Policy rate outcome should not cloud sector thesis; The sharp drop in the INR vs the USD in the last few days perhaps only persuade further in favour of policy caution.

FinTech BizNews Service

Mumbai, 4 December 2025: BNP Paribas India has released the India Banks and Diversified Financials Report wherein Mr. Santanu Chakrabarti, Analyst – Banking and Finance, has shared his views in detail:

We don’t expect a rate cut, unlike the consensus:

The consensus is building a 25bps rate cut in the upcoming MPC announcement on 5th Dec 2025. Most of the fundamental data points support this prognosis given low inflation that even on consensus-expected end FY26 rebound, stays well within RBI’s comfort zone. However, we are yet to change our base case assumption of no rate cut in December. Our contention has been that given external account uncertainties (in both current and capital accounts), sensitivity against INR depreciation might become the decisive policy motivator. A stable GDP growth print and outlook further add to our inkling that the recent fiscal incentives, liquidity support and credit policy will remain the favoured tools of economic accommodation. The sharp drop in the INR vs the USD in the last few days perhaps only persuade further in favour of policy caution.

Either way, impact is small on bank earnings:

Whether or not our estimated rate-cut pause pans out or the widely expected cut materialises, the impact on FY26/27E earnings of our coverage should be range bound. If it does materialise in 3Q, a 25bps cut reduces full-year FY26E bank earnings by c2-3% for our coverage, while adding 1-2% to FY27E. Ergo, our thesis of a strong FY27 earnings-growth outlook for our preferred banks holds up.

For large private banks, earnings growth will start improving materially from 3QFY26

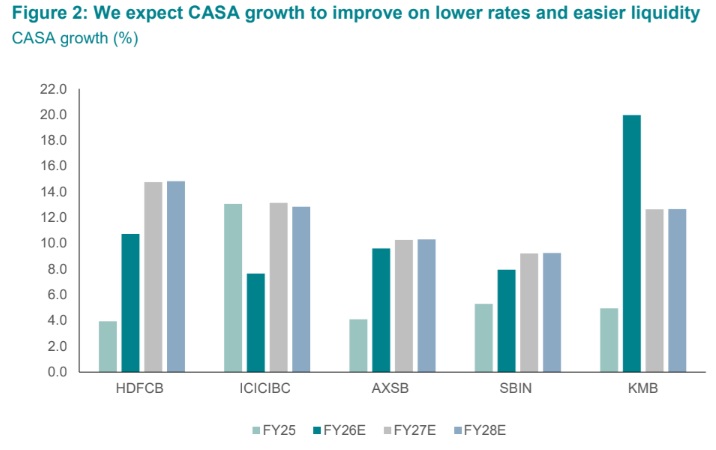

We continue to expect some incremental momentum on credit growth (above consensus expectation of 13% from system in FY26). Given our current assumption of no further rate cuts, the margin impact of loan yield drops should be largely over in 1HFY26. Gradual tailwinds will continue from ongoing transmission on deposit costs and a likely CASA support from (i) the reduction in SA and TD rate gap; and (ii) CA tailwinds from greater credit availability/money market liquidity for businesses, incentivising them to shorten working capital cycles. This implies that, for large private banks, earnings growth will start improving materially from 3QFY26 with double digit FY26 exit earnings growth for our preferred large private banks (HDFC, ICICI, Axis – in that order).