Weakening of dollar amid falling bond yields owing to Fed's pivot towards policy normalization, coupled with RBI's active intervention and inclusion of Indian debt in the global bond index, should keep a check on rupee volatility

Tirthankar Patnaik, PhD

Chief Economist

National Stock Exchange of India Limited (NSE)

Mumbai, December 29, 2023: This is the third part of the series on the December edition of the ‘Market Pulse’, published by NSE. The second and first part was published on this website on December 28 and December 26, 2023.

Prolonged pause for now:

While the pause on rates and stance was widely expected, the commentary became much more balanced vis-à-vis hawkish rhetoric in the previous three policies. Even as the Governor reiterated MPC’s commitment to aligning inflation to the 4% target, he also cautioned against the “risk of overtightening” which looks like a first step towards moving to a neutral stance. In the light of MPC’s comfortable outlook on growth and undeterred focus on the 4% inflation target, we continue to expect a prolonged pause. Until then, RBI is likely to continue to focus on liquidity management to ensure liquidity conditions remain aligned with the monetary policy stance.

Net lending under RBI’s Liquidity Adjustment Facility

Net systemic liquidity remained mostly in deficit throughout October and November, with liquidity injections through the LAF peaking at Rs 1.8trn on November 22nd, the highest since Dec’18. Softening in global yields has resulted in widening of spreads between India and US bonds.

Merchandise trade deficit narrowed on weak imports

India’s merchandise trade deficit narrowed to US$ 20.6bn in Nov’23, much lower than the consensus estimates of US$ 23.6bn. However, it was on account of a steeper fall in imports (-4.3%YoY) as compared to exports (-2.8%YoY). In FY24TD, the overall trade deficit contracted significantly by 11.4%YoY weighed down by greater fall in imports. On the exports front, Petroleum products, Engineering goods and Ready-made textiles constituting for almost half of India’s exports, contracted, reflecting subdued global demand. Notably, during this fiscal, electronic goods exports rose by 24.1% YoY, thanks to higher exports of smartphones.

The narrowing of the merchandise trade deficit and widening of service surplus on account of falling imports shows signs of emerging slowdown in domestic demand. Additionally, weak global backdrop owing to muted demand in Euro area and subdued recovery of the Chinese economy is likely to remain an overhang on India’s export performance. That said, weakening of dollar amid falling bond yields owing to Fed’s pivot towards policy normalization, coupled with RBI’s active intervention and inclusion of Indian debt in the global bond index, should keep a check on rupee volatility. Among the Asian market currencies, INRs one-month volatility remains among the lowest at 0.2%, significantly lower than that of other major Asian currencies like Japanese Yen and Chinese Yaun.

According to UNCTAD’s Trade and Development report 2023, the global merchandise trade is estimated to decline by 7% in 2023. That said, weakening of dollar amid falling bond yields owing to Fed’s pivot towards policy normalization, coupled with RBI’s active intervention and inclusion of Indian debt in the global bond index, should keep a check on rupee volatility.

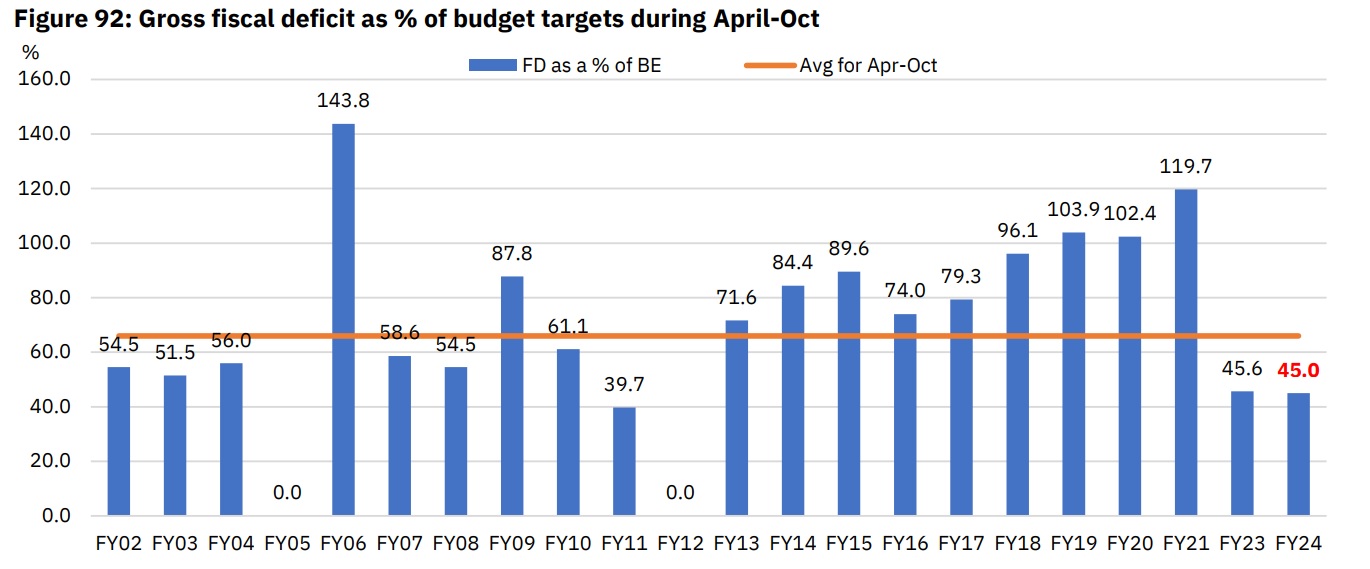

Union finances: Fiscal deficit comfortable at 45% of BE in 7MFY24

The Centre’s total receipts jumped by 14.8% in the first seven months of FY24 (Apr-Nov’23), thanks to a healthy momentum in direct tax growth (+24%YoY)—both corporate and income tax collections recorded a robust expansion of 17.4% and 31.1%YoY respectively. In the light of a strong momentum in direct collections and moderation in revenue expenditure growth, we do not anticipate fiscal stress building up in the current year. As such, the Centre’s fiscal math remains in check with the deficit at 5.9% for FY24. Progress in divestments continued to remain negligible (misc. receipts incl. divestments contracting by over 68% YoY). Capex constitutes around 22.8% of total expenditure incurred in the 7MFY24 (vs. 19.1% last year), the highest in the last 12 years.

RBI Surveys: Improving growth and inflation outlook, High Consumer Confidence T

The RBI released the results of the recently conducted forward-looking surveys including the Consumer Confidence Survey (November 2023), Households’ Inflation Expectations Survey (November 2023), Survey of Professional Forecasters on Macroeconomic Indicators (round 85th). The survey results point to a) Moderation in recovery in consumer confidence with negative sentiments for current and future general economic situation, b) Change in current and one-year ahead median inflation household perception by -20 bps and +20bps respectively, c) An upward revision in growth forecast for FY24 by 60bps, while retaining estimates for FY25 at 6.3%.

Across major cities, Kolkata and Bhubaneshwar showed double digit inflation One Year ahead expectations, while it was the lowest in Ahmedabad and Jammu. Across the age group, the highest expectations were in the 60 years and above cohort.

The GDP growth forecast for FY25 was retained at 6.3%, same as the last survey. However, a quick follow up survey was also conducted by RBI just before the MPC meeting and the GDP forecast was again revised upwards by 40 bps to 6.8%. The forecast for FY24 real GVA growth has also been revised up by 20bps to 6.2%, primarily led by improved growth projections for the services sector, while agricultural sector saw a significant downward revision of 30bps.

Authors Tirthankar Patnaik, PhD; Prerna Singhvi, CFA; Ashiana Salian, Prosenjit Pal, Smriti Mehra, Ansh Tayal, Anand Prajapati, Shuvam Das, Isha Sinha

(To be continued)

(This report is intended solely for information purposes. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. The Report has been prepared on best effort basis, relying upon information obtained from various sources. NSE does not guarantee the completeness, accuracy and/or timeliness of this report neither does NSE guarantee the accuracy or projections of future conditions from the use of this report or any information therein. In no event, NSE, or any of its officers, directors, employees, affiliates or other agents are responsible for any loss or damage arising out of this report. All investments are subject to risks, which should be considered prior to making any investments.)