A central bank has no magic wand to please anyone and everyone; inflation in FY27 set to dip further

FinTech BizNews Service

Mumbai, 6 December 2025: The State Bank of India’s Economic Research Department has cpme out with a the Research Report on the latest MPC decisions. The report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India:

A CENTRAL BANK HAS NO MAGIC WAND TO PLEASE ANYONE AND EVERYONE; THIS MAY NOT BE THE END OF SANTA CLAUSS SENTIMENTS WITH INFLATION IN FY27 SET TO DIP FURTHER...RBI HAS DONE ITS BEST TO ENSURE MONETARY POLICY CONTINUES TO SUPPORT GROWTH..TIME FOR INDIAN MARKETS TO SHOW MATURITY AND REMAIN NON EXUBERANT..

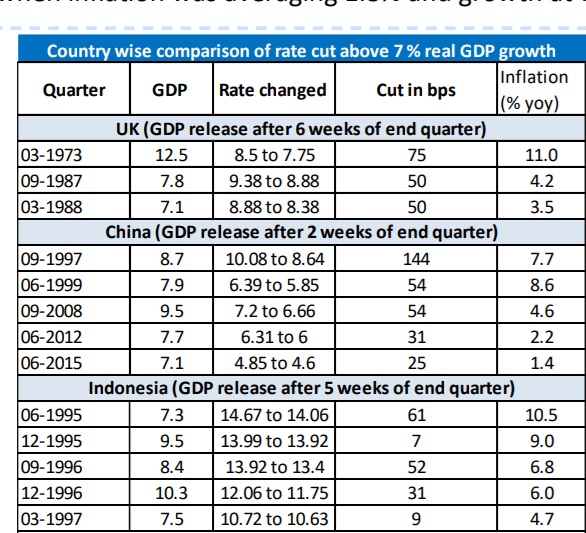

In end 2023, Jerome Powell, the Fed Governor highlighted the importance of Fed’s alignment with its twin mandates, stressing “It is also important to continue to be clear on what we are not doing. The Federal Reserve is not and will not be a "climate policymaker." With different sections of the markets, and distant stakeholders, baying for elixir through Central Bank that hardly puts the mojo back where the buck stops, a Central Bank must also prioritize what it should not be doing. Against this backdrop, the unanimous decision of MPC to vote for a 25 bps rate cut builds in the prospect of future uncertainties in a tumultuous world order. The MPC also continued with the neutral stance. Consequently, the SDF rate stands adjusted to 5.00% while CRR is at 3.0%, post the calibration exercise in phases. With GDP growth above 8.2% and ultra-low inflation of 0.25%, today’s rate cut is exceptional. Historical data of other countries reveal that there have been minimal instances across the UK, China and Indonesia, where central banks have reduced their rates even when GDP growth was high. However, all such cases of rate cuts were from very high levels, even as inflation were also much higher. For example, UK’s chancellor of exchequer in early 1970’s Anthony Barber made a “dash for growth” by cutting rates when inflation was running at 11% and growth at 12.5%. Similarly, Bank of Indonesia had cut successively during 1995-1997 prior to Asian crisis when growth was running at 8.6% and inflation at 7.4%. Its only China that had cut in 2012 and 2015 when inflation was averaging 1.8% and growth at 7.4%.

With continued lower food inflation, with higher kharif production, healthy rabi sowing, adequate reservoir levels and conducive soil moisture, RBI has reduced inflation projection for FY26 to 2.0% from the Oct’25 estimate of 2.6% and Feb’25 estimate of 4.2%. The Q1FY27 estimates are now lower by around 100 basis points to 3.9% from 4.9% put out in June’25. The Q3FY26 estimates at 3.8% now stands at 0.6% as per new forecast. We forecast inflation for FY26 at 1.8% and for FY27 at 3.4%. With such unprecedented level of downward revisions and further prospects of downward revision looming large, the RBI has kept the door ajar for future rate decisions. However, for now, repo rate at 5.25% will be lower for longer.

RBI has also revised Real GDP growth for 2025-26 and is projected at 7.3% now. Real GDP growth for Q1:2026-27 is projected at 6.7% at and Q2 at 6.8%. However, ongoing tariff and trade policy uncertainties will impact external demand for goods and services. We expect more than 7% GDP growth in both Q3 and Q4, with FY26 growth at 7.6%.

Average liquidity as given by Net LAF has largely remained in surplus mode this fiscal year, with large swings in liquidity witnessed in Sep’25 and Oct’25, from 0.9 lakh cr to 2.6 lakh cr (1% of NDTL). For effective transmission, RBI targets liquidity to be in the range of 1-1.5% of liquidity.

Firstly, RBI announced durable liquidity injection through OMO purchase of Rs 1 lakh crore in two tranches of Rs 50,000 crore each on 11 Dec’25 and 18 Dec’25, sanguine of downward spirals exerted by advance tax and GST payments as also augmented credit uptake envisaged (through both banks/non-banks sources) while effective transmission of rate cuts remains a priority.

Secondly, fine tuning the twin dilemma of managing currency depreciation against rising dollar demand from myriad sources, that impact the currency’s short-term momentum, with sustainable liquidity infusion in the system, RBI also announced USD/INR B/S swap of USD 5 billion for a tenor of three years on 16th Dec., which should infuse Rs 450 billion in the system.

Buy-sell swaps have historically led to a fall in the Mumbai Interbank Forward Offer Rate (MIFOR) by lowering forward premiums, making overseas borrowing more attractive and reduces hedging costs for Indian companies. It also helps inject durable rupee liquidity into the banking system, which can drive down interbank funding costs. RBI’s clear differentiation of its distinct though at times overlapping measures aimed at durable and transient liquidity management should come as a confidence building measure for broader markets. While the market players (through banks) are provided with liquidity injection and the Central Bank replenishes its reserves, corporate ALM mismatches are also taken care of through hedging due to liquidity rich feature of Fx swaps. In the CY25, RBI has done Fx B/S swaps of $30 bn, out of which $25 bn second leg will be due in 2028.

However, while volumes are building up in 1 M & 1M-2M segment, and Off-shore NDF activities could jolly well swell in the current tumultuous period, marred with uber volatility, rupee could remain range bound though susceptible to volatility as short term NDF premiums are detached from the interest rate differential. Rupee is likely to remain under pressure cateris paribus.

Downside risks to the growth outlook

MPC has unanimously decided to cut repo rate by 25 bps to 5.25%. The MPC also continue with the neutral stance.

Consequently, the SDF rate shall stand adjusted to 5.00% and MSF rate and the Bank Rate to 5.50%. CRR is at 3.0%.

With continued lower food inflation, with higher kharif production, healthy rabi sowing, adequate reservoir levels and conducive soil moisture, RBI has reduced inflation projection for FY26 to 2.0% from the Oct’25 estimate of 2.6%. Q3FY26 inflation is estimated at 0.6%; and Q4 at 2.9%. CPI inflation for Q1:2026-27 and Q2 are projected at 3.9% and 4.0%, respectively.

However, ongoing tariff and trade policy uncertainties will impact external demand for goods and services. Prolonged geopolitical tensions and volatility in international financial markets caused by risk-off sentiments of investors also pose downside risks to the growth outlook.

RBI has revised Real GDP growth for 2025-26 and is projected at 7.3% now, with Q3 at 7.0%; and Q4 at 6.5%. Real GDP growth for Q1:2026-27 is projected at 6.7% at and Q2 at 6.8%. The risks remain evenly balanced. After GST rationalisation, amid festive spendings, rural demand remained robust and urban demand is recovering. We expect more than 7% Q3 and Q4 GDP growth with full year growth of 7.6%. However, the new series data will be released on 27 Feb’2026, which may change all the numbers.

LIQUIDITY SITUATION

Average liquidity as given by Net LAF has largely remained in surplus mode this fiscal year, with large swings in liquidity witnessed in Sep’25 and Oct’25. System liquidity which averaged 2.3 lakh crore surplus during Apr-Aug’25 reduced to $ 1.4 lakh crore in Sep’25 and only $0.9 lakh crore in Oct’25. However, it recovered thereafter reaching now $2.6 lakh crore in Dec’25 so far which is around 1% of NDTL. For effective transmission, RBI targets liquidity to be in the range of 1-1.5% of liquidity.

Accordingly, RBI has currently announced durable liquidity injection through OMO purchase of Rs 1 lakh crore in two tranches of Rs 50,000 crore each on 11 Dec’25 and 18 Dec’25.

USD/INR BUY/SELL SWAP

Fine tuning the twin dilemma of managing currency depreciation against rising dollar demand from myriad sources, importers to FPIs to prop desks, each displaying unique characteristics and diverse intensity to hedge or otherwise (rupee crossed the psychological benchmark of 90 against USD recently but post policy announcement it retracted significantly, though later ceding most of the gains) with sustainable liquidity infusion in the system, RBI has announced USD/INR Buy/Sell Swap auction of USD 5 billion for a tenor of three years. At the current average exchange rate this implies an injection of Rs 450 billion. Even though liquidity is optimal now at ~2.6 lakh crore, the advance tax and GST related outflows, as also expected credit uptake (through both banks/non-banks sources) could exert a downward spiral that may checkmate RBI’s well intended measures for optimal transmission of rate cuts across niche areas in time.

On December 2, 2025, the one-month USD/INR forward premium in the Non-Deliverable Forwards (NDF) market shot up to 19 paisa, its highest level since this May and reflected the rising cost of hedging against the weakening rupee, with a short-term premium distortion as one month NDF premium was 7-8 paise over and above the actual interest rate differential. While volumes are building up in 1M-2M segment, and Off-shore NDF activities could jolly well swell in the current tumultuous period, marred with uber volatility, rupee could remain range bound with growth coming in higher buckets.

RBI’s decision for the higher B/S swap, could also ease the pressure on hedging. Buy-sell swaps have historically led to a fall in the Mumbai Interbank Forward Offer Rate (MIFOR) by lowering forward premiums, making overseas borrowing more attractive and reduces hedging costs for Indian companies. It also helps inject durable rupee liquidity into the banking system, which can drive down interbank funding costs. RBI’s clear differentiation of its distinct though at times overlapping measures aimed at durable and transient liquidity management should come as a Confidence Building Measure for broader markets.

While the market players (through banks) are provided with liquidity injection and the Central Bank replenishes its reserves, corporate ALM mismatches are also taken care of through hedging due to liquidity rich feature of Fx swaps that comes handy for corporates that have availed of longer tenor ECBs. Corporates prefer a shorter tenor (say 1 year) forward premium swap through MIFOR, willing to take a calculated risk on gap years movement. Market players would be familiar with RBI’s strategy during the heady days of taper tantrum when RBI had facilitated banks to use the swap window against gush of FCNR deposits that had a twin positive effect on filling the Fx reserves and INR strengthening…. While FCNR deposits are in positive territory since last year, the narrowed interest rate differential has kept the flows in check.

CROSS COUNTRY EXPERIENCE– HIGH GROWTH AND RATE CUTS

• With GDP growth above 8.2% and ultra low inflation of 0.25%, today’s rate cut is exceptional. Historical data of other countries reveal that there have been minimal instances across the UK, China and Indonesia, where central banks have reduced their rates even when GDP growth was high. However, all such cases of rate cuts were from very high levels, even as inflation were also much higher. For example, UK’s chancellor of exchequer in early 1970’s Anthony Barber made a “dash for growth” by cutting rates when inflation was running at 11% and growth at 12.5%. Similarly, Bank of Indonesia had cut successively during 1995-1997 prior to Asian crisis when growth was running at 8.6% and inflation at 7.4%. Its only China that had cut in 2012 and 2015 when inflation was averaging 1.8% and growth at 7.4%.

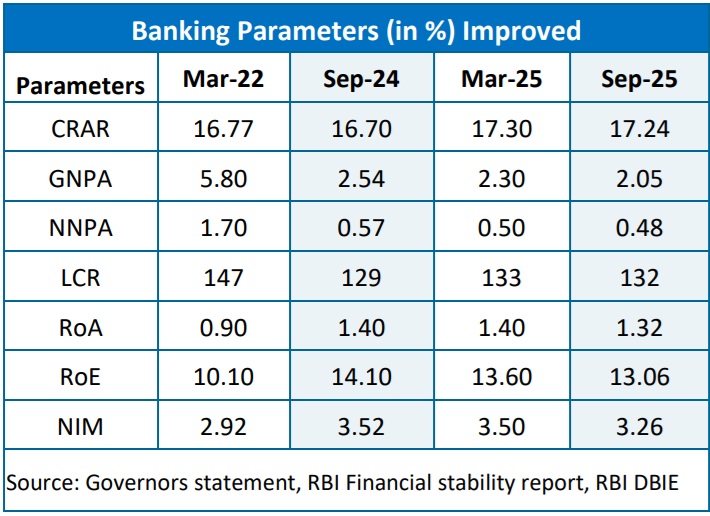

BANKING SECTOR IS SOUND & STABLE

Indian banking system is now positioned as a sound and well capitalised sector to support growth. In the current year, the credit growth of SCBs is slowly picking up and grew by 11.3% YoY, (last year 11.8%) for the fortnight ended 31 Oct’2025, while deposits growth remains at 9.7% (last year: 11.7%).

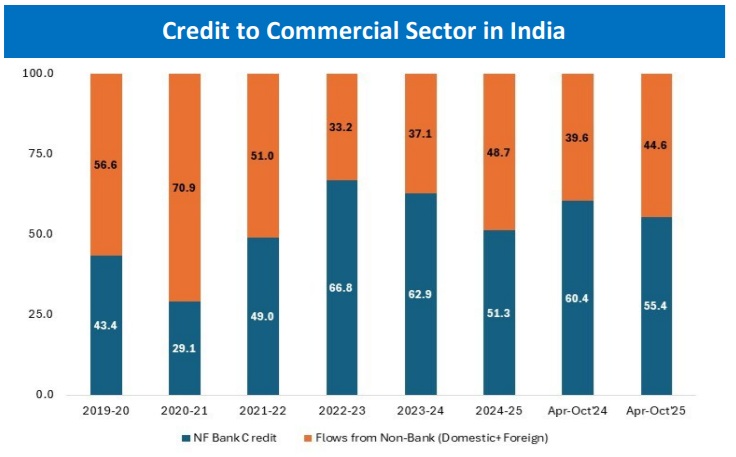

The resource flows to commercial sector indicate that the share of bank funding hold 55% during AprOct’25, compared to 60% in Apr-Oct’24, which is mainly due to the Rs 2.2 lakh crore flows from ‘Corporate Bonds by Non-Financial Entities’, compared to last year Rs 39,201 crore during AprOct’2024.

In response to the cumulative 100 bps cut in the policy repo rate, the weighted average lending rate (WALR) of SCBs has declined by 69 bps for fresh rupee loans and 63 bps on outstanding rupee loans during February-October 2025. Transmission has been broad-based across sectors.

On the deposit side, the weighted average domestic term deposit rate (WADTDR) on fresh deposits has declined by 105 bps, while that on outstanding deposits has softened by 32 bps over the same period. However, the latest data for October on interest rates indicate that all bank groups have increased lending rates on fresh loans (WALR_fresh) by 09-18 bps while reduced fresh deposits rates by 04-05 bps. With this rate cut, banks would have to revisit their ALM position, calibrating against challenges on both resources mobilization and credit off-take.