Global markets monitored Fed Chair's speech which hinted at delayed start to the rate cut cycle, probably later this year

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, March 7, 2024: Global markets monitored Fed Chair’s speech which hinted at delayed start to the rate cut cycle, probably later this year. However, Fed Chair’s comments that inflation has eased has provided some degree of comfort. Added to this was the less than expected change in private payroll number. Even wages increased at the slowest pace in more than two years. All this led DXY and US 10Y yield close lower. On macro front, trade data in Germany showed some momentum with both exports and imports picking up on seasonally adjusted sequential basis. Even in China, exports picked up for the first two months of CY24. Elsewhere, in Japan, wage data firmed up, raising hopes of a pivot from BoJ. On domestic front, RBI governor reiterated its focus on bringing inflation to the targeted 4% level.

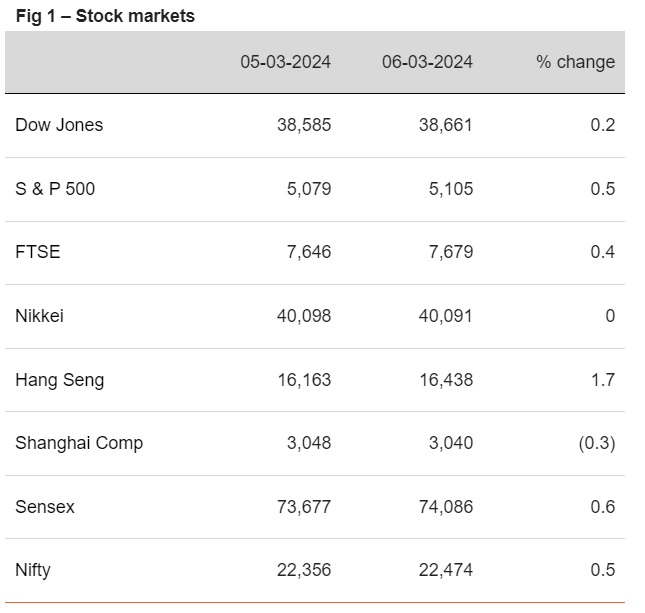

Except China and Japan, stocks elsewhere closed stronger as Fed Chair acknowledged the possibility of rate cuts this year. This came on the heels of data showing weakening momentum in the US labour market. FTSE rose after UK’s budget announcements. Sensex rose to a fresh record-high led by a rally in banking and technology shares. It is trading further stronger today, in line with other Asian stocks.

Global yields closed mixed. 10Y yields in US and UK moderated. This was followed by less than hawkish comments of Fed Chair and also supported by softening macro data in the US. In UK, investors assessed the budget statement. India’s 10Y yield closed stable. It is trading at 7.05% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)