To mitigate, NBFCs are diversifying into new geographies and product adjacencies.

FinTech BizNews Service

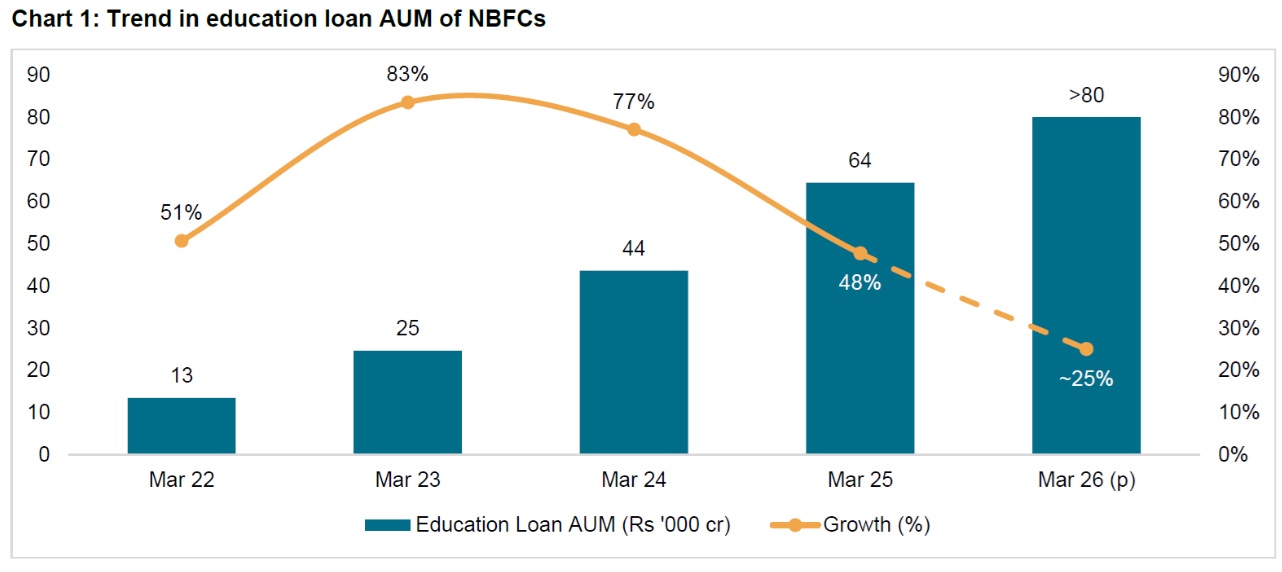

Mumbai, July 10, 2025: For non-banking finance companies (NBFCs), education loans have been the fastest-growing asset class, clocking over 50% growth in the assets under management (AUM) over the past few years. That pace is set to halve this fiscal as disbursements for pursuing educational courses in the US decelerate following a raft of policy changes there.

To mitigate, NBFCs are diversifying into new geographies and product adjacencies.

While non-performing assets (NPAs) have remained stable so far, asset quality will be monitorable given the global uncertainties and a large proportion of AUM (~85%) remaining under contractual principal moratorium.

The education loan AUM of NBFCs grew a rapid 48% to Rs 64,000 crore last fiscal. That followed an even faster 77% growth in fiscal 2024. This fiscal, growth is seen moderating to ~25% with AUM reaching ~Rs 80,000 crore.

Says Malvika Bhotika, Director, Crisil Ratings, “Policy uncertainties in the US, combined with measures including reduced visa appointments and the proposed elimination of Optional Practical Training2 norms have culled newer loan originations. This has led to a ~30% decline in total disbursements to that geography last fiscal. Disbursements linked to even Canada, the second-largest market, fell as student visa rules turned stricter, including increased financial requirements via proof of available funds, and cap on permits. Consequently, overall education loan disbursements were up only ~8% in fiscal 2025, compared with ~50% in fiscal 2024.”

To offset these headwinds, NBFCs have sharpened focus on other geographies. Disbursements linked to courses in the UK, Germany, Ireland and smaller countries have doubled in the past fiscal as students opted for alternative destinations. The share of such geographies in total disbursements rose to almost 50% in fiscal 2025 from 25% a year ago. But this will not fully offset the decline in US-linked disbursements.

Notably, the share of US in overall education loan portfolio has already come down to 50% as on March 31, 2025, from a peak of 53% as seen on March 31, 2024, and is expected to go down further over next few years as lenders gravitate towards other geographies.

NBFCs are also looking at domestic student loans and adjacencies such as school funding, loans for skill development, certification and coaching. Given the lower ticket sizes of such loans, their share in the overall portfolio is unlikely to be material, but they may lend some stability in times of global uncertainties.

Says Sonica Gupta, Associate Director, Crisil Ratings, “Despite the global developments, NBFCs have maintained healthy asset quality so far. Gross NPAs stood low at 0.1% as on March 31, 2025. And even after adjusting for the moratorium, gross NPAs were well under control at ~0.7%. However, high growth in the past few years and estimated ~15% of the portfolio coming out of contractual moratorium this fiscal, pose some asset quality risks. The ability of NBFCs to scale up and maintain asset quality in some of the newer domestic products will bear watching as well.”

Moreover, the agility of the NBFCs to navigate the complexities of the global landscape, characterized by uncertainty and change in preferences of students, will be crucial for sustained growth and success.