Net Interest Margin for Q4 of FY24 stood at 4.26% against 4.28% for Q4 of FY 23 and 4.29% for Q3 of FY24

FinTech BizNews Service

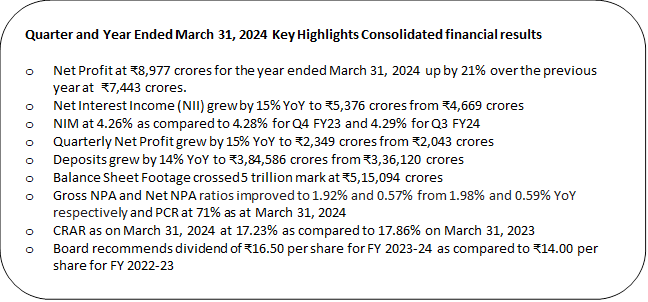

Mumbai, April 25, 2024: The Board of Directors of IndusInd Bank Limited approved the financial results of the Bank for the Quarter/ Year ended March 31, 2024, at their meeting held in Mumbai on Thursday, April 25, 2024.

NIM at 4.26%, Net NPA at 0.57%, Provision Coverage Ratio at 71%, Capital Adequacy Ratio (CRAR) at 17.23%, CASA at 38% and Liquidity Coverage Ratio at 118% underscore the strength of operating performance of the Bank and adequacy of capital.

CONSOLIDATED FINANCIAL RESULTS

The Bank’s financial results include the financial results of its wholly owned subsidiary, Bharat Financial Inclusion Limited (BFIL), a business correspondent (BC) of the Bank involved in originating small ticket MFI loans for the Bank and IndusInd Marketing and Financial Services Private Limited (IMFS), an associate of the Bank.

Profit & Loss Account for the Quarter ended March 31, 2024

Net Interest Income for the quarter ended March 31, 2024 at Rs5,376 crores, grew by 15% YoY and 2% QoQ. Net Interest Margin for Q4 of FY24 stood at 4.26% against 4.28% for Q4 of FY 23 and 4.29% for Q3 of FY24.

Other income at Rs2,508 crores for the quarter ended March 31,2024 as against Rs2,154 crores for the corresponding quarter of previous year, grew by 16% YoY. Core Fee grew by 10% YoY to Rs2,293 crores as against Rs2,087 crores for the corresponding quarter of previous year.

Operating expenses for the quarter ended March 31, 2024 were Rs3,803 crores as against Rs3,066 crores for the corresponding quarter of previous year, increased by 24%.

Pre Provision Operating Profit (PPOP) at Rs4,082 crores for the quarter ended March 31, 2024 registered a growth of 9% over the corresponding quarter of previous year at Rs3,758 crores. PPOP/Average Advances ratio for the quarter ended March 31, 2024 at 5.10%.

Net Profit for the quarter ended March 31, 2024 was Rs2,349 crores as compared to Rs2,043 crores during corresponding quarter of previous year up by 15% YoY.

Yield on Assets stands at 9.85% for the quarter ended March 31, 2024 as against 9.20% for the corresponding quarter of previous year. Cost of Fund stands at 5.59% as against 4.92% for corresponding quarter of previous year.

Profit & Loss Account for year ended March 31, 2024

Net Interest Income for the year ended March 31, 2024 increased to Rs20,616 crores, up by 17% from Rs17,592 crores previous year.

Fee income at Rs9,396 crores for the year ended March 31, 2024 over the previous year at Rs8,173 crores.

For the year ended March 31, 2024, the Bank earned Total Income (Interest Income and Fee Income) of Rs55,144 crores as compared to Rs44,541 crores for the previous year.

Operating expenses for the year ended March 31, 2024 were Rs14,148 crores as against Rs11,346 crores for the previous year.

Pre Provision Operating Profit (PPOP) at 15,864 crores for the year ended March 31, 2024 over the previous year at Rs14,419 crores.

Net Profit at Rs8,977 crores for the year ended March 31, 2024 up by 21% over the previous year at Rs7,443 crores.

Balance Sheet as of March 31, 2024

Balance sheet footage crosses 5 trillion mark as on March 31, 2024 was at Rs5,15,094 crores as against Rs4,57,837 crores as on March 31, 2023, marking growth of 13%.

Deposits as on March 31, 2024 were Rs3,84,586 crores as against Rs3,36,120 crores, an increase of 14% over March 31, 2023. CASA deposits increased to Rs1,45,666 crores with Current Account deposits at Rs46,989 crores and Savings Account deposits at Rs98,676 crores. CASA deposits comprised 38% of total deposits as at March 31, 2024.

Advances as of March 31, 2024 were Rs3,43,298 crores as against Rs2,89,924 crores, an increase of 18% over March 31, 2023.

ASSET QUALITY

The loan book quality remains stable. Gross NPA were at 1.92% of gross advances as on

March 31, 2024 as against 1.98% as on December 31, 2023. Net NPA were 0.57% of net advances as on March 31, 2024 as compared to 0.59% as on December 31, 2023.

The Provision Coverage Ratio was consistent at 71% as at March 31, 2024. Provisions and contingencies for the quarter ended March 31, 2024 were Rs3,885 crores as compared to Rs4,487 crores for the corresponding quarter of previous year, reduced by 13% YoY. Total loan related provisions as on March 31, 2024 were at Rs7,210 crores (2.1% of loan book).

CAPITAL ADEQUACY

The Bank’s Total Capital Adequacy Ratio as per Basel III guidelines stands at 17.23% as on March 31, 2024, as compared to 17.86% as on March 31, 2023. Tier 1 CRAR was at 15.82% as on March 31, 2024 compared to 16.37% as on March 31, 2023. Risk-Weighted Assets were at Rs3,83,660 crores as against Rs 3,37,036 crores a year ago.

NETWORK

As of March 31, 2024, the Bank’s distribution network included 2984 branches/ Banking outlets and 2956 onsite and offsite ATMs, as against 2606 Branches/ Banking outlets and 2878 onsite and offsite ATMs as of March 31, 2023. The client base stood at approx. 39 million as on March 31, 2024.

Commenting on the performance, Mr. Sumant Kathpalia, Managing Director & CEO, IndusInd Bank, said, "IndusInd Bank completed yet another year with robust financial performance. I am proud that the bank achieved two important milestones of completing 30 years of operations and balance sheet crossing Rs5,00,000 crores. Financial Year 2023-24 saw a healthy loan growth of 18% supported by a deposit growth of 14%. The asset quality remains healthy with stable NNPAs of 0.57%. The bank delivered annual profit of Rs8,977 crores for the year growing 21% YoY. As the Indian economy continues to be a bright spot amongst major economies, I am confident that the bank should continue to progress on its journey of Growth, Granularity and Governance."