Sensex is trading higher today

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, April 8, 2024: US labour market is showing signs of resilience with non-farm payrolls for Mar’24 at 303k, much higher than est.: 214k and 270k in Feb’24. Unemployment rate also inched down, to 3.8% in Mar’24 from 3.9%. Average hourly earnings rose by 0.3% (MoM) from 0.2% in Feb’24. This has pushed the probability of a rate cut by Fed in Jun’24 to 54% from 59% before the data was released. Sustained increase in wage growth, along with higher prices of commodities (oil, copper) may add to pressure on inflation. Added labour expenses is impacting the services sector in the US, as the ISM PMI moderated to 51.4 in Mar’24 from 52.6 in Feb’24. This was dragged by dip in new orders and imports. Domestically, RBI maintained status quo in its policy. Quarterly projections of GDP and inflation were changed, with growth now estimated to be higher and inflation projected to be lower in Q1FY25.

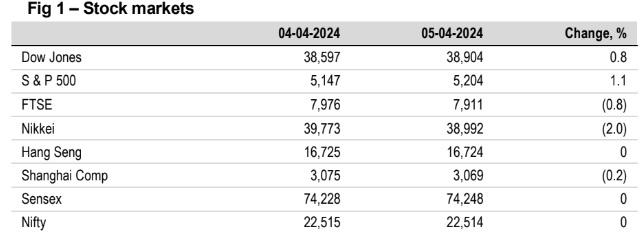

§ Global stocks ended mixed as investors assessed the US jobs report. Hopes of a rate cut in Jun’24 diminished as payroll additions were higher than expected. Even so, stocks in US edged up, led by a rally in tech stocks. Nikkei fell sharply, as BoJ hinted at more rate hikes. Sensex ended marginally weaker after the RBI policy announcement. It is trading higher today, in line with other Asian stocks.

Except INR, other global currencies ended weaker against the dollar. DXY rose by 0.2% as a stronger than expected jobs report in the US has once again jeopardized expectations of rate cuts. JPY depreciated the most by 0.2%, even as Japanese government cautioned against increased volatility in the exchange rate. INR is trading stronger today, while Asian peers are trading mixed.

Global yields broadly closed higher as US labour market remains strong. US 10Y yield jumped the most, by 9bps, followed by UK and Germany. Odds of rate cut by Fed in Jun’24 have reduced to 54% from 59% earlier. Tracking global cues, rise in oil prices, and RBI’s policy decision, India’s 10Y yield rose by 3bps. It is trading further higher today, at 7.14%.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)