A lower nominal GDP than what the Union Budget had pencilled in, could result in the fiscal deficit printing at 6.0% of GDP

FinTech BizNews Service

Mumbai, December 30, 2023: The Government of India's fiscal deficit shrank to Rs. 9.1 trillion or 50% of the FY2024 BE in April-November FY2024 from Rs. 9.8 trillion in April-November FY2023. The fiscal deficit in November 2023 was half the year-ago level, led by lower tax devolution, a contraction in revex and marginal growth in capex in that month. While net tax revenues rose by 17.2% YoY during April-November 2023, non-tax revenues expanded by 43.4% on the back of the RBI dividend, amidst a 3.6% growth in revenue expenditure, and a significant 31.0% expansion in capex.

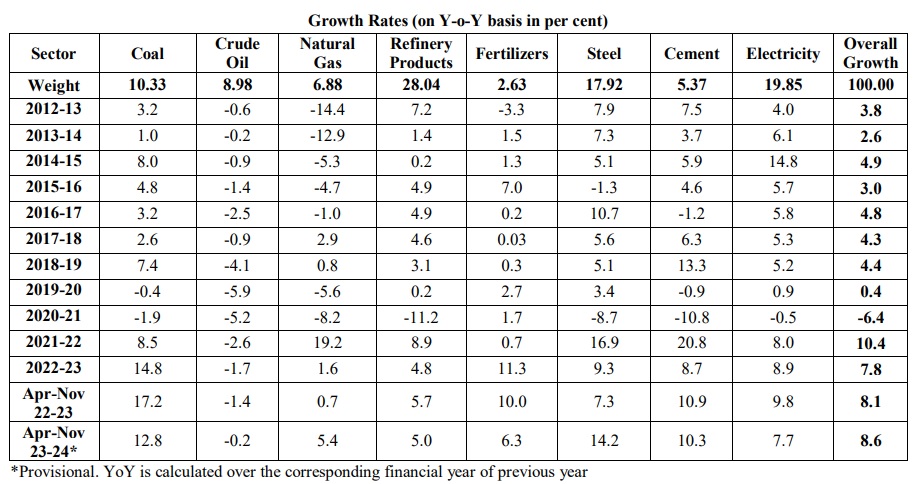

Aditi Nayar, Chief Economist, Head - Research & Outreach, ICRA, observes: “As expected, the delayed onset of the festive season led to a moderation in core sector growth to a six month low 7.8% in November 2023 from 12% in October 2023, with only petroleum refinery products displaying a pickup in YoY growth between these two month. Disaggregated data remained mixed, with crude oil and cement displaying a YoY contraction in November 2023, even as petroleum refinery products and coal recorded a double-digit expansion. On average, the core sector expanded by nearly 10% in October-November 2023, an encouraging sign. Given the larger number of factory holidays, we anticipate a modest 2-4 rise in the IIP in November 2023.”

In the month of November 2023, capex rose by a meagre sub-2% on a YoY basis, amidst the festive season. With the model code of conduct likely to be imposed in the ensuing quarter, the capex target may be missed. Aditi Nayar explains: “Our baseline expectation is that direct taxes will surpass the FY2024 BE by around Rs 0.85 trillion, a portion of which will be absorbed by lower-than-budgeted union excise duty collections, leaving a gross upside of at least Rs. 0.5 trillion. Setting aside the additional devolution to the states, we estimate that net tax revenues will exceed the FY2024 BE by a modest Rs 0.3-0.4 trillion. However, this will be offset by a similar shortfall in disinvestment proceeds.”

As per the latest data provided by the Ministry of Finance, the GoI has transferred an additional instalment of tax devolution amounting to Rs. 729.6 billion to the states in Dec 2023, over and above the earlier monthly instalment of the same amount. Consequently, the central tax devolution (CTD) to the states rose to Rs. 7.5 trillion during Apr-Dec 2023, 22.6% higher than Rs. 6.1 trillion transferred during Apr-Dec 2022. Aditi Nayar points out: “To meet the FY2024 BE (Rs. 10.2 trillion), the GoI must release Rs. 2.7 trillion to the states during Q4 FY2024, which is a sharp 19% lower than the amount devolved in Q4 FY2023 as per ICRA's calculations (Rs. 3.4 trillion). This would aid in containing the incremental fiscal deficit in the last quarter of FY2024. Based on our assessment of the gross tax revenues, the CTD would need to exceed the FY2024 BE by approximately Rs. 0.2-0.3 trillion; even this would entail a YoY contraction of 10-13% in Q4 FY2024. Higher-than-budgeted dividend surplus transfer by the RBI and healthy direct tax collections would offset the undershooting in other revenue streams (disinvestment or excise duty inflows). Moreover, expenditure savings and lower-than-budgeted capex are likely to offset the extra allocations under the 1st SDG. Overall, ICRA does not expect the fiscal deficit target of Rs. 17.9 trillion for FY2024 to be breached. However, a lower nominal GDP than what the Union Budget had pencilled in, could result in the fiscal deficit printing at 6.0% of GDP.”