WALR On Fresh Rupee Loans Of SCBs Stood At 9.34%

The weighted average domestic term deposit rate (WADTDR) on fresh rupee term deposits of SCBs moved to 6.34 per cent in November 2023

FinTech BizNews Service

Mumbai, December 30, 2023: Data on lending and deposit rates of scheduled commercial banks (SCBs) (excluding regional rural banks and small finance banks) received during the month of December 2023 are analyzed with the following Highlights:

Lending Rates:

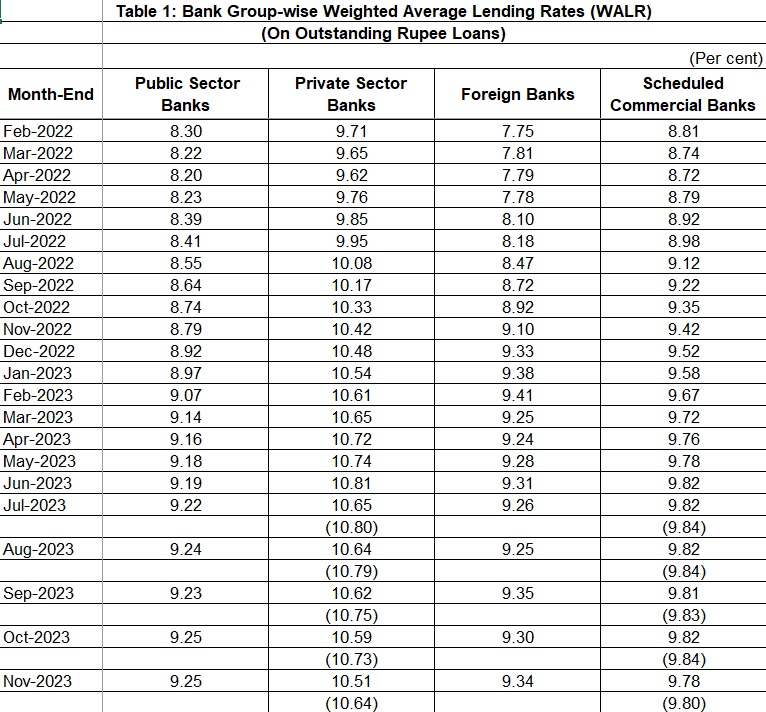

- The weighted average lending rate (WALR) on fresh rupee loans of SCBs stood at 9.34 per cent in November 2023 (9.50 per cent in October 2023).

- The WALR on outstanding rupee loans of SCBs was at 9.80 per cent in November 2023 (9.84 per cent in October 2023).1

- 1-Year median Marginal Cost of Fund based Lending Rate (MCLR) of SCBs moved to 8.75 per cent in December 2023 from 8.70 per cent in November 2023.

- The share of External Benchmark based Lending Rate (EBLR) linked loans in total outstanding floating rate rupee loans of SCBs was 53.3 per cent at end-September 2023 while that of MCLR linked loans was 41.9 per cent.1

Deposit Rates:

- The weighted average domestic term deposit rate (WADTDR) on fresh rupee term deposits of SCBs moved to 6.34 per cent in November 2023 from 6.31 per cent in October 2023.

- The weighted average domestic term deposit rate (WADTDR) on outstanding rupee term deposits of SCBs stood at 6.78 per cent in November 2023 (6.75 per cent in October 2023).1