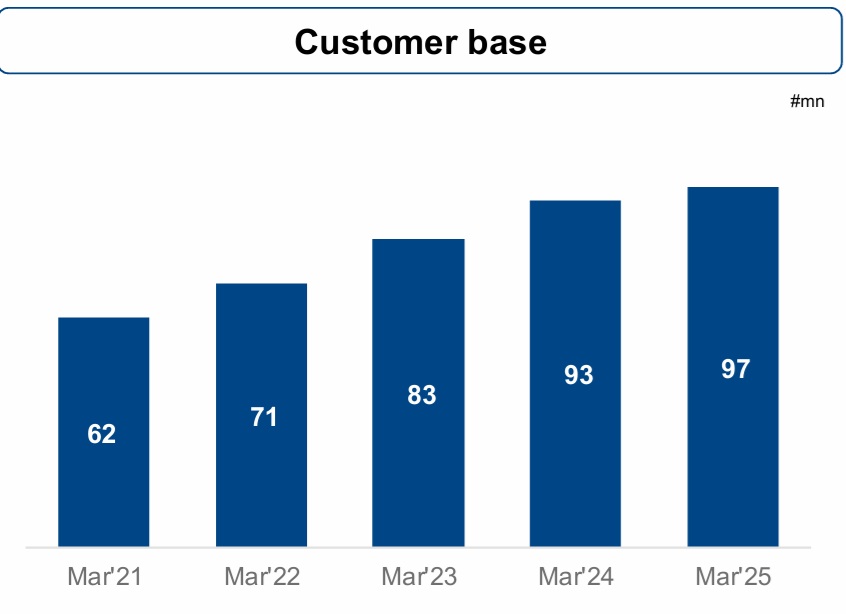

As of March 31, 2025, the Bank’s distribution network was at 9,455 branches and 21,139 ATMs across 4,150 cities / towns as against 8,738 branches and 20,938 ATMs across 4,065 cities / towns as of March 31, 2024. 51% of our branches are in semi-urban and rural areas. In addition, we have 15,399 business correspondents, which are primarily manned by Common Service Centres (CSC). The number of employees were at 2,14,521 as of March 31, 2025 (as against 2,13,527 as of March 31, 2024).

ASSET QUALITY

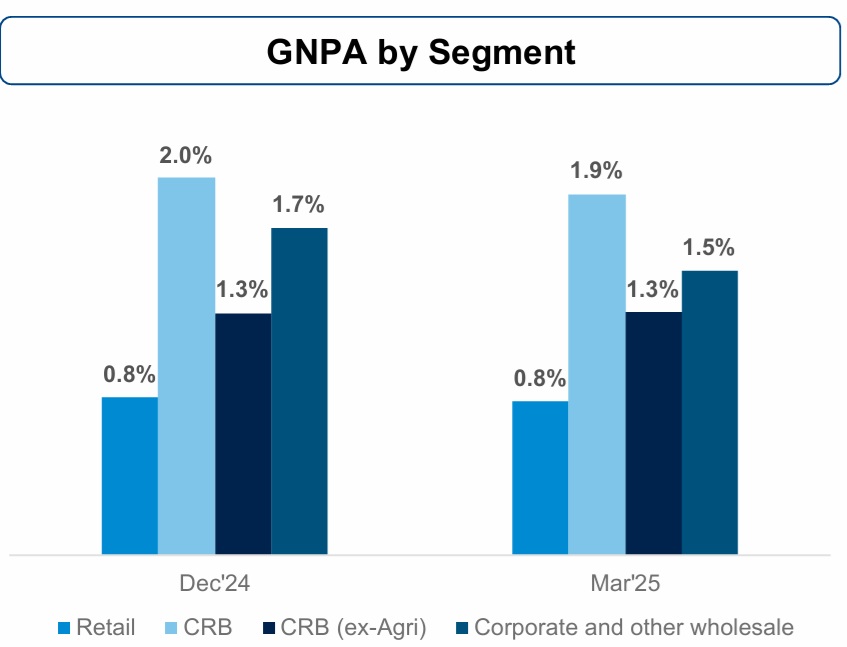

Gross non-performing assets were at 1.33% of gross advances as on March 31, 2025 (1.13% excluding NPAs in the agricultural segment), as against 1.42% as on December 31, 2024 (1.19% excluding NPAs in the agricultural segment), and 1.24% as on March 31, 2024 (1.12% excluding NPAs in the agricultural segment). Net non-performing assets were at 0.43% of net advances as on March 31, 2025.

SUBSIDIARIES

Amongst the Bank’s key subsidiaries, HDFC Life Insurance Company Ltd and HDFC ERGO General Insurance Company Ltd prepare their financial results in accordance with Indian GAAP and other subsidiaries do so in accordance with the notified Indian Accounting Standards ('Ind-AS'). The financial numbers of the subsidiaries mentioned herein below are in accordance with the accounting standards used in their standalone reporting under the applicable GAAP.

HDB Financial Services Ltd (HDBFSL), is a non-deposit taking NBFC in which the Bank holds a 94.3% stake. For the quarter ended March 31, 2025, HDBFSL’s net revenue was at Rs 26.2 billion. Profit after tax for the quarter ended March 31, 2025 was Rs 5.3 billion compared to Rs 6.6 billion for the quarter ended March 31, 2024. Profit after tax for the year ended March 31, 2025 was Rs 21.8 billion. The total loan book was Rs 1,069 billion as on March 31, 2025. Stage 3 loans were at 2.26% of gross loans. Total CAR was at 19.2% with Tier-I CAR at 14.7%.

HDFC Life Insurance Company Ltd (HDFC Life), in which the Bank holds a 50.3% stake, is a leading life insurance solutions provider. Profit after tax for the quarter ended March 31, 2025 was Rs 4.8 billion compared to Rs 4.1 billion for the quarter ended March 31, 2024, a growth of 15.8%. Profit after tax for the year ended March 31, 2025 was Rs 18.0 billion.

HDFC ERGO General Insurance Company Ltd (HDFC ERGO), in which the Bank holds a 50.3% stake, offers a range of general insurance products. Profit after tax for the quarter ended March 31, 2025 was Rs 0.7 billion, as against loss after tax of Rs 1.3 billion for the quarter ended March 31, 2024. Profit after tax for the year ended March 31, 2025 was Rs 5.0 billion.

HDFC Asset Management Company Ltd (HDFC AMC), in which the Bank holds a 52.5% stake, is the Investment Manager to HDFC Mutual Fund, and offers a comprehensive suite of savings and investment products. For the quarter ended March 31, 2025, HDFC AMC’s Quarterly Average Assets Under Management were approximately Rs 7,740 billion. Profit after tax for the quarter ended March 31, 2025 was Rs 6.4 billion compared to Rs 5.4 billion for the quarter ended March 31, 2024, a growth of 18.0%. Profit after tax for the year ended March 31, 2025 was Rs 24.6 billion.

HDFC Securities Ltd (HSL), in which the Bank holds a 94.5% stake, is amongst the leading broking firms. For the quarter ended March 31, 2025, HSL’s total revenue was Rs 7.4 billion. Profit after tax for the quarter ended March 31, 2025 was Rs 2.5 billion, as against Rs 3.2 billion for the quarter ended March 31, 2024. Profit after tax for the year ended March 31, 2025 was Rs 11.3 billion.