In India, equity indices started the new fiscal year on a positive note with the Sensex rising by 0.5%

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, April 2, 2024: US ISM manufacturing index rose to 50.3 in Mar’24, defying expectation of 48.3. The input cost of manufacturers also firmed up with prices paid index rising to 55.8 from previous month’s level of 52.8. This has again led to some bit of repricing about future course of Fed rate. Fed Chair also reiterated that there is no rush for a pivot and is contingent on the evolution of growth-inflation matrix. Elsewhere, investors monitored comments of China’s President which urged PBOC to go in for bond buying and selling operation to regulate liquidity. In Japan, weakness in Yen again spurred speculation of an intervention by BoJ. On domestic front, GST collections reached second highest record collection of Rs 1.78 lakh crore in Mar’24.

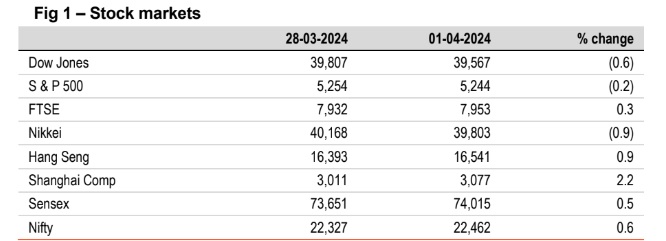

§ Global equity markets ended mixed. Stocks in US ended lower as strong PMI data dented expectations of a Jun’24 rate cut by the Fed. On the other hand, stocks in China and Hong Kong rose sharply buoyed by improvement in China’s official PMIs. In India, equity indices started the new fiscal year on a positive note with the Sensex rising by 0.5%. Gains were led by real estate and metal sectors. It is however trading weaker today, while other Asian stocks are higher.

Global currencies ended broadly weaker against the dollar. DXY rose by 0.5% as manufacturing activity in the US expanded for the first time since Sep’22. JPY continued to trail near a 34-year low with the government citing the currency’s move as “speculative”. CNY depreciated despite a pickup in both manufacturing and non-manufacturing PMI. INR is trading a tad stronger today, while other Asian currencies are trading mixed.

Except UK (stable) and India (tad lower), global yields closed higher. US 10Y yield rose at the sharpest pace by 11bps as ISM manufacturing index rose unexpectedly in Mar’24. 10Y yield in Germany, Japan and China remained range bound in absence of fresh cues. India’s 10Y yield got comfort from a lower-than-expected H1 borrowing. It is trading at 7.08% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)