Loan amount of Rs 22,805 Cr was disbursed in Q1 FY 25-26 through 41.5 Lk accounts, including disbursement of Owned as well as Managed portfolio. This is 23.6% lower than the amount disbursed in Q1 FY 24-25.

FinTech BizNews Service

Mumbai, September 6, 2025: Micro Finance Industry Network (MFIN) releases the 54th edition of Micrometer for Q1 FY25-26 based on the industry position as on June 30, 2025.

Micro Finance Industry Network (MFIN) is an industry association of Banks, NBFC-MFIs,

SFBs and NBFCs providing microfinance and an RBI-recognized self-regulatory

organization.

Micrometer is the flagship publication of MFIN, which covers progress of Indian

Microfinance industry on a quarterly frequency, this is the 54th Issue.

Some highlights of this quarter/ financial year are as under:

· As on 30 June 2025, 3.8 Cr clients* have loan outstanding from NBFC-MFIs, which is 16.5% lower than number of clients as on 30 Jun 2024.

· The Asset Under Management (AUM) of MFIs is Rs 1,34,574 Cr as on 30 June 2025, including owned portfolio Rs 1,11,849 Cr and managed portfolio (off BS) of Rs 22,725 Cr. The owned portfolio of MFIN members is 80.8% of the NBFC-MFI universe portfolio of Rs 1,38,439 Cr.

· AUM decreased by 16.4% compared to 30 June 2024 and decreased by 5.4% compared to 31 March 2025.

· Loan amount of Rs 22,805 Cr was disbursed in Q1 FY 25-26 through 41.5 Lk accounts, including disbursement of Owned as well as Managed portfolio. This is 23.6% lower than the amount disbursed in Q1 FY 24-25.

· Average loan amount disbursed per account during Q1 FY 25-26 was Rs 54,956 which has increased by around 16.5% in comparison to same quarter of last financial year.

· As on 30 June 2025, the borrowings O/s were Rs 96,190 Cr. Banks contributed 62.7% of borrowings O/s followed by 12.7% from Non-Bank entity, 12.1% from External Commercial Borrowings (ECB), 8.6% from AIFIs and 4.0% from other sources.

· During Q1 FY 25-26, NBFC-MFIs received a total of Rs 12,781 Cr in debt funding, a 19.9% decrease from Q1 FY 24-25. Banks contributed 81.9% of the total Borrowing received followed by Non-Bank entities 8.4%, AIFIs 3.6%, ECB 3.5% and Others 2.6%.

· Total equity decreased by 6.2% as compared to end of Q1 FY 24-25 and is at Rs 34,582 Cr as on 30 June 2025.

· Portfolio at Risk PAR 31-180 days as on 30 June 2025 has deteriorated to 5.4%** as compared to 2.5%** as on 30 June 2024.

· MFIs have presence in 26 states and 6 union territories.

· In terms of regional distribution of portfolio (AUM), East and North-East accounts for 33% of the total NBFC-MFI portfolio, South 28%, North 15%, West 15%, and Central contributes 9%.

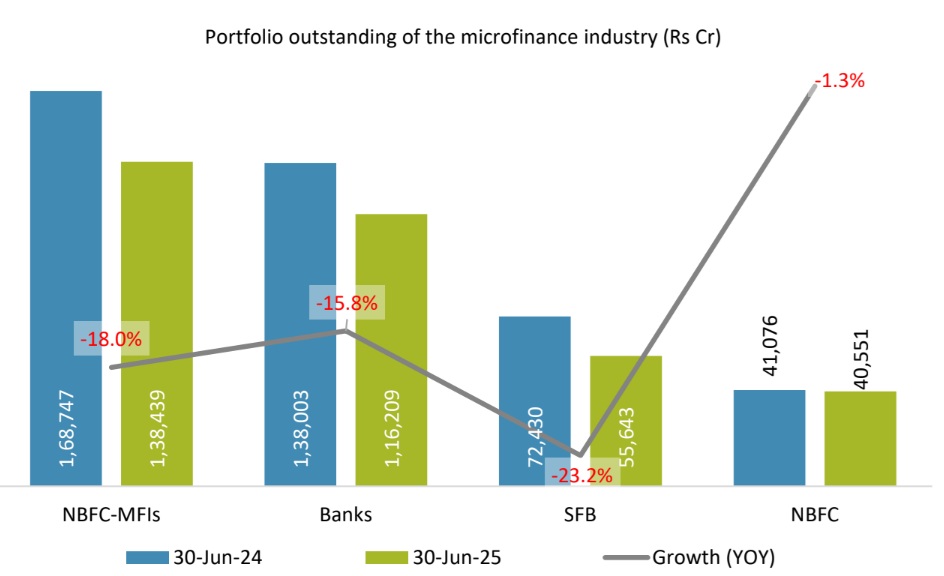

As of 30th Jun,’25, microfinance operations were spread across 36 states/UTs and 721

districts providing financial services to around 7.5 crore unique clients. Data for Q1 FY 25-

26 shows that on a YoY basis due to lower disbursements on account of liquidity

constraints and stricter underwriting post guardrails, the sector’s portfolio came down to

Rs 3,53,233 Cr.

Despite lower disbursements seen from previous quarters, with Q1 disbursement of Rs.

56,677 crore, portfolio quality has started to show signs of improvement. PAR 31-60 days

in end June 25 was 1.1% as compared to 1.6% in December 24. Similarly PAR 61-90 days has

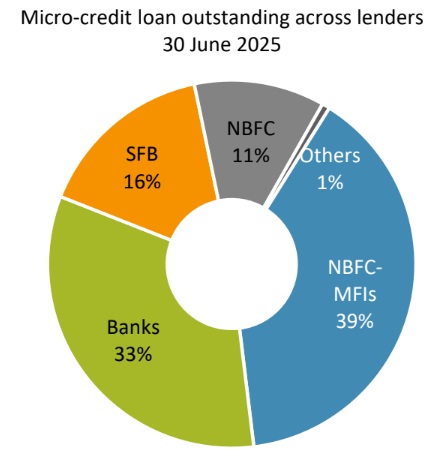

improved to 1.4% compared to 1.6% in December 24. NBFC-MFIs, despite sharp contraction,

continue to be the market share leader with 39% share, followed by banks at 33%. The

sector also contributes 36.6% of its outreach in Eastern and North-Eastern states - areas

where financial inclusion is needed the most.

Other key positives are:

Expansion in Branch Network: NBFC-MFIs reported 22,896 branches, marking an

8.0% year-over-year (YoY) increase from 21,205 in Q1 FY 24-25. This indicates

continued investment in physical infrastructure to enhance outreach.

Increase in Workforce of NBFC-MFIs: Employee count rose to 2,12,479, a 5.8% YoY

growth from 2,00,894, supporting operational scalability and client servicing

capabilities.

During the quarter, a positive development came from the RBI in the regulations for NBFC-

MFIs by way of reduction in qualifying asset norm. This revised norm will help NBFC-MFIs

avoid frequent breaches caused by liquidity inflow as well as provide an opportunity to

NBFC-MFIs to diversify their product offering. The outcomes of this regulatory change will

need to be monitored in the coming quarters.

Dr Alok Misra, CEO & Director, MFIN observed, “It is a sign of relief that despite a severe

drop in flow of bank funding and the adoption of tighter underwriting, which has led to a

contraction in the Gross Loan Portfolio, the credit quality on the mend. Over the last two

quarters (Q3 FY 24-25 onwards) there has been a significant improvement in portfolio

quality in the early PAR buckets (PAR 31-60 and PAR 61-90) indicating that fresh

disbursements are exhibiting healthier quality. At this juncture, the sector is delicately

poised and needs liquidity to sustain the improvement. I hope that the twin factors of RBI’s

injection of liquidity and the improvement in credit quality, will together lead to better

funding to the sector.”