Through Legal Periscope... How the US Supreme Court verdict reads between-the-lines; The court has referred the case back to the CIT for determining the scope and extent of the EXCESS tariff collected, lying at the center of the arbitration proceed

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India

Mumbai, 21 February 2026: Unscrapping of the tariff structure by the Court(s) can upend uncertainty going forward while jurisdictions need to put in place counter intuitive negotiation to position themselves strategically in the intermittent period where ultimate power lies with a delicately balanced US Congress ... the convergence between inter-sovereign treaties and juristic persons on effective tariff structure can be a melee if not a mess...

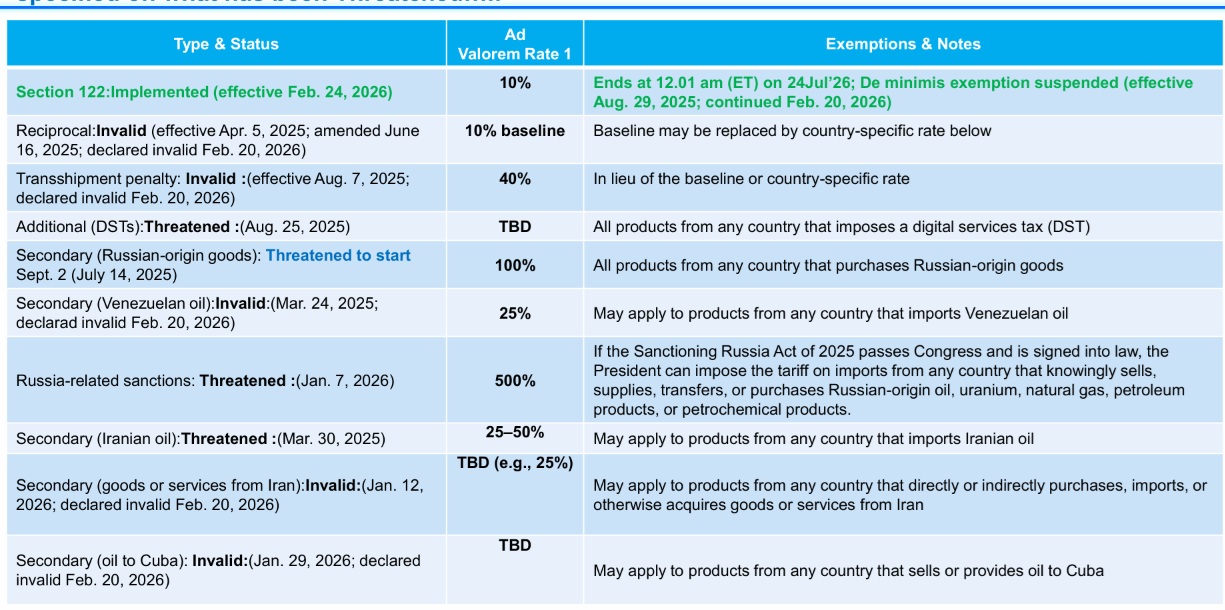

US has now imposed 10% Tariff On all Imports

❑ On February 20, 2026, the US Supreme Court issued a landmark decision that invalidated the POTUS/Administration’s use of imposing tariffs under the International Emergency Economic Powers Act (IEEPA), 1977. The act had never before been used by a President to impose tariffs and does not find much footing in peacetime….

❑ However, the executive has quickly invoked Section 122 of the 1974 Trade Act to impose new 10% global tariff on all imports to US for 150 days (note: this will be the first time Section 122 authority has ever been used). This temporary measure will start from 24 Feb 2026 and ends in July should the Congress not ratify the imposition

❑ Under the trade Act, President can impose temporary import surcharges (up to 15%) or quotas to fix US balance of payment issues. It lasts up to 150 days max, unless Congress extends via legislation

❑ The new 10% tariff has exemptions, including goods from Canada and Mexico that comply with the USMCA, as well as specific, already-in-place national security tariffs

❑ It is expected that during this time, the Administration would complete investigations and levy tariffs using Section 301 and Section 232

Through Legal Periscope… How the Supreme Court verdict reads between-the-lines…

A detailed reading of the US Supreme Court verdict (6-3) reveals caution intertwined and woven delicately (and, deliberately) in the order, both for and against….

❑ The Ld. Judges painstakingly note the ‘originalism’ inherent in the Constitution; The Framers gave “Congress alone” the power to impose tariffs during peacetime….. “The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises.” (Article I, Section 8, of the US Constitution)

❑ The Government thus concedes, as it must, that the President enjoys no inherent authority to impose tariffs during peacetime….. Accordingly, the President must “point to clear congressional authorization” to justify his extraordinary assertion of that power…

❑ The power to tax was, Alexander Hamilton explained, “the most important of the authorities proposed to be conferred upon the Union.” It is both a “power to destroy,” and a power “necessary to the existence and prosperity of a nation”—“the one great power upon which the whole national fabric is based…..That “ ‘lack of historical precedent,’ coupled with the breadth of authority” that the President now claims, suggests that the tariffs extend beyond the President’s “legitimate reach.”

❑ The dissenting order from Ld. Justice KAVANAUGH, J. concludes…. “The tariffs at issue here may or may not be wise policy. But as a matter of text, history, and precedent, they are clearly lawful. I respectfully dissent.” …..That said, with respect to tariffs in particular, the Court’s decision might not prevent President from imposing most if not all of these same sorts of tariffs under other statutory authorities…

Further, “A second issue is the decision’s effect on the current trade deals. Because IEEPA tariffs have helped facilitate trade deals worth trillions of dollars—including with foreign nations from China to the United Kingdom to Japan, the Court’s decision could generate uncertainty regarding various trade agreements. That could be difficult.”

❑ The gist of the divided ruling is that the POTUS/ The Executive branch does not have the inherent powers to impose taxation on imports under IEEPA in peace time and lot of rulings from the past have been quoted to buttress this line through prior cases like Biden v. Nebraska, West Virginia v. EPA, National Federation of Independent Business v. OSHA where the court earlier refused to read (executive) authorization as intended…. That could deter the Executive from embarking on a steep tariff led rolling stone gathering revenue but susceptible to refund

❑ But the dissenting judgements point to statutes like the Section 122 of the Trade Act of 1974, Section 201 of the Trade Act of 1974 and Section 301 of the Trade Act of 1974 that offer alternative solutions to the Executive to impose tariff…Clearly, the tug-of-war and the implications of tariff on the national exchequer, apart from its weaponization as a sentimental issue would ensure that it keeps on resurfacing in one form or the other, alleviating the grounds of friction and fissures impacting global trust, supply chains and trade dynamics

New Tariff for all Countries: Invalid implies Supreme Court has scrapped.. Supreme Court has not specified on what has been Threatened…..

Way to 10 %....the back-up Plan

The Section 232 of The US Trade Expansion Act 1962 are levied on specific sectors, rather comprehensively ❑Indian cos, as also the world, face Sec 232 tariffs on steel and aluminum, automobiles, copper etc as the section has not been scrapped

❑It will be intriguing to watch how the trade deals amongst multiple sovereigns are interpreted at private, independent legal, artificial, or "juristic" persons end (i.e. the firms who filed the case and won a favorable judgement for refund and scrapping of the tariff structure) and how the shifting sands of the bilateral relations add or abate the landscape

Refund of Excess Tariffs can be a painful pathway but can be a Reality Check too!

The court has also referred the case back to the CIT for determining the scope and extent of the EXCESS tariff collected, lying at the centre of the arbitration proceed

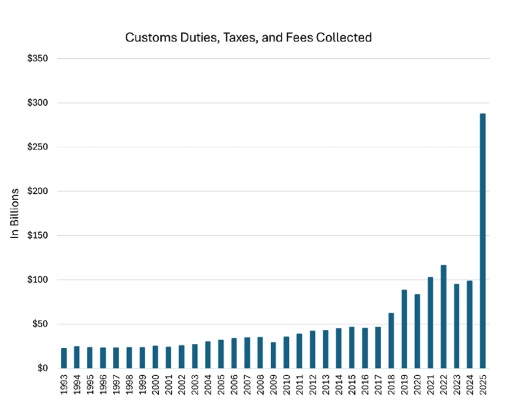

❑ Basis latest estimates, the proceeds collected from various jurisdictions range from $160-175 Bn basis Penn-Wharton estimates (Chinese companies have paid the highest likely) and the refund could be a ‘mess’ but it would also be a psychological deterrent in imposition of future tariff structure

❑ Since the case has been filed by the firms impacted, and not by individual sovereigns/jurisdictions, the order’s impact can have an overarching effect over the various trade treaties the US has entered with countries, bringing the effective tax rate to 10%+MFN rate now