FY25 real GDP growth expected at 7.1% YoY

Indranil Pan & Deepthi Mathew,

Economics Knowledge Banking,

YES Bank

Mumbai, May 31, 2024: India’s real GDP rose 7.8% YoY in Q4FY24 (Q3FY24: upwardly revised 8.6% YoY), while real GVA was up by 6.3% YoY (Q3FY24: 6.8% YoY). Though some moderation was visible, manufacturing sector grew by 8.9% YoY whereas services sector grew by 6.7% YoY. On the expenditure side, private consumption rose by 4.0% YoY, with its share in GDP coming lower at 52.9%. Gross fixed capital formation registered a growth of 6.5% YoY. We do expect growth to moderate in the coming quarters on account of lagged impact of monetary policy tightening, moderation in global growth, continuing geopolitical tensions and rising geo-economic fragmentation risks.

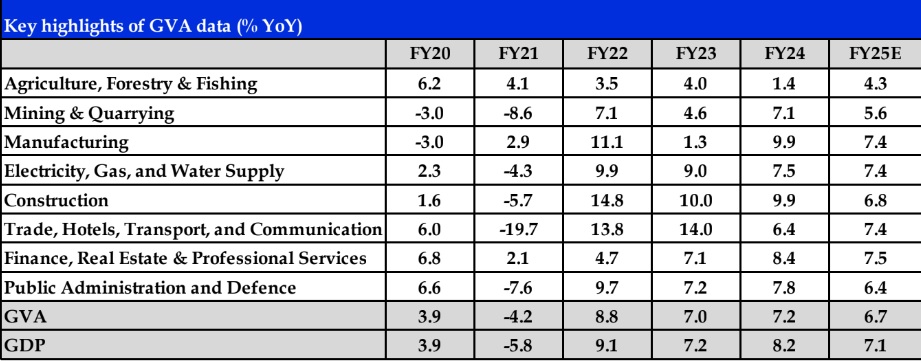

Correspondingly, we expect FY25 real GDP growth at 7.1% YoY (earlier 6.9% YoY). GVA growth moderates to 6.3% vs 6.8% in Q3FY24: India’s GVA grew by 6.3% YoY, with the industry sector registering a growth of 8.4% YoY. Within the industry sector, manufacturing grew by 8.9% YoY (11.5% YoY in Q3FY24) whereas ‘mining’ and ‘electricity, gas & water supply’ grew by 4.3% YoY and 7.7% YoY, respectively. The construction sector grew by 8.7% YoY corroborating the strong growth seen in steel production (7.8% YoY) and cement production (8.4% YoY). The agriculture sector grew by 0.6% YoY vs 0.4% YoY in Q3FY24. As per the second advanced estimates, rabi food grain production for crop year 2023-24 is estimated at 155.2 million mt compared to 158 million mt last year.

Services sector growth moderates on a YoY basis:

Services sector grew by 6.7% YoY in Q4FY24 vs 7.1% YoY Q2FY24. On a QoQ basis, the services sector grew by 5.3% vs (-) 5.9% YoY in Q3FY24.Contact intensive services, in particular trade, hotels, transport and communications sector registered a growth of 5.1% YoY vs 6.9% YoY in the previous quarter. On a QoQ basis, it grew by 10.7%. Financial services and real estate grew by 7.6% YoY in Q4FY24 and by 2.7% on a QoQ basis. Public administration & defense grew by 7.8% YoY (1.5% QoQ).

Private consumption remains steady in Q4FY24:

Both on a YoY and QoQ basis, India’s GDP grew by 7.8%. Private consumption expenditure grew by 4.0% YoY (4.0% in Q3FY24) while on a sequential basis it de-grew by 2.9%. The share of private consumption came to 52.9%, lowest in the series. Government consumption grew by 0.9% YoY. Gross Fixed Capital Formation (GFCF) or the investment demand in the economy expanded by 6.5% YoY (9.7% YoY in Q3FY24), accounting for a share of 33.2% in GDP.Net exports reported a surplus of INR 645 bn vs (-) INR 802 bn in Q3FY24.

Exports of goods and services grew by 8.1% YoY whereas imports of goods and services grew by 8.3% YoY. Net taxes grew by 22.2% YoY indicative of the higher tax collection and lower subsidy outgo in Q4FY24.

FY25 GDP growth expected at 7.1%:

A higher-than-expected Q4FY24 GDP print (Q3FY24 was revised higher to 8.6%) resulted in FY24 GDP growth at 8.2%. In today’s print also, the higher growth in the net taxes widened the gap between GDP and GVA. The GVA for Q4FY24 came at 6.3% with some moderation seen in manufacturing and services sector growth. We expect the moderation in the manufacturing sector to continue given the uptick in commodity prices translating to a higher input cost. As per the PMI data, manufacturing sector is witnessing an uptick in the input prices but the same is not visible in the output prices. This eventually could put pressure on the margin growth of the companies. The forecast for an above normal SW monsoon bodes well for the agricultural sector and rural economy. Even though SW monsoon arrived on time,

its spatial and temporal distribution need to be closely monitored. Going forward, we see growth to moderate in FY25 compared to FY24. The specific factors that could lead to the moderation are: (a) lagged impact of monetary policy percolating through the system as the reflection of the 250bps increase in the repo rate is still not seen in the lending rates on fresh loans; RBI expected to keep rates ‘higher for longer’, (b) slower personal loan growth due to an increase in risk weight for some segments, (c) reduction

in the pace of government spending, (d) continuing geopolitical and geoeconomic fragmentation risks to weigh on the trade sector, (e) risks of growth moderation in AEs.

In FY25, we expect the gap between GDP and GVA to narrow with the net taxes growth normalizing in the coming quarters. Factoring in all the above, we expect GDP growth for FY25 at 7.1% (earlier 6.9%) and GVA growth is estimated at 6.7%.

(Disclaimer: Information gathered and material used in this document is believed to have been obtained from reliable sources. However, YES Bank makes no warranty, representation or undertaking whether expressed or implied, with respect that such information is being accurate, complete or up to date, nor does it assume any legal liability, whether direct or indirect or responsibility for the accuracy, completeness or usefulness of any information in this document. YES Bank takes no responsibility for the contents of those external data sources or such third party references. No third party will assume and direct or indirect liability, whose references have been provided in this document. It is the responsibility of the user of this document to make its/his/her own decisions or discretion about the accuracy, currency, reliability and correctness of information found in this document.)