Monetary Policy: By the Temperament or by the Tie? Everything on a lighter note...To be taken with a pinch of sugar

FinTech BizNews Service

Mumbai, July 4, 2025: The State Bank of India’s Economic Research Department has come out with a Research Report, which has been authored by Dr. Soumya Kanti Ghosh, Member, 16th Finance Commission & Group Chief Economic Adviser, State Bank of India.

The Monetary Multiverse

(In an alternate universe, monetary policy isn’t just data-driven — it’s fashion-fueled, text-mined and trend-sensitive. Welcome to a world where the color of a necktie, the tone of a speech and the public engagement shape the future of interest rates)

Everything on a lighter note...To be taken with a pinch of sugar

Monetary policy... By the Temperament or by the Tie?

Imagine a world where interest rates aren’t determined by models, mandates or macroeconomic indicators—but by midnight tweets, personal equations and possibly necktie colors

What if Donald Trump, instead of Jerome Powell, had chaired the Federal Reserve—changing rates not in response to inflation, growth or output gaps, but primarily in reaction to stock market slumps or headlines he didn’t

like?

In this alternate universe, monetary easing is less of a policy stance and more a reflex.....

Chairs Swapped... Imagine Trump takes the Fed seat....

Closer to home, we also ask: Can monetary policy be predicted by something more subtle like the color of the RBI Governor’s necktie??

Personality Switch – Trump is now Powell....

In this alternate monetary multiverse, Donald Trump now commands the Fed

“What would the Fed Funds Rate look like if the Chair had a campaign slogan instead of a neutral stance?”

Trump vs Powell Interest Rate Policy Simulation... Scenario-1

❑ We construct a counterfactual interest rate path to evaluate how monetary policy might have differed if President Donald Trump had personally directed interest rate decisions in place of Federal Reserve Chair Jerome Powell

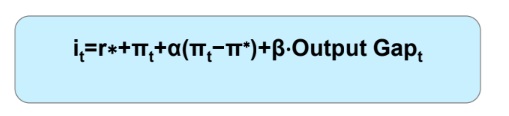

❑ Drawing on President Trump's well-documented preference for lower interest rates—expressed through numerous public statements, tweets, and press briefings—we simulate a "Trump-style" monetary policy using a modified version of the Taylor Rule. While the standard Taylor Rule is defined as:

Trump vs Powell Interest Rate Policy Simulation

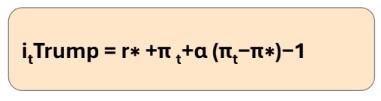

❑ We adjust the specification to reflect Trump's approach by

(i) Setting a lower neutral real rate r∗ of 0.25%, reflecting post-crisis natural rate estimates

(Laubach & Williams, 2015)

(ii) Reducing the inflation and output gap responsiveness by setting α=0.10 and eliminating

the output gap term (β=0)

(iii) Subtracting an additional 100 basis points (−1%) to capture Trump’s repeated calls for lower rates even during economic expansions as Trump had said on June 7’25 that the Fed has been too slow to lower borrowing costs and US Fed should cut rates by a full percentage point....

This gives us Trump adjusted Tylor’s rule formula given as

Trump vs Powell Interest Rate Policy Simulation:

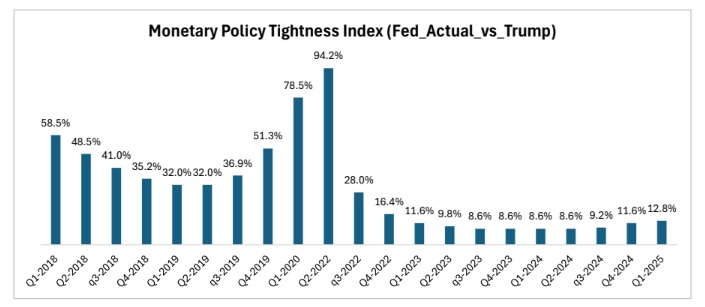

❑ We compare this simulated rate path with the actual Federal Funds Rate by constructing a Monetary Policy Tightness Index defined as

It measures the relative policy divergence over time. The index reveals that during several quarters between 2018 and 2025, the Fed’s policy stance was up to 40–70% tighter than what a Trump-aligned rule would prescribe. In Q2’2022, it was 94.25 been tighter...This analysis highlights the significant deviation between conventional monetary policy and Trump’s preference for persistently accommodative rates, regardless of prevailing macroeconomic conditions

Simulating Public Engagement Using a Trump Attention Index...Scenario-2

❑ Now that Trump is in Fed chair.....We now simulate how public attention toward interest rate decisions by the U.S. Federal Reserve would have evolved if Donald Trump were the Fed Chair instead of Jerome Powell.

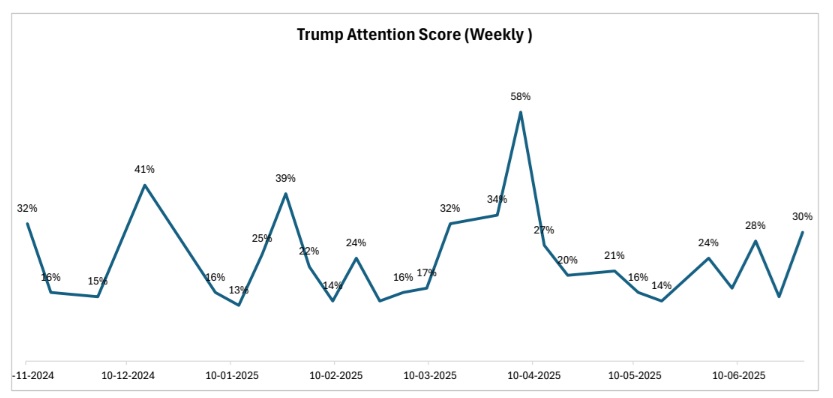

Using actual Google Trends data for monetary policy–related search terms, and a dynamic amplification model based on Trump’s media presence, we construct a Trump Attention Score (TAS) that captures how much more publicly visible monetary policy could have been under a Trump-led Fed

❑ This helps us explore how communication style and political personality affect public discourse on economic policy, even if the technical decisions themselves remain unchanged

❑ Using weekly Google Trends data for public engagement in Fed and rate cuts, we get the real-world public engagement data for each week, denoted as X(t), where t indexes time in weeks. This series represents the baseline level of public interest in monetary policy under the actual Fed Chair Jerome Powell

Simulating Public Engagement Using a Trump Attention Index...

❑ We then defined a dynamic Trump Engagement Multiplier (TEM) based on public engagement,

TEM =1+(x(t) /100)

❑ This multiplier assumes that the more prominent Trump is in the public discourse, the more amplified the attention toward monetary policy would be

❑ This gives us the Trump-adjusted public engagement(Y(t)) for each week, reflecting how much more visible interest rate decisions might have become

❑ To quantify the increase in attention, we defined the Trump Attention Score (TAS) as the percentage lift in public engagement due to Trump’s hypothetical presence

Simulating Public Engagement Using a Trump Attention Index...

❑ TAS captures the week-wise increase in attention, ranging from 0% to potentially 100% delineating increased public engagement in Fed related actions under Trump

TAS =(Yt –xt)/ xt)*100

Conclusion in case chairs are swapped...Fed rates decline by 100 bps...public engagement

with Trump goes up by 30%...Forget the standard textbook.....

❑ Actual Fed interest rate path that is currently 12.8% tighter as compared to the case if Trump was Fed chairman

❑ Trump therefore cuts the interest rate by 100 basis points

❑ As Trump cuts interest rates, Public engagement towards Fed interest rate cycles becomes 30% higher with Trump at Fed Chair

Necktie Nomics: When Fashion Meets Fiscal Signals”...

In this alternate universe, monetary policy doesn’t just follow inflation or GDP—it follows the Governor’s wardrobe.

When repo decisions are made, it’s not just models and mandates that matter, but the shade of silk around the RBI

Governor’s neck

From bold reds to cautious blues, we investigate whether the color of the tie can quietly signal the tone of the rate decision

When the Tie talks, the Repo walks...

❑ In this alternate monetary universe, where visual symbolism may speak louder than economic models, we attempt to decode the signalling power of the RBI Governor’s necktie colours worn during MPC announcements. The aim is to determine whether the choice of tie colour correlates with policy direction — and if so, whether it does so consistently

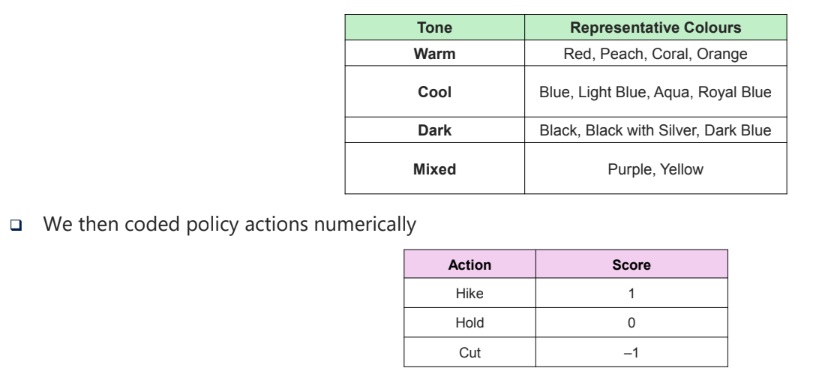

❑ We grouped ties into broader tone categories based on established psychological and visual perception theory

Tie Volatility and Tilt Index (TVBI) ...

❑ We designed the Tie Volatility and Tilt Index (TVBI) to measure both the directional signal and its consistency

❑ For each tone, we calculated:

Policy tilt Score (PTS)

PBS = Mean of action scores

Tells us whether the tone leans hawkish (+), dovish (–), or neutral (0)

Policy Volatility Score (PVS)

PVS = Standard deviation of action scores

Tells us how consistently that tone is used for one kind of decision.

Low PVS = strong signal, High PVS = ambiguous use:

TVTI=PTS×(1−PVS)

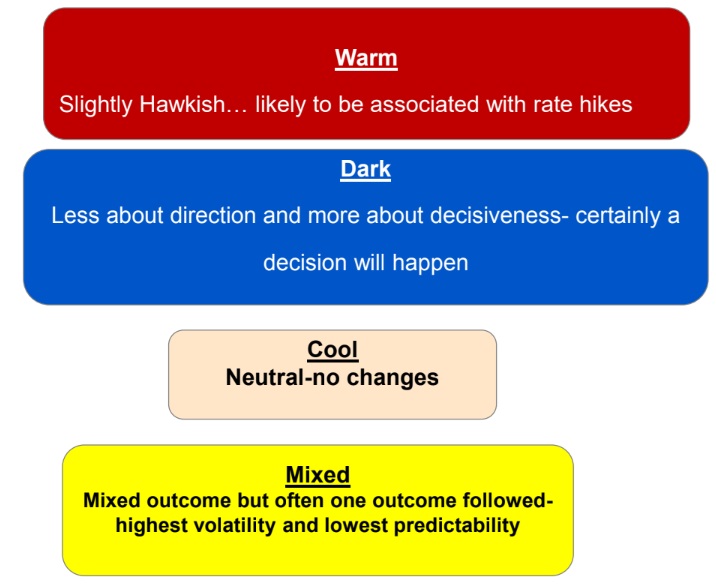

Results and Interpretation...

❑ In the uncertainties besieged world, Dark looks more associated with decisiveness as it clearly happened in the

recent jumbo rate cut of 50 bps....

Beyond Neckties.....when Words Get Bigger, So Do the Hints"...

❑ In this parallel world, The language doesn’t just explain policy — it quietly leads the way!!

❑ Our text analysis shows that when certain words start appearing more frequently in the Governor’s speeches — like “growth” instead of “inflation” — they reflect a real shift in the central bank’s priorities. translating into action

❑ In our text mining analysis, the size of the words in the word cloud reflects how often they appear in the Governor’s speech — and this, in turn, reveals the RBI’s policy priorities. When words like “growth” become larger than “inflation,” it signals a clear shift in focus, often followed by a change in policy stance like in case of recent 50 bps jumbo cuts.. In June policy the word was mentioned 24 times...