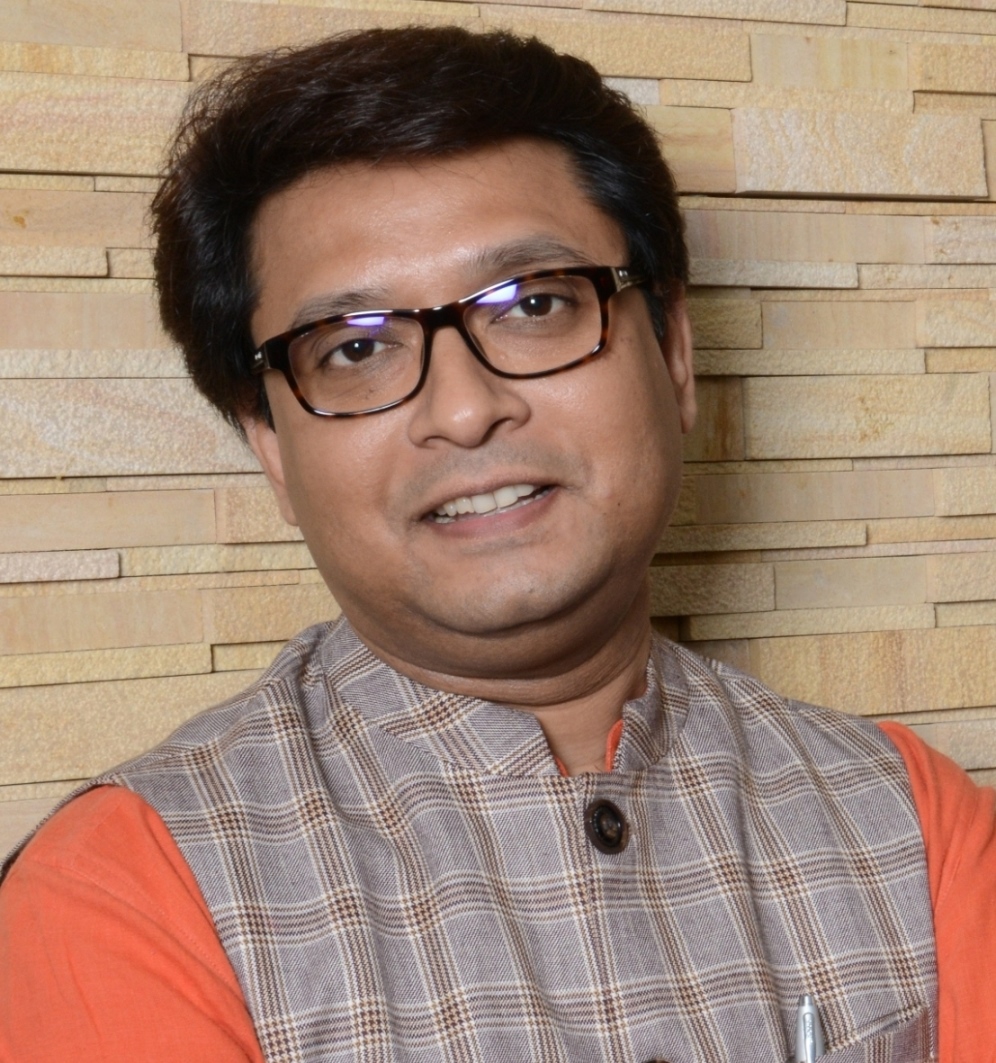

Kuldip Maity, MD & CEO of Kolkata-based NBFC-MFI, VFS Capital, shares his expectation from the budget.

FinTech BizNews Service

Mumbai, January 29, 2024: The interim budget is going to be announced on Feb 01, 2024. Kuldip Maity, MD & CEO of Kolkata-based NBFC-MFI, VFS Capital, shares his expectation from the budget. He said that ‘Microfinance has become a vital backbone of financial inclusion in India, empowering over 7 crore borrowers across the country, especially women in rural areas, with readily accessible, collateral free credit. This impactful approach has significantly contributed to India's journey towards inclusive growth. However, to amplify this contribution and ensure sustained growth, the sector needs targeted policy support, particularly dedicated funding for microfinance institutions (MFIs).

These institutions, with their nimble operations and deep understanding of local contexts, often reach the most underserved regions and populations. Yet, they often lack access to adequate funding, hindering their potential to further expand financial inclusion.

The microfinance sector holds significant untapped potential, yet financial institutions within this space require additional capital support to broaden their outreach and extend much-needed credit assistance to individuals seeking loans to start their entrepreneurial venture.

Therefore, we strongly urge the Finance Minister to consider establishing a dedicated low-cost funding window to provide equity support to microfinance institutions. By prioritizing dedicated funding and policy support to microfinance institutions (MFIs), especially small and mid-sized players, India can leverage the tremendous potential of microfinance to empower millions more individuals, foster inclusive economic growth, and build a truly resilient financial ecosystem.