Domestic retail loans grew by 108.9%, commercial and rural banking loans grew by 24.6% and corporate and other wholesale loans (excluding non-individual loans of eHDFC Ltd of approximately Rs807 billion) grew by 4.2%

FinTech BizNews Service

Mumbai, April 21, 2024: The Board of Directors of HDFC Bank Limited approved the Bank’s (Indian GAAP) results for the quarter and year ended March 31, 2024, at its meeting held in Mumbai on Saturday, April 20, 2024. The accounts have been subjected to an audit by the statutory auditors of the Bank.

CONSOLIDATED FINANCIAL RESULTS:

The Bank’s consolidated net revenue grew by 133.6% to Rs 807.0 billion for the quarter ended March 31, 2024 from Rs 345.5 billion for the quarter ended March 31, 2023. The consolidated profit after tax for the quarter ended March 31, 2024 was Rs 176.2 billion, up 39.9%, over the quarter ended March 31, 2023. Earnings per share for the quarter ended March 31, 2024 was Rs 23.2 and book value per share as of March 31, 2024 was Rs 600.8. The consolidated profit after tax for the year ended March 31, 2024 was Rs 640.6 billion, up 39.3%, over the year ended March 31, 2023.

STANDALONE FINANCIAL RESULTS:

Profit & Loss Account: Quarter ended March 31, 2024

The Bank’s net revenue grew by 47.3% to Rs 472.4 billion (including transaction gains of Rs 73.4 billion from stake sale in subsidiary HDFC Credila Financial Services Ltd) for the quarter ended March 31, 2024 from Rs 320.8 billion for the quarter ended March 31, 2023. Net interest income (interest earned less interest expended) for the quarter ended March 31, 2024 grew by 24.5% to Rs 290.8 billion from Rs 233.5 billion for the quarter ended March 31, 2023. Core net interest margin was at 3.44% on total assets, and 3.63% based on interest earning assets. Other income (non-interest revenue) for the quarter ended March 31, 2024 was Rs 181.7 billion as against Rs 87.3 billion in the corresponding quarter ended March 31, 2023. The four components of other income for the quarter ended March 31, 2024 were fees & commissions of Rs 79.9 billion (Rs 66.3 billion in the corresponding quarter of the previous year), foreign exchange & derivatives revenue of Rs 11.4 billion (Rs 10.1 billion in the corresponding quarter of the previous year), net trading and mark to market gain of Rs 75.9 billion, including transaction gains of Rs 73.4 billion mentioned above (loss of Rs 0.4 billion in the corresponding quarter of the previous year) and miscellaneous income, including recoveries and dividend of Rs 14.4 billion (Rs 11.3 billion in the corresponding quarter of the previous year). Operating expenses for the quarter ended March 31, 2024 were Rs 179.7 billion, an increase of 33.5% over Rs 134.6 billion during the corresponding quarter of the previous year. Operating expenses for the quarter ended March 31, 2024 included staff ex-gratia provision of Rs 15 billion. The cost-to-income ratio for the quarter was at 38.0%. Excluding certain transaction gains and the ex-gratia provision, cost to income ratio for the quarter was at 41.3%. The credit environment in the economy remains benign, and the Bank's credit performance across all segments continues to remain healthy. The Bank’s GNPA at 1.24% has shown an improvement over the prior quarter. The Bank has considered this as an opportune stage to enhance its floating provisions, which are not specific to any portfolio, but act as a countercyclical buffer for making the balance sheet more resilient, and these also qualify as Tier 2 Capital within the regulatory limits. Therefore, the Bank has made floating provisions of Rs 109.0 billion during the quarter. Provisions and contingencies for the quarter ended March 31, 2024 were Rs 135.1 billion (including the floating provisions of Rs 109.0 billion mentioned above). Provisions and contingencies, excluding the floating provisions, for the quarter ended March 31, 2024 were Rs 26.1 billion as against Rs 26.9 billion for the quarter ended March 31, 2023. The total credit cost ratio (excluding the floating provisions mentioned above) was at 0.42%, as compared to 0.67% for the quarter ending March 31, 2023. Profit before tax (PBT) for the quarter ended March 31, 2024 was at Rs 157.6 billion. Profit after tax (PAT) for the quarter, after certain tax credits, was at Rs 165.1 billion, an increase of 37.1% over the quarter ended March 31, 2023.

Balance Sheet: As of March 31, 2024

Total balance sheet size as of March 31, 2024 was Rs 36,176 billion as against Rs 24,661 billion as of March 31, 2023.

Total Deposits were at Rs 23,798 billion as of March 31, 2024, an increase of 26.4% over March 31, 2023. CASA deposits grew by 8.7% with savings account deposits at Rs 5,987 billion and current account deposits at Rs 3,100 billion. Time deposits were at Rs 14,710 billion, an increase of 40.4% over the corresponding quarter of the previous year, resulting in CASA deposits comprising 38.2% of total deposits as of March 31, 2024. Gross advances were at Rs 25,078 billion as of March 31, 2024, an increase of 55.4% over March 31, 2023. Grossing up for transfers through inter-bank participation certificates and bills rediscounted, advances grew by 53.8% over March 31, 2023. Domestic retail loans grew by 108.9%, commercial and rural banking loans grew by 24.6% and corporate and other wholesale loans (excluding non-individual loans of eHDFC Ltd of approximately Rs 807 billion) grew by 4.2%. Overseas advances constituted 1.5% of total advances.

Year ended March 31, 2024 For the year ended March 31, 2024,

The Bank earned net revenues (net interest income plus other income) of Rs 1,577.7 billion, as against Rs 1,180.6 billion for the year ended March 31, 2023. Net interest income for the year ended March 31, 2024, crossed Rs 1 trillion and was Rs 1,085.3 billion, up 25.0%, over the year ended March 31, 2023. Profit after tax for the year ended March 31, 2024 was Rs 608.1 billion, up by 37.9% over the year ended March 31, 2023.

Capital Adequacy:

The Bank’s total Capital Adequacy Ratio (CAR) as per Basel III guidelines was at 18.8% as on March 31, 2024 (19.3% as on March 31, 2023) as against a regulatory requirement of 11.7%. Tier 1 CAR was at 16.8% and Common Equity Tier 1 Capital ratio was at 16.3% as of March 31, 2024. Risk-weighted Assets were at Rs 24,680 billion.

DIVIDEND

The Board of Directors recommended a dividend of Rs 19.5 per equity share of Rs 1 for the year ended March 31, 2024. This would be subject to approval by the shareholders at the next annual general meeting.

NETWORK

As of March 31, 2024, the Bank’s distribution network was at 8,738 branches and 20,938 ATMs across 4,065 cities / towns as against 7,821 branches and 19,727 ATMs across 3,811 cities / towns as of March 31, 2023. 52% of our branches are in semi-urban and rural areas. In addition, we have 15,182 business correspondents, which are primarily manned by Common Service Centres (CSC). The number of employees were at 2,13,527 as of March 31, 2024 (as against 1,73,222 as of March 31, 2023).

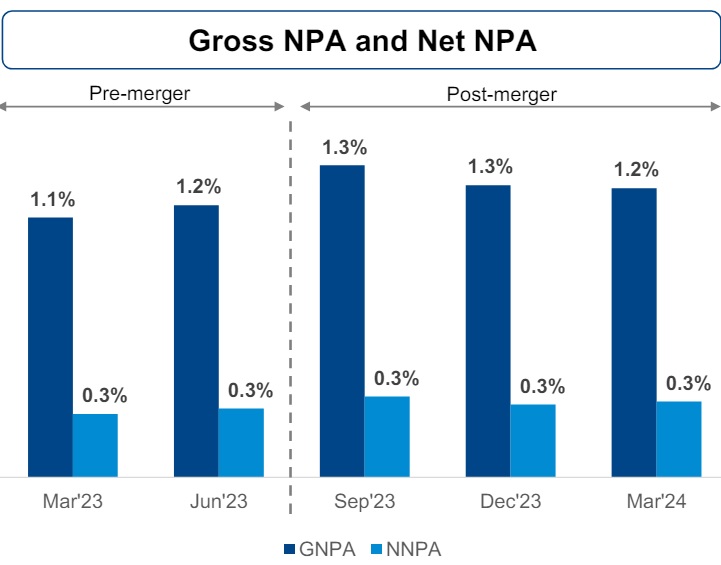

ASSET QUALITY

Gross non-performing assets were at 1.24% of gross advances as on March 31, 2024, as against 1.26% as on December 31, 2023, and 1.12% as on March 31, 2023. Net nonperforming assets were at 0.33% of net advances as on March 31, 2024.

Note: The figures for the period ended March 31, 2024 include the operations of erstwhile HDFC Ltd which amalgamated with and into HDFC Bank on July 01, 2023 and hence the comparisons with the previous periods have to be looked at in light of the same.