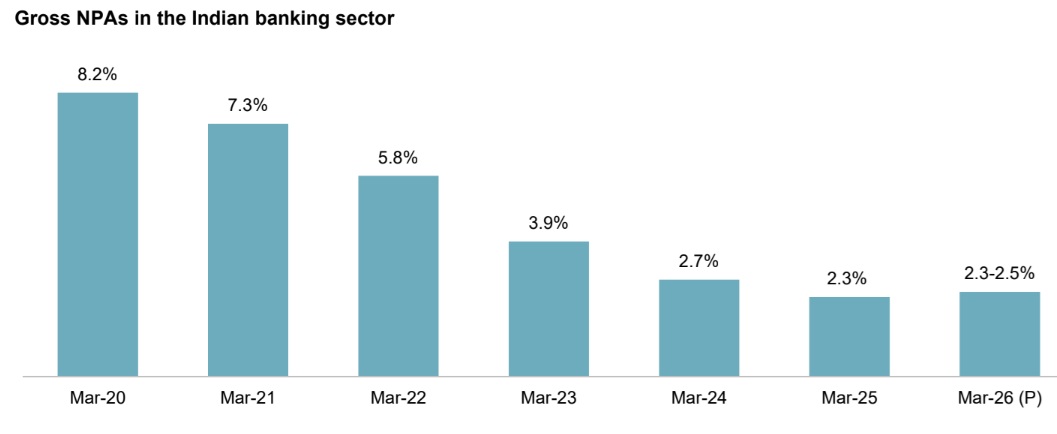

Bank Gross NPA To Remain Controlled At 2.3-2.5%

FinTech BizNews Service

Mumbai, October 6, 2025: Gross non-performing assets (NPAs) of the banking sector have likely bottomed out and should remain in the 2.3-2.5% range by March 31, 2026 (see chart in annexure), close to the historical low of 2.3% as on March 31, 2025.

Asset quality of corporate credit, the largest segment, is foreseen stable. However, NPAs in the MSME[1] segment may inch up, primarily in the export-oriented sectors. The impact of seasoning following high growth in recent years could be another reason for this. On the retail front, delinquencies in the unsecured segment remain under watch.

Gross NPAs in the MSME segment (17% of overall bank credit[2]) have declined secularly in recent years, to 3.6% as on March 31, 2025, from 8.7% as on March 31, 2021. Government schemes such as the Credit Guarantee Fund for Micro Units (CGFMU) and Emergency Credit Line Guarantee Scheme (ECLGS) have supported asset quality. Further, some part of the decline is because of bank write-offs.

Increasing formalisation of the MSME sector in the recent years has improved data availability, helping banks refine their underwriting, credit decisioning and monitoring processes.

This is evident in the controlled level of Special Mention Accounts-2 (SMA-2)[3] at 0.8% as of March 31, 2025, compared with ~1.2% as on March 31, 2024. However, it is pertinent to note that in the past, periods of rapid MSME growth have inevitably led to higher NPAs in the later years.

Says Subha Sri Narayanan, Director, Crisil Ratings, “This fiscal, we see NPAs in the MSME sector increasing moderately to 3.7-3.9%. This is primarily due to the recent, steep hike in tariffs announced by the US, which affects export-oriented MSME sub-segments such as textiles, garments and carpets, gems and jewellery, shrimp and processed seafoods and certain segments of the chemicals sector. The organic seasoning of the portfolio, which has seen a higher-than-system compound annual growth rate (CAGR) of ~16%[4] in the past three fiscals, will also contribute to the uptick in the NPAs.”

In the corporate portfolio (38% of bank credit), gross NPAs should remain steady at 1.4-1.5% as of March 31, 2026, given strong corporate balance sheets that provide a cushion against uncertainties.

For this fiscal, we estimate gearing at 0.4-0.5[5] time and interest cover at 5.2-5.3 times in our rated portfolio.

In the retail portfolio (33% of bank credit), gross NPAs held steady at 1.2% as on March 31, 2025. Over half of the retail book comprises housing loans and this segment has exhibited healthy asset quality through economic cycles.

However, the unsecured loan portfolio—accounting for 25% of overall retail portfolio—bears watching. Banks have adopted an aggressive write-off policy in this sub-segment. While slippages were elevated during the fiscal (>2 times the opening gross NPA), high write-offs (~50% of opening gross NPA + slippages) resulted in only a modest uptick in gross NPAs to 1.8% as of March 31, 2025, from 1.5% a year earlier.

Says Vani Ojasvi, Associate Director, Crisil Ratings, “Retail gross NPAs should remain at ~1.2% as of March 31, 2026, as well, driven by the steady performance of secured asset classes such as housing. In the unsecured portfolio, banks have taken corrective actions due to which the newer vintages are performing better. However, the overall SMA[7] ratio for unsecured loans remained elevated at 7.4% as of March 31, 2025, just as in March 31, 2024. The performance of this segment bears watching. While reported gross NPA may remain controlled due to write-offs, the impact of any continued higher slippages will be seen in credit costs”

All in all, asset quality trends for the banking sector should be benign even as gross NPA is expected to have bottomed out.

The impact of lingering global uncertainties on the domestic economy remains monitorable. The leverage levels of retail borrowers, especially on the unsecured side, will also bear watching.