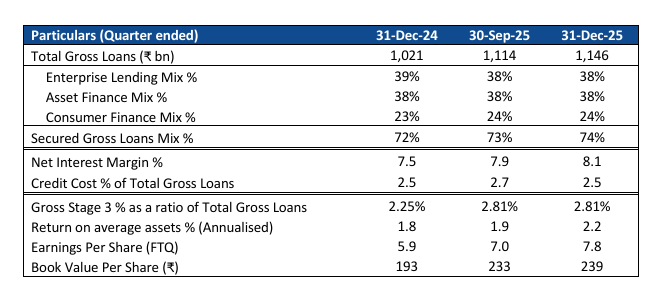

Total Gross Loans stood at Rs1,14,577 crore as on December 31, 2025 compared to Rs1,02,097 crore as on December 31, 2024, a growth of 12.2%

FinTech BizNews Service

Mumbai, 14 January 2026: A meeting of the Board of Directors of HDB Financial Services Limited was held in Mumbai on Wednesday, January 14, 2026 to consider and approve the unaudited financial results for the quarter ended and nine months ended 31st December 2025.

Performance Highlights – Q3FY26:

· Asset under management (AUM) was Rs 1,14,853 crore as on December 31, 2025 compared to Rs 1,02,514 crore as on December 31, 2024, a growth of 12.0%

· Total Gross Loans stood at Rs 1,14,577 crore as on December 31, 2025 compared to Rs 1,02,097 crore as on December 31, 2024, a growth of 12.2%

· Net interest income was Rs 2,285 crore for the quarter ended December 31, 2025 compared to Rs 1,872 crore for the quarter ended December 31, 2024, an increase of 22.1%

· Net total income was Rs 2,970 crore for the quarter ended December 31, 2025 compared to Rs 2,499 crore for the quarter ended December 31, 2024, an increase of 18.8%

· Employee benefit expense includes a provision of Rs61 crores on account of the new labour codes, of which Rs56 crores pertains to the Lending business

· Pre-provisioning operating profit was Rs 1,573 crore for the quarter ended December 31, 2025 compared to Rs 1,276 crore for the quarter ended December 31, 2024, an increase of 23.2%

· Loan losses and provisions was Rs 712 crore for the quarter ended December 31, 2025 compared to Rs 636 crore for the quarter ended December 31, 2024, an increase of 12.0%

· Profit before tax was Rs 860 crore for the quarter ended December 31, 2025 compared to Rs 641 crore for the quarter ended December 31, 2024, an increase of 34.3%

· Profit after tax was Rs 644 crore for the quarter ended December 31, 2025 compared to Rs 472 crore for the quarter ended December 31, 2024, an increase of 36.3%

· Profit after tax was Rs 1,793 crore for the nine months ended December 31, 2025 compared to Rs 1,645 crore for the nine months ended December 31, 2024, an increase of 9.0%

· Gross Stage 3 loans was at 2.81% as against 2.25% as at December 31, 2024

· Net Stage 3 loans was at 1.25% as against 0.90% as at December 31, 2024

· Provision Coverage stood at 55.59% on stage 3 assets as against 60.02% as at December 31, 2024